Here’s how and why the stock exchanges celebrate Pfizer’s anti-Covid vaccine

What happened on Wall Street and not just after Pfizer announced the Covid vaccine. The comment by Giuseppe Sersale, strategist of Anthilia Capital Partners Sgr

Do not rest easy for a moment.

Markets were intent on pricing Biden's appointment as president, which took place over the weekend – without Trump's concession – when the headline everyone was waiting for appeared. Preliminary findings from Pfizer's vaccine Trial 3 show that it achieved an efficacy rate of over 90%.

Disrupted scenario once again, and record euphoria on the markets. Sentimentrader.com noted that today's opening gap of the S&P 500 (around 3%) constitutes a historical record from 1982 onwards, if you add the condition that it will reach new highs at one year. The best of the previous 17 (intended as gaps greater than 1% with a peak at 52 weeks) was almost half (+ 1.6%) on February 2, 1998. For the record, the backtest shows a good performance at 3 months (+ 4.6% average with 94% win ratio), but poor up to 2 weeks (-0.9% average, with 29% win ratio).

Put the almanac aside, let's go and see how the day went. As mentioned, the Asian session had a good run, with the main indices in positive, showing progress well above 1% (2% in the case of the Nikkei) and with US and Euro futures bearing similar gains. Biden's statement as president-elect (barring an unlikely – but not impossible – success of Trump's claims) has certainly removed a bit more uncertainty from the price action. Other support may have come from the Chinese trade balance in October, which showed strong and above-expected exports (+ 11.4% year on year from + 9.9% and vs estimates for + 9.2%), demonstrating a recovery global demand, for the less in the US and Asia. On the other hand, imports were weak (+ 4.7% from previous + 13.2% and vs estimates for + 8.6%), but this is partly an effect of the accumulation of chip imports by Huawei in September.

The European morning started with the same positive tone, spread across all assets. Shares rose, with the Eurostoxx 50 adding 2 points to 8 last week. Bonds went up, with rates falling everywhere. The euro rose, commodities and precious metals rose.

This positive scenario was upset at 12.45 am Italian time by the appearance of this headline: * PFIZER VACCINE PREVENTS 90% OF COVID INFECTIONS IN LARGE STUDY, succinct summary of the press release .

In a nutshell, Pfizer has announced that the preliminary results of phase 3 show that the effectiveness of the vaccine would exceed 90%: the 94 infections that occurred in the trial population (44,000 individuals) are almost all in the half that did not receive the vaccine. A level of effectiveness that – should receive confirmation – would be much, much higher than expected (I remember that the FDA had lowered the limit for approval to 50%, to speed up the process). Such efficacy would allow immunization to be achieved fairly easily. A study by DB shows that assuming an R0 of 2.5 and an efficacy of 90%, to obtain an immunization it would be sufficient to vaccinate 60% of the population.

The trial is expected to produce definitive results in the second half of November, after which Pfizer will be able to apply for an emergency clearance from the FDA. The company expects to produce 50 million doses in 2020, and 1.3 billion doses in 2021.

As always happens, Pfizer's announcement has melted the language of other manufacturers.

* RUSSIA'S SPUTNIK V VACCINE MORE THAN 90% EFFECTIVE: HEALTH MIN.

NOVAVAX COVID-19 VACCINE GRANTED FAST TRACK DESIGNATION BY US FDA

More noticeable is the reception that Fauci gave to the news, announcing that Moderna also shows similar results

** FAUCI SAYS PFIZER VACCINE CANDIDATE EFFICACY IS ʻEXTRAORDINARY '- BBG

** FAUCI SAYS PFIZER DRUG WILL HAVE MAJOR IMPACT ON COVID RESPONSE

** FAUCI SAYS MODERNA MAY HAVE SIMILAR RESULTS AS PFIZER VACCINE

Indeed, it appears that Pfizer's preliminary results, as well as being very good, have come in advance of estimates. In light of what Fauci revealed about Moderna, it seems reasonable to expect that other preliminary results of phase 3 may also surprise us positively. Between the speed and the level of effectiveness of the products, the target for the distribution of vaccines in sufficient quantities to immunize seems closer than what was estimated until yesterday.

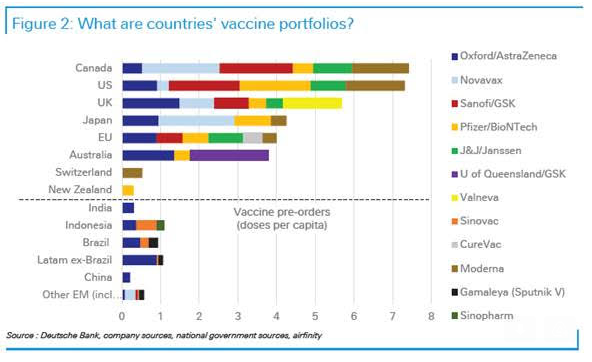

Many countries have already entered into important supply contracts with major companies. To get a picture of the situation, Deutsche Bank comes to our aid, with a graph showing the contracts made by the main industrialized and emerging countries with the various houses, in terms of per capita doses.

