What happens to RC auto. Ania report (and controversy)

Numbers, comparisons and wishes on RC auto in the annual report of Ania. The gap between the insurance premium paid in Italy in 2019 and the average of Germany, France, Spain and the United Kingdom is 62 euros. Because?

A structural reform of motor liability insurance. This is what Ania, the association of insurance companies, is asking the Conte government to reduce the cost of car insurance. Italy pays over 60 euros more than the average of Germany, France, Spain and the United Kingdom.

Health insurance policies should also be reviewed. All the details.

THE COST OF INSURANCE

Let's start with the numbers of the RCA in our country. There are 45 million vehicles in circulation, for a premium payment of 13 billion. Insurance "employs just over 4 billion to repair damaged vehicles, almost 5 billion to compensate for the damage of individuals who suffer physical injuries (minor and / or serious), just under 2 billion for the families of victims of fatal accidents and almost 3 billion to carry out its business ”, writes Ania in the report“ Let's keep risks away ”, 2020 edition .

RISK

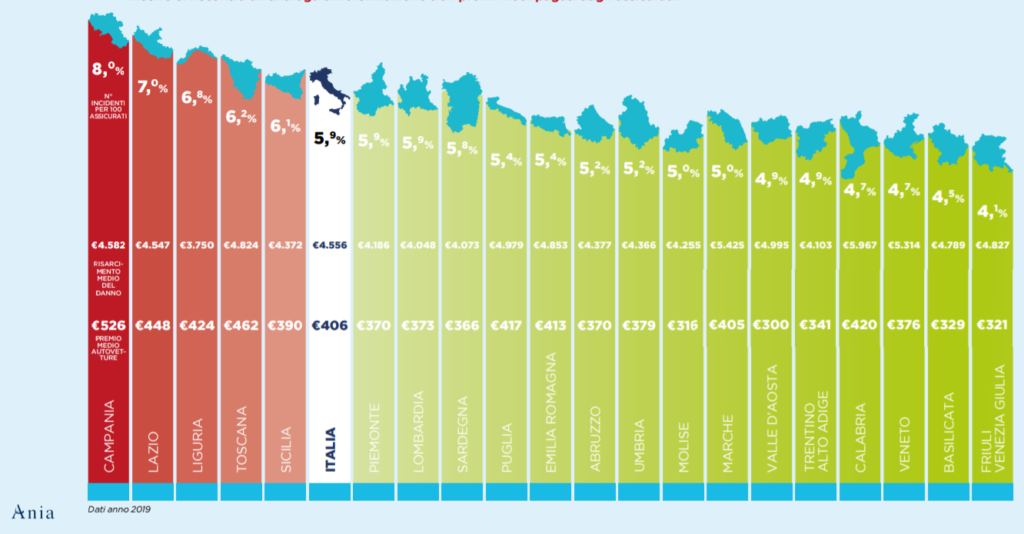

The riskiness of traffic in our country is also very variable, both for the average number of accidents that occur and for the relative average compensation.

COMPARISON WITH THE REST OF EUROPE

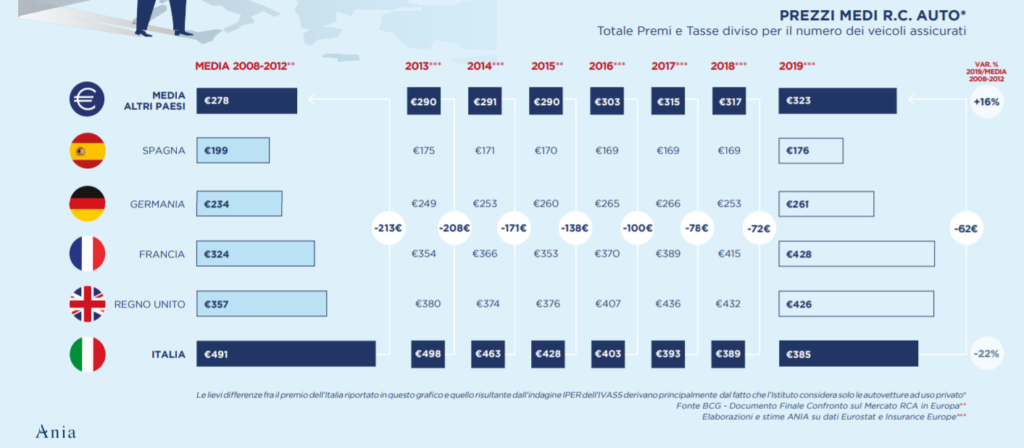

And big differences, on the front of RC auto, there are also in the numbers between Italy and the rest of Europe.

The gap between the insurance premium paid in Italy in 2019 and the average of Germany, France, Spain and the United Kingdom is 62 euros. An improvement, however, if we look at previous years: in the period between 2008 and 2012 the policies were more expensive by 213 euros. In 2015, the gap had narrowed to 138 euros and seems to continue to gradually decrease.

In recent years, however, in Italy people pay less than France and the United Kingdom.

WHAT THE GOVERNMENT SHOULD DO

However, something still needs to be done to encourage a price warming. "In the ample space to be opened for reforms, the opportunity could finally be taken to rethink the regulatory system of car insurance in a structural way, with the aim of further reducing the overall cost for the community, the only way to reduce prices in favor of everyone, favoring virtuous behavior and avoiding unnecessary costs ”, said the president of the association Maria Bianca Farina.

Italy, Farina suggests, could “standardize and calm the growth dynamics (over 45% since 2009) of the average compensation for serious injuries, above 9 points of disability. It is also necessary to tackle the phenomenon of insurance and organized crime frauds even more incisively. We believe it is urgent to intervene in an organic way to change the legislation for this purpose ".

