World debt causes pandemic: numbers and sustainability. Sace report

The pandemic crisis contributed to a further increase in world debt. Extract from the report "Map of Risks 2021" by Sace presented by the chairman Error and by the CEO Latini. All the details

The pandemic crisis has contributed to a further increase in world debt, negatively impacting the international credit situation, a risk factor that we have already highlighted in past editions of the Risk Map , especially for low-income countries.

Global debt, both public and private, has increased by about 60 trillion dollars in the last four years (according to the Institute of International Finance, IIF), exceeding 281 trillion in 2020 (+24 trillion compared to 2019) . In 2020, the debt reached 355% of global GDP, a sharp increase compared to the 320% of the previous year. Debt is particularly onerous in Emerging Countries, where it has increased by 30 percentage points and stops at 250% of GDP; the increase was more marked in the advanced countries (+37 percentage points, approximately), where the debt reached almost 420% of GDP.

Furthermore, according to recent estimates by the World Bank, last year the debt measured in relation to tax revenue exceeded the 250% threshold globally, up 43 percentage points compared to 2019, mainly driven by a strong increase in countries Emerging. For 2021, the projections indicate a settling on nonetheless high levels, attributable to a gradual downsizing of fiscal interventions in a context of accommodative monetary policy for some time to come.

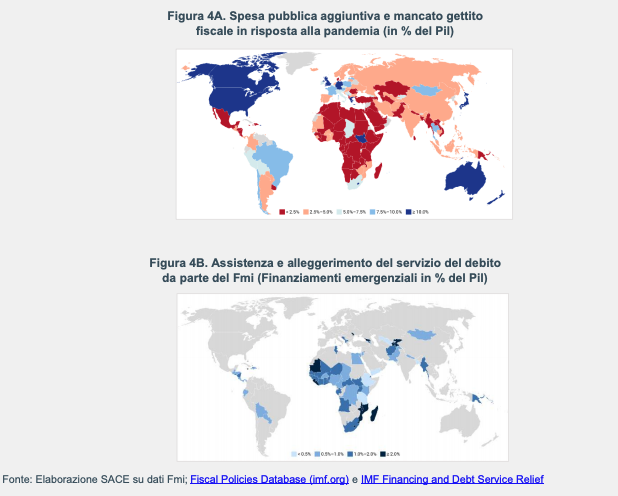

The marked worsening of the debt situation in 2020 is the inevitable backlash of the attempt to avert even heavier economic repercussions of the shock (Fig. 4A). In particular, several emerging economies have had difficulty in meeting at least in part the obligations accrued on foreign debt in the aftermath of the collapse of the inflows of hard currency due to the interruption of trade. For this reason, they found themselves in the need to resort to the support of international institutions both in terms of emergency financing and in lightening, albeit temporary, the debt burden. The IMF supported the financial needs of economies in difficulty with two types of credit lines (“Rapid Financing Instrument” and “Rapid Credit Facility”) and with the extension of ad hoc programs. Overall since the beginning of the pandemic, it has provided liquidity for 32.3 billion dollars in 83 countries, of which about 16.7 billion towards Sub-Saharan Africa, about 5.4 billion towards Latin America and about 3.9 billion towards the MENA area (Fig. 4B).

In this context fits the invitation of the new US Treasury Secretary, Janet Yellen, to the other members of the G7 to strengthen the fiscal stimulus to support their economies in the recovery from the pandemic. In addition, the United States recently spoke out in favor of an increase of up to $ 500 billion in the IMF's Special Drawing Rights (SDR) in support of developing countries, in contrast to the position taken during the Trump presidency.

