Who is the Indian super scrooge Gautam Adani targeted by a US fund

At 16 he started trading diamonds, at 30 he was already a billionaire, today he is the richest man in India. Gautam Adani, nicknamed "Modi's Rockefeller", survived an attempted kidnapping and a terrorist attack, but will he manage to avoid being overwhelmed by the fraud scandal accused by Hindenburg Research? Facts, numbers and curiosities

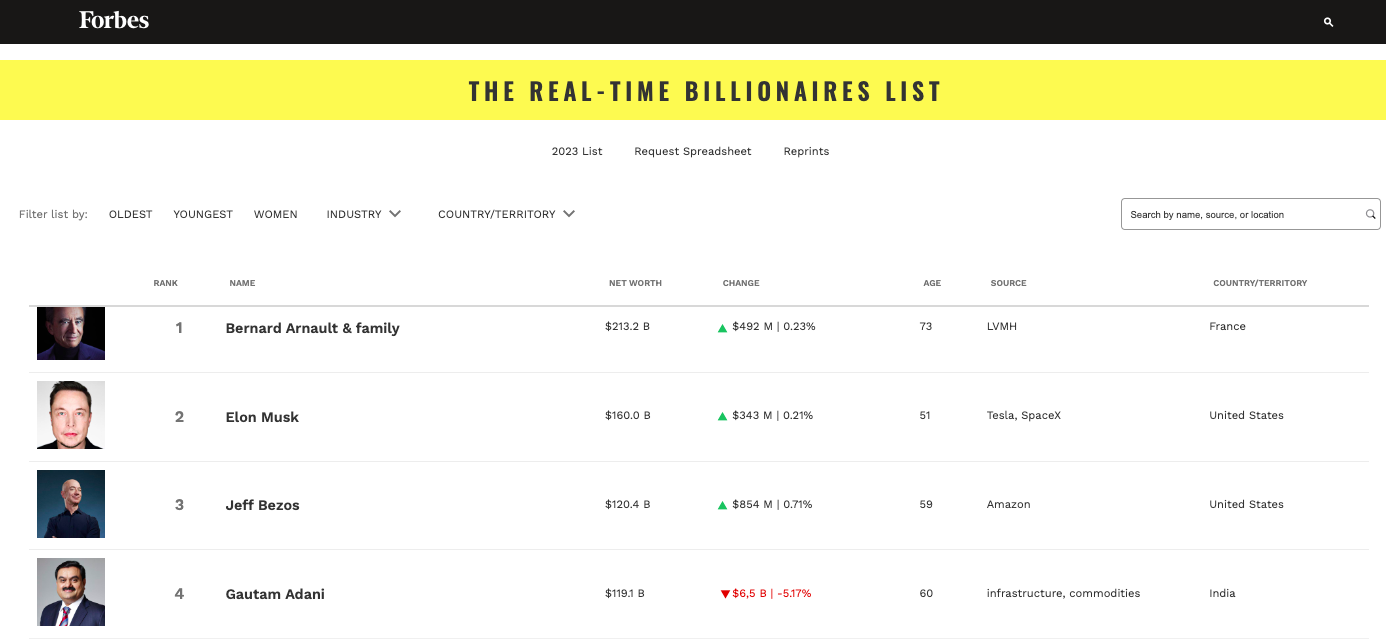

He is the richest man in India and the fourth in the world (the third until a few hours ago, according to the Forbes real-time ranking ). He is 60 years old and manages an empire of about 120 billion dollars. Until last month it was even worth 150 but in these hours Gautam Adani of the Adani Group is having a bad time because of the investment research company Hindenburg Research, which accuses him of having manipulated the value of the shares of his holding and of having committed accounting fraud for decades.

Revelations that for now have cost the tycoon 6.5 billion dollars and the bronze medal in the Scrooge rankings, where the news made him relegate and surpass Jeff Bezos.

WHO IS GAUTAM ADANI

Gautam Adani was born in 1962 in Ahmedabad, Gujarat, into a family of small textile traders. Passionate about business but not about his father's business, at the age of 16, with little money in his pocket, he abandoned his studies and boarded a train that took him to Mumbai, where after three years he earned a commission of 10,000 rupees for having helped a Japanese buyer in the diamond trade.

Despite the satisfactions and realization of himself as a self-made man in his early twenties, Adani has one regret, that of not having completed his education.

“While my early experiences made me wise, I now realize that formal education broadens knowledge rapidly. To acquire wisdom one must gain experience, but to acquire knowledge one must study. And although I'll never really know, sometimes I think my skills would have expanded faster if I had attended university,” he told some students a few days ago.

THE BUILDING OF THE ADANI EMPIRE

But Adani has always had clear ideas and a desire for freedom that made him fear nothing. “First generation entrepreneurs – he continued – mostly start with a single advantage: that of having nothing to lose. This belief is their strength. For me it was a liberation. I didn't have a legacy to follow, but I had the opportunity to create one."

Returning to his hometown to complete his secondary education and help his family with a small PVC factory, in 1991, with liberalization by then Prime Minister PV Narasimha Rao, Adani moved quickly to set up a global trading company specializing in polymers, metals, textiles and agricultural products. And in 1994 Adani Exports, now Adani Group, was listed on the Stock Exchange.

According to Forbes , the phrase that describes him is: “Being an entrepreneur is my dream job, because it tests tenacity. I could never take orders from anyone."

But in addition to his high-profile business career, the New York Post writes that Adani survived the 2008 terrorist attacks in Mumbai and an attempted kidnapping and ransom in 1998. He was also much criticized during his rise and for his close relationship with Indian Prime Minister Narendra Modi. His ability to navigate Indian political circles has earned him the nickname "Modi's Rockefeller".

ADANI GROUP

In about 45 years, says The Economic Times , Adani has made his group “the largest solar energy company in the world, the largest airport and port operator in India, the nation's largest integrated energy operator, the second largest producer of cement of the country and a conglomerate with a market capitalization of over 225 billion dollars”.

Indeed, the group has 7 listed entities with activities ranging from energy, ports and logistics, mining and resources, gas, defence, aerospace and airports.

GRAIN WITH HINDENBURG RESEARCH

But all these firsts are now facing the earthquake caused by Hindenburg Research, an investment fund focused on the short selling of securities, founded by speculator Nathan Anderson and based in New York.

Hindenburg Research, which is no stranger to this sort of thing, released a nearly 100-page report on Tuesday accusing the Indian conglomerate of "brazen" stock manipulation and accounting fraud worth $218 billion. .

The report yesterday caused the group's shares to fall by more than 5%, with an overall loss of 10.8 billion dollars, which forced the company to forcefully deny its content, defined in a official statement "a malicious combination of selective disinformation and stale, unfounded and discredited allegations".

Adani Group further said that the timing of the report suggests the malicious intent to "undermine the group's reputation with the main objective of harming the upcoming public offering of Adani Enterprises," referring to the group's plans to launch the largest secondary equity offering in the country, with the aim of raising $2.5 billion including from investors such as the Abu Dhabi Investment Authority and Morgan Stanley.

The tycoon's company, according to Reuters , is also considering "corrective and punitive actions" under US and Indian laws against Hindenburg Research.

Media statement on a report published by Hindenburg Research. pic.twitter.com/ZdIcZhpAQT

— Adani Group (@AdaniOnline) January 25, 2023

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/chi-e-il-super-paperone-indiano-gautam-adani-preso-di-mira-da-un-fondo-usa/ on Thu, 26 Jan 2023 10:22:00 +0000.