How US economic policy will change with Biden

All the potential news regarding economic policy in the United States with the new president Joe Biden. The analysis by Andrea Delitala, Head of Euro Multi Asset at Pictet Asset Management

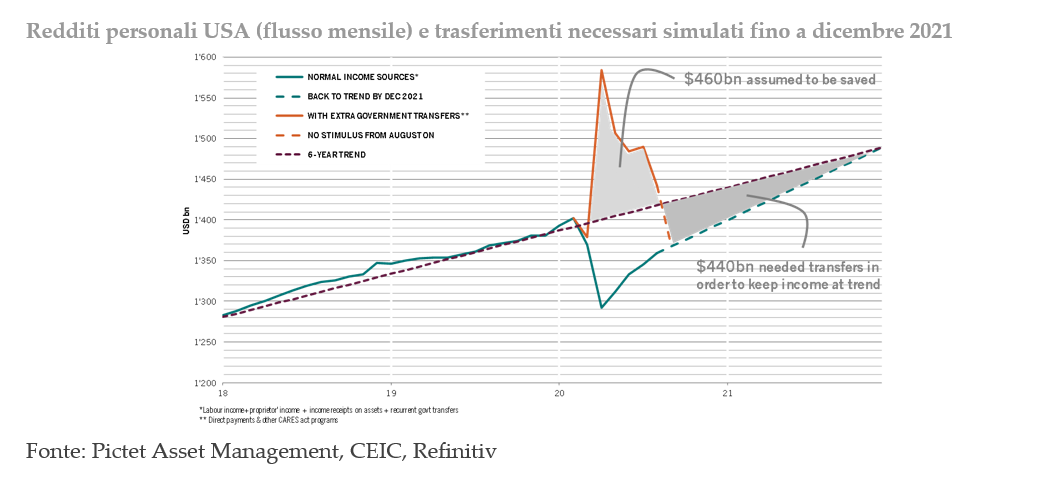

With Biden's victory, the first interventions of the new Presidency could most likely be aimed precisely at the field of health and a second priority could only be that of work. In the immediate future, it is necessary to take action to bring back the violent wave of unemployment as soon as possible and in this way also relaunch the driving consumption of the stars and stripes economy. In fact, the federal transfers that have sustained the personal income of US citizens in recent months are about to come to an end, more than actually compensating for the drop in earnings caused by the peak of unemployment. To avoid the fiscal cliff that the end of transfers would cause, at least an additional $ 440 billion in support measures will be needed in the short term, before or immediately after the elections.

