$ 4,300bn of options expiring on Friday. Circulate people, circulate …

While the "turbo taper" threatens to make tomorrow's Fed conference decisive, Friday will be a quiet day with only $ 4.3 trillion of options to expire.

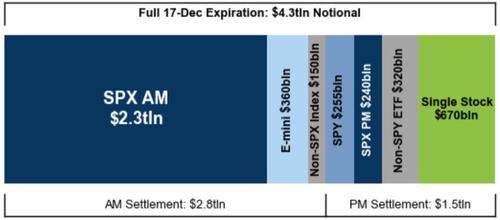

$ 4.3 trillion of notional share options (accounting for more than 8% of Russell 3000's market capitalization) are expiring (including $ 23 trillion of SPX quarterly options, $ 360 billion of options on SPX E-mini futures , $ 255 billion of SPY options and $ 670 billion of individual stock options). Among other things, the deadline is divided between morning and afternoon ..

This has historically been the busiest week of options trading year.

The December 2021 OpEx has lower total open interest than last December's deadline, but more of its open interest is close to money than last year. Although this is the smallest December deadline in at least a decade, but bigger than almost any non-December deadline.

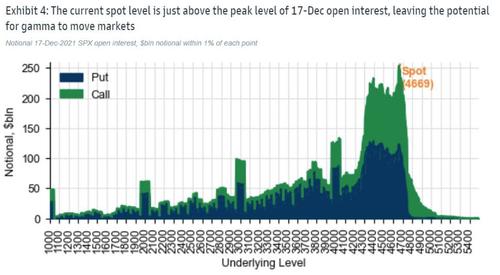

As Goldman notes, the high volatility over the past month has driven index option volumes higher than the year, leaving extra positioning slightly below the current spot level after the SPX (the index based on the US stock exchange) reached a new all-time high.

Even when the SPX hit a new all-time high on Friday (Dec 10), the VIX was at its high for a record day of SPX since the index hit 3975 in March, consistent with a high macro risk environment.

According to Goldman, the prevailing high volatility risk premium this year is an indication that investors have been net buyers of index options, leaving a “street” short range position which may help volatility remain high this week.

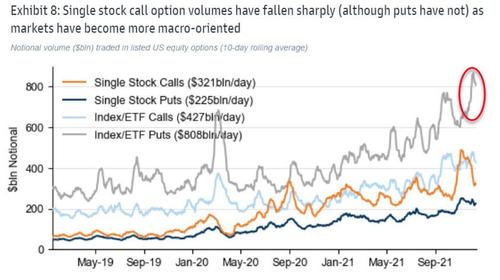

As SpotGamma concludes, the volatility of individual stocks remains quite high even though volumes have declined moderately in recent months.

The strong negative performance of many stocks is attracting large volumes of put, i.e. put options, creating a highly concentrated negative range at 12/17 expiration.

For the top 50 stocks with high volumes of options, investors traded $ 196 billion in puts (put options) on the average day of the last month, a 40% increase over the previous year. TSLA, HD, PFE, AMD and SE are among the large market capitalization stocks where put volumes have increased by more than 80% from the previous year.

The problem with having “Put” positions is that they are forward sales contracts, so .. You should have the securities to sell. If they are pure options, no problem: you lose the commission and go. But if they are "Futures", with the obligation to deliver the title, the thing is completely different. Friday we may see many positions to cover.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article 4300 billion dollars of options expiring on Friday. Circular people, circular… it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/4300-mld-di-dollari-di-opzioni-in-scadenza-venerdi-circolare-gente-circolare/ on Wed, 15 Dec 2021 08:00:08 +0000.