COUNTER DRIVING WITHOUT INSURANCE

It's still. We should "actively combat the phenomenon of those who drive without insurance", adds Farina. “It is estimated that around 2.6 million vehicles circulate without paying insurance, putting other citizens at risk and causing claims that are ultimately paid for by the community. Also in this case it is a question of promptly identifying, using new technologies and the diffusion of cameras, the owners of registered but uninsured cars and providing for effective sanctions ”.

THE BONUS-MALUS SYSTEM

For Ania, the “bonus-malus system” also needs to be “radically reviewed”. The new system should be more sustainable, adapting to a reality of claims frequency that has profoundly changed compared to the first regulatory system and differentiating the evolutionary rules based on the type of accident caused, so for example that a small scratch in a parking lot does not count as a left with serious injuries ".

COLLAPSE ACCIDENTS WITH LOCKDOWN

Returning to the numbers, with the lockdown, claims "fell by 35-40% compared to the same period of 2019, with the combined ratio of Motor TPL dropped from 100 to 86%, given the lower circulation of vehicles caused by the Covid pandemic ”, Said the president of Ivass, Daniele Franco, speaking at the ANIA assembly.

All this has led to savings for insurance companies quantified at 1.3 billion euros: "The costs for claims decreased by 9%, from 14.4 to 13.1 billion", Franco said, recalling that Ivass he had hoped for "Initiatives in favor of policyholders, which in many cases have been launched". “We are now acquiring from the companies – added the president of the Authority – an organic and updated framework of these measures to better understand their type and scope”.

CODACONS: REFUND CUSTOMERS

Codacons intervened precisely on this issue. "If insurance companies really want to contribute to the revitalization of our economy, they should start by reimbursing users the amount paid for motor liability insurance policies not used during the lockdown period", says Codacons, commenting on the statements of the president of Ania, Maria Bianca Farina .

"Italian motorists suffered economic damage on the RC car front in 2020 amounting to a total of € 3.9 billion due to the travel bans provided for by the measures linked to the Covid emergency, for a total of about € 100.8 per insured, a figure which is obviously higher for residents of southern cities and for new drivers, who pay higher rates. All this while accidents on Italian roads have collapsed as a result of travel limits, with enormous economic benefits for insurance companies that have forfeited profits against the elimination of the risk of accidents ”. Therefore, "introducing forms of compulsory reimbursement for all insurance companies would guarantee equity and put resources into the pockets of families, already heavily damaged by the Covid emergency", writes the association in a note.

WHAT'S WRONG WITH HEALTH INSURANCE

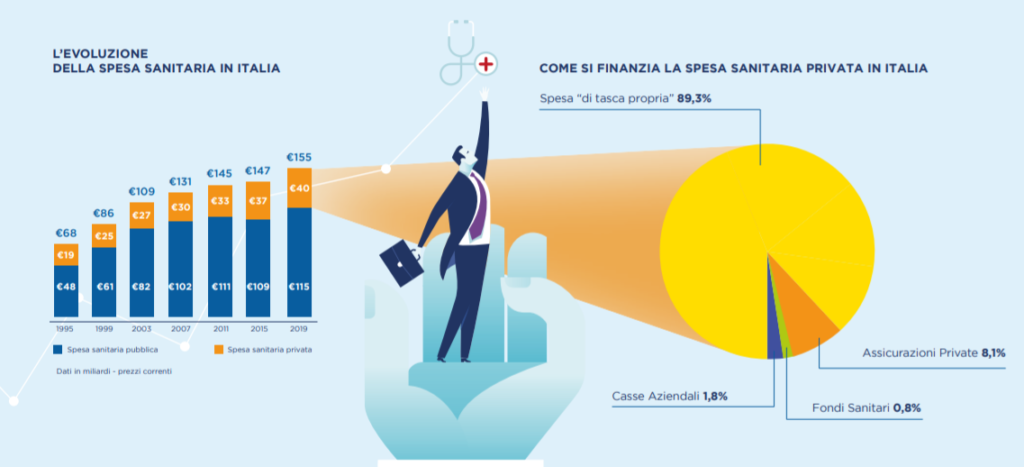

Even on the health insurance front, Italy struggles to hold up a European comparison. The boot, reads the Ania report, is the country with the highest incidence (89%, against a European average of 56%) of families who use their savings to meet medical care and expenses. “This aspect is socially unfair, because it puts people in front of the choice between paying (when they are able to do so) or, even more serious, giving up treatment when they are most fragile. It would be profitable to reflect seriously on a new welfare model that best combines public and private resources, with a broader role assigned to supplementary healthcare which, based on a principle of mutuality, typical of insurance, would guarantee greater equality for citizens and higher levels of protection for the sick ”, writes Ania in the report.

Healthcare spending in Italy reached 115 billion in 2019 (approximately 6.5% of GDP). These figures are not sufficient, however, to limit the expenses of Italians: “the component of healthcare expenditure that individuals and families support privately and which now amounts to 40 billion is constantly growing. The lack of insurance protection to cover medical care is evident if we consider that just 8% of these private costs are attributable to insurance and 2.6% to health funds and funds. The remaining part, 36 billion (about 90%), is paid each year from their own pockets by Italian families and this makes them more fragile and exposed to unexpected outlays which, in some cases, become unsustainable ”, they write in the report.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/cosa-succede-allrc-auto-report-ania-e-polemiche/ on Tue, 20 Oct 2020 06:13:14 +0000.