What happens to the economy, rates and stock exchanges

Third quarter with a focus on liquidity and demand stability. An in-depth analysis by Antonio Cesarano, Intermonte's chief global strategist

The second semester begins, which, in some respects, seems to have potentially different characteristics compared to the first, during which there was an almost monothematic focus on two topics:

- galloping inflation

- growing problems on the supply chain front.

Result: Stock markets down, rates and commodities up, against the appreciation of the dollar following the acceleration of restrictive monetary policies.

The post-pandemic phase has created the “revenge spending” effect: the boom in demand that remained unanswered by constraint during the pandemic has spilled over into the market, putting supply in difficulty; as a result, consumer prices have risen.

The war added the final “icing”, not so much in terms of further price hikes, as an increase in the persistence of inflation at high levels. A bit like it happens with rain: you can have a less rainy year, but the aggravating circumstance is that there are several consecutive months of no rain. In summary, the persistence and continuity of the phenomenon can make its impact much stronger. In the face of increased persistence, central banks have thrown in the towel.

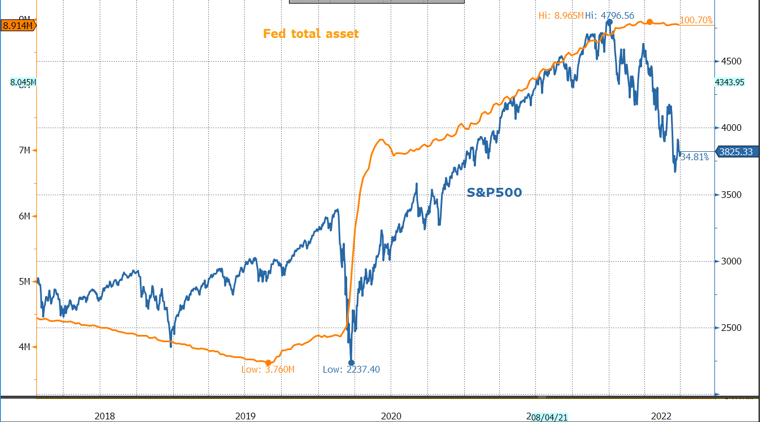

The Fed, in particular, has changed its attitude. Now the goal is to drastically curb growth with rapid rate hikes and (last but not least) doses of liquidity reduction (Quantitative Tightening) from June with acceleration to September (-95 billion $ per month). And history so far teaches how much the arrest of liquidity growth has a weight on the lists.

After this brief excursus we come to the second semester

The high inflation scenario was priced as a response from central banks with Fed Funds estimated at 3.5% by March 2023.

Now, for the second half of the year, the focus shifts to the recession hypothesis, after the countless US data pointing in this direction, now no longer excluded even by Powell, with the Atlanta Fed hypothesizing a 2.1 drop in GDP % annualized in 2Q, which would imply a technical recession for the US.

- What is emerging from the latest data is a potential drastic decline in demand on various fronts, paradoxically precisely when some first sign of a less stressed supply chain arrives, especially on the chip front.

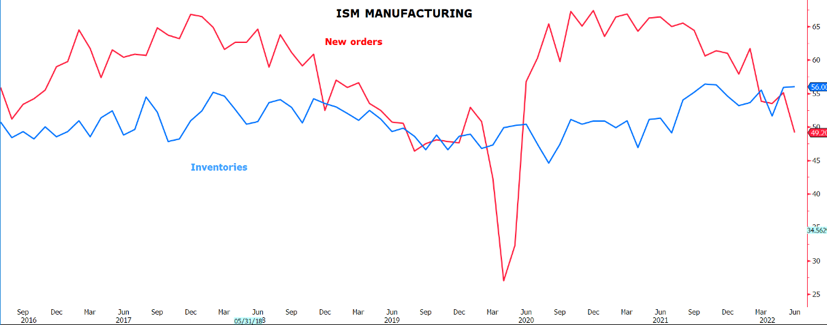

- For example, companies in the US manufacturing sector are recording a decline in new orders (now in a contraction zone) in the face of still very high inventories, the result of a phase in which inventories were the key to positively address the boom in demand.

The stagflation pendulum, therefore, could remain unbalanced on the “stag” theme, increasingly understood as a recessive hypothesis. In this context, the performance of the individual asset classes could be as follows during the second half of the year, with particular focus on the quarter that has just begun:

Rates and commodities down along with the stock exchanges. This does not exclude hypotheses of technical rebounds but the expected trend is the one outlined above. What are the logical mechanisms that explain the conversion of the decline in liquidity into a negative impact on equity markets and potentially positive for Treasuries?

