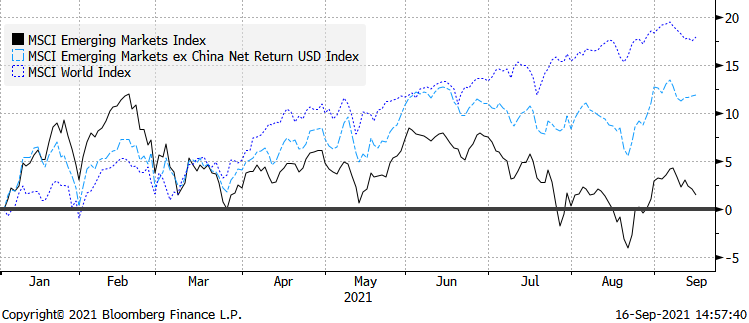

What happens to the performance of China and the emerging markets?

The negative performance of Chinese equities continues to penalize the performance of the entire emerging sector. The analysis by Richard Flax, Chief Investment Officer Moneyfarm

EMERGING SHARE

The question to ask is whether the recent declines have opened up valuation possibilities. Prices are relatively low at the moment and this could represent an opportunity: on the one hand, the investor must assess whether the discount is sufficient to offset the effect of political uncertainty on the market environment and, on the other hand, whether the fundamentals and business growth could be compromised.

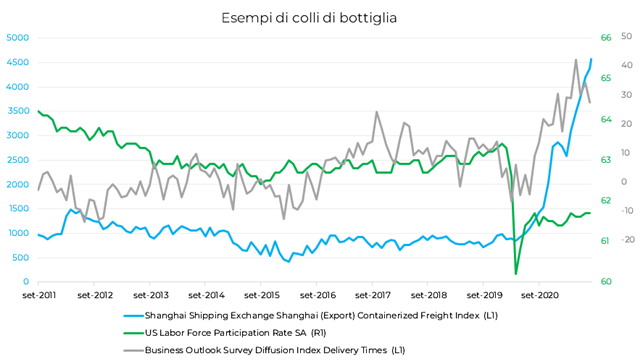

BOTTLE NECK AND LABOR MARKET

We are experiencing a transition phase of the global economy, in some ways unique: on the one hand a very strong but uneven recovery, on the other the pandemic, which continues to have consequences despite the slowdown in restrictions. This situation leads the global economy to have peculiarities which, we feel we can say, have hardly appeared all together in the past and which give the idea of being in a context in which globalization has jammed.

Shortage of truckers, haywire shipping, lack of semiconductors, localized closures in Asia due to the Delta variant, skyrocketing container rates are all indications that global trade channels are experiencing turbulent times. All of these factors translate into higher prices for end consumers, an effect that should prove temporary according to central banks.

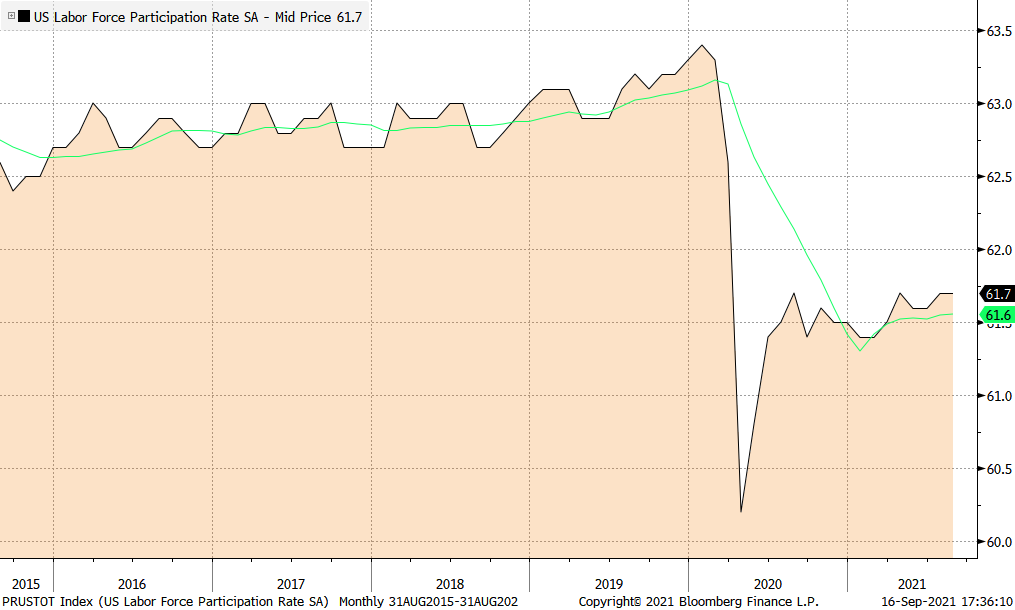

The job market remains for now the most fascinating economic mystery of recent months. Even in countries where social benefits have run out, labor shortages continue to put downward pressure on supply, somewhat limiting economic recovery. Take, for example, the US labor market participation curve which has remained broadly flat in recent months.

Here, then, we see company inventories at their lowest, producer prices rise and the economic outlook becoming more uncertain. If the strong recovery in demand remains undoubted, it is now the offer that is unprepared, and this opens up further food for thought on inflation.

Optimism prevails for the moment. The idea is that with the normalization of the labor market and with the progress of vaccination campaigns also in Asia, the knots will begin to unravel and economic growth will remain strong also in 2022. The bottlenecks underlying the increase in prices of many goods have little to do with monetary policy: raising interest rates would not help resolve these situations and therefore would not be an effective policy option at this time.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/performance-cina-emergenti/ on Sat, 25 Sep 2021 06:00:08 +0000.