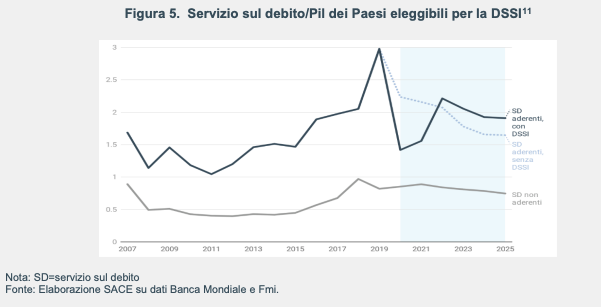

The G20 member countries have also moved in this direction with the adoption of the Debt Service Suspension Initiative (DSSI), an instrument that grants the economies most vulnerable to the consequences of the shock to reschedule the debt with the same value. In January 2021, 46 of the 73 eligible countries, mostly African, joined the moratorium, with a total benefit estimated at 16.9 billion dollars (equal to 0.7% of the GDP of the adhering countries). The adhering countries are those in which the service of foreign debt is more onerous (3% against 0.8% of GDP in 2019), such as Ethiopia, Senegal, Pakistan (Fig. 5). Not all beneficiary countries have chosen to join the DSSI, those who have not done so (for example Nigeria, Ghana, Bangladesh and Uzbekistan) have preferred to avoid the perception of a risk of illiquidity for the financial markets, so as not to preclude the possible future access. The Figure shows the evolution of the foreign debt service for eligible but non-adhering countries (light gray line) and for adhering countries (dark gray line). For the latter, the distinction with respect to what would have happened in the absence of the DSSI (dotted line) shows the benefit for the two-year period 2020-2021, which will however be reimbursed (plus interest on the deferred installments) starting from 2022.

More indebted public systems and private systems with weaker financial structures result in increased credit risks for all counterparties. For advanced countries, the debt has increased in absolute terms, in some cases even significantly, but not such as to question its sustainability. This for various reasons: an example among all, within the EU, the importance of the temporary suspension of the Stability Pact and the historic measure of the Recovery Plan in a context of rates kept low by the European Central Bank (ECB) and , in the United States, the $ 1.9 trillion fiscal stimulus package launched by the new administration.

The landscape is distinctly different and more complex for emerging economies. Zambia, Suriname and Lebanon, which declared default in 2020, may not be an extreme case: countries with past economic fragility, governments that have not been able or able to adequately implement measures to contain the crisis and the persistence of the pandemic could lengthen the list of countries whose debt will reach critical thresholds (among these, for example, El Salvador, Tunisia, Oman and Sri Lanka). There are also cases in which, while maintaining a very high level of debt to foreign creditors of a very high nature, governments have managed to carry out a restructuring (for example Ecuador and Argentina). In a pandemic year, however, there are also relatively virtuous examples of countries that have managed to keep their credit scores almost stable (for example Vietnam and Chile). The worsening of credit risk can also be seen in banks and businesses. The sharp decline in corporate income and turnover attributable to the crisis will in fact be reflected in pressure on bank balance sheets, attributable to the deterioration in credit quality and the squeezing of profit margins.

According to the rating agency Standard and Poor's, the expected losses on world bank loans for the two-year period 2020-2021 amounted to 1.8 trillion dollars12: if on the one hand, compared to last July, the forecasts see an improvement of 300 billion as a result of the support measures of the various governments, in particular in the United States, China and, in part in the Asia Pacific area, on the other hand, the persistence of fiscal support provides for the maintenance of a still high value of the losses for the 2022; of the $ 867 billion in credit losses forecast for 2022, more than half will be recorded in Asia and in particular China (453 billion); the Dragon, the first country to face the crisis, is also one of the few to record positive GDP growth last year thanks not only to the recovery of production, but also to the support of banks for businesses – often state-owned – and to the reabsorption of non-performing loans and other losses of failed businesses. The EU and North America follow with respectively 183 and 148 billion dollars in losses, while Latin America is less affected (41 billion).

Global economies, as recalled by the Group of the Thirty (G30) 13, are approaching the "edge of a cliff" where keeping alive "masses of zombie companies" that drain already scarce public resources could cause them to fall for good. In this perspective, it is necessary that States have a long-term vision that focuses on both sustainability and growth, without which it will be difficult to recover the lost ground. If the exit from the crisis requires not removing the stimulus measures prematurely, debt sustainability and financial stability will make it necessary to ensure that these same measures are of a temporary nature and do not end up undermining the efficiency, even of the private system.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/debito-mondiale-causa-pandemia-numeri-e-sostenibilita-report-sace/ on Sat, 06 Mar 2021 06:13:48 +0000.