Who supports Biden (and who supports Trump) in the financial markets

The comment by Antonio Cesarano, Intermonte's chief global strategist, on the American elections and on Trump and Biden's programs

The market reaction until yesterday was increasingly clearly focused on the hypothesis of a Biden victory .

Find the main points of the program of both quantified according to a recent paper by Moody's in the attached slides.

Biden much more devoted to public spending with increased tax revenues due to tax increases, Trump much less devoted to public spending and in favor of the continuation of the tax cut policy.

In particular, on the subject of the infrastructure plan, in the next mandate 2021/2024 Biden's program contemplates an expenditure of approximately $ 2400 billion (of which at least $ 500 billion on green issues), compared to approximately $ 400 billion for Trump.

Biden also appears to be much softer on the issue of trade policy, ie less inclined to a policy of widespread tariffs on a large scale. In any case, the attitude on the subject of China would not be tender, preferring however an approach aimed at an international coalition rather than unilateral measures.

The realization of the plans of each of the contenders will then be subject to the verification of the outcome of the vote for the Congress, that is, whether there will be a "blue or red wave".

However, operators today are focusing on the possible victory of Biden, raising interest rates especially in the long term (in view of large government issues), tonic stock markets in view of expansionary fiscal policies despite the rise in taxes and the dollar in depreciation, also in view of greater softness on the commercial policy issue. As can be seen from the following graph, the dollar tends to weaken in a context of lower uncertainties on the trade policy front.

Press rumors show that Trump is already trying to prepare his legal battle strategy to contest the vote, mainly focused on the state of Pennsylvania.

If this is the market's attitude, the final outcome still presents several uncertainties.

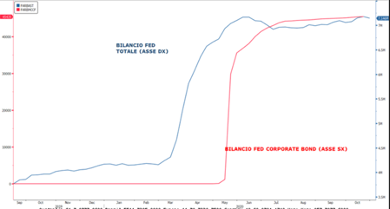

Regardless of who will be the winner, the impression is that the true driver of the markets will still be represented by central banks in the coming weeks, starting with the Fed on Thursday which could, for example, imply that it is ready to resume purchases. on corporate bonds, effectively interrupted for several months at $ 45Bn towards a potential maximum of $ 750Bn.

Central banks (especially the ECB) are therefore expected to return to the field massively in the coming weeks, after more than two months of absence. The Fed, in fact, kept the balance sheet steady at around $ 7000 billion and the ECB remained on standby before recently announcing the recalibration of all the maneuvers already in place at the latest on 10 December.

Consequently, the overall climate for the stock exchanges for the end of the year remains in tune with the risk on, which for the USA could involve a big switch, that is a little less US tech and a little more tech China. On this front came today the news of the suspension of the start of the listing of Ant group on Shanghai and Hong Kong, after Jack Ma had explicitly criticized the Chinese regulators a few days ago. For now, this is a suspension and not a cancellation and it is therefore possible that the IPO will be completed in the next few days after the regulator's findings.

On the European front, the other theme could be sector “great rotation”, with a preference for some sectors that have underperformed since the beginning of the year and are closely linked to China. In the coming months, while the West will still be in the grip of the virus waiting for a cure / vaccine, China / Asia will remain the only outlet market, relevant for some sectors (such as the German car).

At the same time, OPEC + is demonstrating a concrete will (primarily Russia, unlike last March) to support the market even at the limit with further production cuts. I remember that the $ 40 on Brent represents the budget breakeven for Russia. Furthermore, China (the first importer in the world) has announced that next year it will allow "private" operators (especially the teapots refineries) to increase imports by 20% compared to 2020, ie equal to about 800,000 b / d.

In summary: if the post-US election results in turbulence on the markets, it could still be a buy opportunity in view of the return to the field of the driver of recent years, that is the liquidity of central banks.

In this context, oil could also benefit from the combined OPEC + cuts / increase in Chinese demand, in a context of historically very contained long speculative net positions on Brent which, by the end of the year, could bring Brent back to around $ 45 / b.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/chi-tifa-biden-e-chi-tifa-trump-nei-mercati-finanziari/ on Wed, 04 Nov 2020 14:58:42 +0000.