- The lower liquidity translates into greater difficulty for US companies to refinance themselves in terms not only of cost, but also and above all of quantity. In the second half of the year, High Yield companies made issues of $ 26 billion, the second lowest level on a quarterly basis since 2006

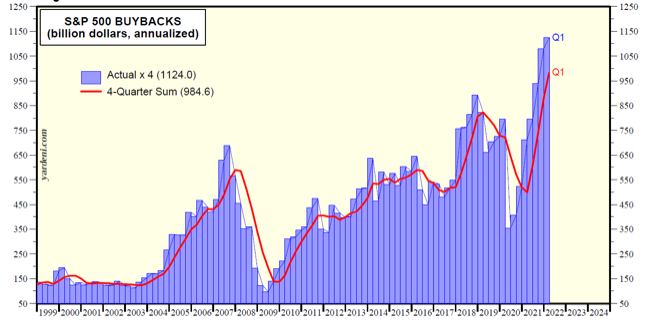

- Lower issues potentially lead to lower pay out ratios, especially with reference to the volume of buy backs

- Lower buy backs bring less support to the stock market, given their importance in the bull market years with over $ 1000 billion in 2021

- Widening of corporate spreads, starting from the high yield sector, with a consequent preference for the safe haven of Treasuries

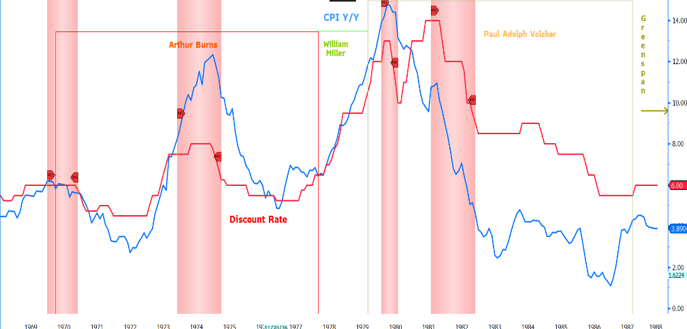

The decline in Treasury rates is in turn also fueled by the expectation of a scenario similar to the one that emerged during Volcker's Fed presidency, which began in the late 1970s: substantial rate hikes at the end of 1979, with the discount rate brought at 13% and then quickly brought back to 10% in the course of 1980, in the face of the emergence of the recession. Subsequently, after the recession, Volcker resumed the rate hike to continue the fight against inflation.

IN SUMMARY

- For the third quarter of 2022 the expectation is in a context characterized on average by:

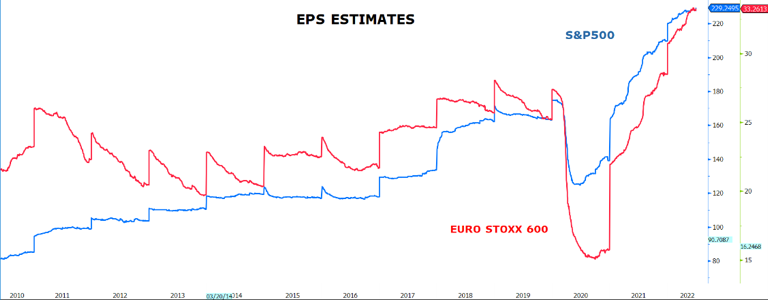

falling rates and commodities - decline in share prices which in the quarterly reports of July and September could lead to a global revision of the high levels of EPS both in the case of the S & P500 index and of the EuroStoxx600

- The fulcrum of this trend is represented by central banks grappling with the intention of slowing down growth, even with high doses of liquidity drain.

- At the end of the year / early 2023, these maneuvers could lead to an easing of the restrictive hold of central banks, up to hypothesizing a reversal in the course of 2023.

In this context, the 2022 share falls could represent a favorable sowing ground perhaps already at the end of the year but more realistically 2023. Between the end of 2022 and 2023 there could also be a downsizing of inflation, but paid earlier in terms of falling demand, called upon to do the dirty work of rebalancing supply and demand after the sharp fluctuations after the pandemic. - On the interest rate front, the rising phase of the first half could give way to an opposite trend, with a target of 2 / 2.25% on the 10 y US sector by the end of the year, a level induced both by outflows from the corporate market and by expectations reversal of the Fed in 2023, and the simultaneous sharp decline in commodities, an important prelude to hypothesize an easing of inflationary pressures starting from the US.

- If this scenario turns out to be correct, the resulting decline in rates (first nominal rates and then real rates) could on average favor the growth sector over value over the quarter, all in relative terms, at least in the current quarter.

- In order to hypothesize absolute benefits, it will be necessary to wait for signs of an end to the restrictive maneuvers of the central banks, primarily the QT of the Fed and other central banks.

- In the meantime, within the trend outlined for the quarter, there may probably be rebounds connected to short-term excesses that can once again be captured by jointly monitoring financial conditions indicators (fear & greed for example) together with the Vix level ( better the closer to area 35).

- The main risk (positive for equity markets) for this scenario is the end of hostilities in the Donbass. The news could induce a marked rebound in the short term and then the word would pass to verify whether this news will accompany (and in what timeframe) the easing of sanctions on the European side and a more regular flow of gas and other raw materials / finished products. (refined products in primis) Russian.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succede-a-economia-tassi-e-borse/ on Tue, 05 Jul 2022 05:14:23 +0000.