Should it indeed emerge that major candidates are showing similar progress to Pfizer, the target of an immunization over the next year would no longer be so optimistic. We bet that the newsflow will intensify in the coming days / weeks: for example, Astra Zeneca should publish preliminary results of its trial 3 in the UK in a short time.

Wonderful news, which for the first time really let us glimpse the possibility of a normalization over the next 4/6 quarters. However, we must keep in mind that from here to the approval, hitches, unwanted side effects or other may also arise, capable of reducing the scope of this news.

And we come to the market reaction.

Equities accelerated violently to the upside, adding, particularly in Europe, spectacular progress to last week's already sensational performance. Under the surface, however, sector rotation is wild. Cyclical and value stocks have literally exploded. Banks show double-digit progress. Transport and leisure services earn tens of percentage points. The defensives struggle, while the "stay at home business" yield, and in some cases (videoconferencing, remote diagnostics, some social networks, home entertainment etc) they correct heavily. This is why Europe, full of banks and traditional cyclicals, outperforms the US, where the Nasdaq drops at times, on a day in which the S&P 500 is 3% and the traditional DOW 4.5%.

Rates rise significantly, costing more reflation and less financial repression by central banks. Inflation expectations are rising, and, in the US, also real rates, to price more growth, with the idea that the advent of the vaccine completely avoids the impact of the second wave, given that at the moment lockdowns are predominant in Europe.

The dollar follows this logic. Less Covid and more growth, ergo a less dovish Fed. The greenback recovers against the main crosses (Yen and CHF in the lead), but falls against emerging markets and commodity and oil-driven currencies.

Among commodities, oil explodes, to price higher demand, while precious metals collapse, to discount less QE, less monetary stimulus in general.

The EU session closes without these trends showing signs of fatigue. The Eurostoxx 50 takes 6.36%, which is added to the 8.3% of last week, going to touch the highs of July. Eurostoxx Banks rises by 13.9%. Energy takes 10%. On the other side of the spectrum, pharmas close unchanged. On the bonds front, the 10-year yields of Germany, France and Italy see yields rise by 10/11 bps. the € closed at 1.182, after scoring 1.1920 in the early afternoon. Oil at + 8% and gold -4% complete the picture. In the US, the Nasdaq 100 is currently at -0.40%.

Needless to say, these news took away the consolidation I expected after last week's spectacular performance. It is incredible how a market that seemed battered in the last days of October (in which I was talking about capitulation ) was able to pass, in the space of 6 sessions, to a situation of exceptional optimism. Beyond today's performance, justified by the news, sentiment was already euphoric this morning, in the presence of a not exactly unpredictable picture a week ago: Biden won, Congress is (presumably) divided, and Trump disputes the result. The lack of impact of the litigation probably depends on the fact that, unlike in 2000, these were widely expected, and for the moment no big clashes are to be seen, indeed Trump seems quite isolated, even among the Republicans. There can be.

What is certain is that, in the short term, the performances are stratospheric. The Eurostoxx reaches resistance having recovered 15% in 6 sessions, at a rate of 2.5% per day. At the same time, the S&P 500 has recovered 10%, but marks an all-time high. The Vix lost almost 40%. Such violent movements usually cause short positions to collapse. In this case, the process is accelerated by the frenetic cover-ups on the sectors penalized by the Coronavirus. The market has been totally displaced by the sunset of the “blue Wave” which forced investors to give up cyclical and value stocks to return to tech, and to buy back bonds. In this sense, the impact of today's news is a total shock.

The result of this wild price action can be a positioning opposite to that observed 7/8 days ago, which produced the rally. It's hard to think that hedges against post-election volatility are still standing after this treatment.

Which is why, while remaining positive in the medium term, for the usual arguments, namely fiscal and monetary stimulus, to which is now added the light at the end of the tunnel on the virus, I do not consider it attractive at all to pursue these levels. Also because the goal of distributing vaccines in large doses is still far away, as the current US health secretary and the elected president also observe. And in the meantime, the infection can still cause a lot of trouble.

** US HEALTH SECRETARY AZAR SAYS IT WILL LIKELY TAKE SEVERAL WEEKS FOR FDA TO RECEIVE AND REVIEW PFIZER DATA ON VACCINE -FOX NEWS INTERVIEW

* BIDEN SAYS STILL MANY MONTHS UNTIL VACCINE WIDELY AVAILABLE

And, once the euphoria has passed, and assuming that the new schedule is respected, there is the small question of the acceptance of the vaccine by the population.

That governments and central banks can remove the stimulus early due to the vaccine, however, worries me quite little.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-e-perche-le-borse-festeggiano-dopo-il-vaccino-di-pfizer-anti-covid/ on Tue, 10 Nov 2020 14:10:24 +0000.