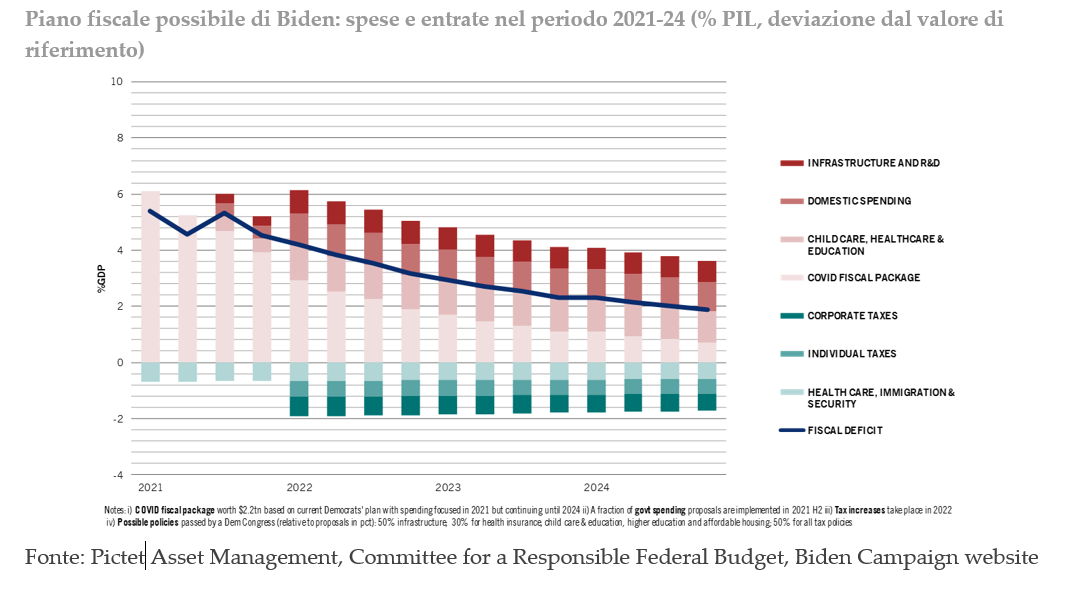

This first emergency intervention would be followed by a structural greater fiscal expenditure for the years to come: the package proposed during the election campaign is around 8% of GDP, but could in all probability stop at 4-5%, a level in any case capable of boosting the country's economic recovery. We could see a new social pact like Lyndon Johnson's Great Society (1964), with a more massive intervention by the state in the economy in support of the lower-middle class hard hit by the pandemic, in a climate characterized by state-enterprise collaboration. to favor a retraining of workers, and a reduction in economic inequality. To counteract this fiscal expenditure in the form of transfers and investments in infrastructures (especially green ), there should be a rise in taxes on corporate profits and higher incomes with redistributive effects, but this would hardly happen before 2022. The same Wall Street in recent weeks seems to be accepting with a certain serenity a clear victory by the Democrats, also because it would be a result corroborated by a strategy of winning the vote of the moderates.

The democratic one is an extremely ambitious program, which cannot be carried out without the cooperation between the state and the Federal Reserve. Another change of course that a possible Biden victory could favor: the attitude towards central banks, the subject of repeated accusations by Trump in recent years, could return to being more collaborative. The result would be a path of economic recovery fueled by debt-financed government spending, in turn made easily sustainable thanks to supportive monetary policies such as Quantitative Easing or its variants (Twist, Yield Curve Control), all destined to contain the level of interest rates (and therefore the service charge) of the public debt.

This highly expansive policy mix, resulting from neo-Keynesian spending policies associated with accommodative monetary policies, could push US GDP growth in 2021 even 2-3% above our current base forecasts (5% which includes the mini -budget of about $ 500 billion, but not the package linked to a hypothetical "Blue Sweep") and would have some chance of succeeding where monetary policies alone have failed, or rather to make some inflation reappear, in turn capable of eroding the value of public debt in real terms. An inflation tax that appears far less traumatic than the alternative: austerity or default.

The more conciliatory attitude would also be taken in matters of foreign policy. The opposition with China would not be abandoned: the Asian giant is destined to remain the strategic rival in any case, given that the anti-Chinese sentiment is widely shared (and bi-partisan). In this context, in order not to waste energy and not risk remaining politically isolated, a resumption of multilateralism is conceivable, through rapprochement with NATO and the European Union with which the Democrats also share their attention to environmental issues.

Health and work, fiscal and foreign policy, relations with international organizations and central banks, pro-environment policies, the political and economic structure of the USA, and a cascade of a large part of the planet, could be about to undergo a sudden reverse. Always if, this time, the polls are right.

MARKETS AND IMPACTS ON THE PORTFOLIO

From the point of view of market strategies, after the improvement of the outlook for the US post-vote which marked the highest relative to the stock indices on October 12, uncertainties have arisen regarding the rapid approval of even a minimal package of US measures (skinny budget), still under discussion, and especially with regard to the effectiveness of the pandemic containment policies, especially in the Old Continent. It is clear that the latter factor dominates all other considerations in determining the fate of the markets, as can be seen from the underperformance of the European indices; it is therefore important to evaluate scenarios regarding the availability and effectiveness of an anti-Covid vaccine.

In this regard, it should be noted that the forecasts of professionals1 say that 70% will have a vaccine distributed on a large scale by mid-spring 2021. A potentially long horizon for the economy and markets, especially if we return to restrictive measures such as in Europe, given the scarce effectiveness of the strategy adopted. The possibility of being able to have therapies and vaccines, therefore, affect the market (slight deterioration in October due to the setbacks of Astra Zeneca and Johnson & Johnson ): if we assume that the market correctly incorporates the possible scenarios and these are well reflected in the estimates cited, it is clear that stock indices could suffer from possible lockdowns, but also rebound in a stentorian way following the approval of a vaccine (or drug) ahead of schedule.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/come-cambiera-la-politica-economica-usa-con-biden/ on Sun, 08 Nov 2020 17:07:27 +0000.