6+1 economic predictions that have been proven spectacularly false

New year, and some economic forecasts. You will hear promises of growth, forecasts of collapse, exaltation of new sectors, often also made by people considered prepared and truly of great culture. Too bad these predictions often turn out to be wrong.

Today we want to introduce you to the six wrong economic predictions that have gone down in history.

IRVING FISHER AND THE STOCK EXCHANGE IN 1929: Irving Fisher was one of the great economists of the first half of the 20th century. His contributions to economic science are varied: the relationship between inflation and interest rates, the use of price indices or the reformulation of the theory of the quantity of money are some of his best known theories. However, he is sometimes remembered for an unfortunate statement made in the days leading up to the crash of 1929. Fisher said that “stock prices have reached what looks like a permanently high plateau (…) I expect to see the stock market much higher within a few months". A few days later, the stock market crashed with devastating consequences. After all, even geniuses are not without mistakes, especially when it comes to financial markets.

JOHN MAYNARD KEYNES AND THE 15-HOUR WORKWEEK: In 1930, the famous British economist John Maynard Keynes wrote an essay on the future of work entitled "Economic Opportunities for Our Grandchildren." In it, he argued that rising levels of wealth and prosperity would ensure that by 2030 people in industrialized countries would only have to go to the office for short "three-hour shifts or a fifteen-hour workweek." Keynes argued that this new model of work would allow humanity to "do more things for ourselves than is usual for today's wealthy, all too content to have little duties and tasks and routines." Tempting as it may sound, economic trends indicate that Keynes's utopian "society of leisure" isn't coming anytime soon. As total wealth has increased since 1930, so have personal spending and income inequality. Or, simply, Keynes' models of full employment were not applied in favor of monetarists first and the so-called "Neo-Keynesians" later, for whom the very short working week remains a dream, but our fault.

PAUL EHRLICHT AND THE “DEMOGRAPHIC BOMB”: In 1968, biologist Paul Ehrlich published a book in which he argued that hundreds of millions of people would starve to death in the following decades due to overpopulation. He went so far as to say that "the battle to feed all humanity is over (…) nothing can prevent a substantial increase in the world mortality rate". Naturally, Ehrlich's predictions never came true. Since the publication of the book, the death rate has risen from 12.44 per thousand in 1968 to 7.65 per thousand in 2016, and undernourishment has declined dramatically even as the population has doubled since 1950. Rarely in history has anyone been so wrong. on the future of humanity, this error is periodic and one of the forerunners on the subject was the well-known Malthus. If there is a devastating famine it will not be due to nature, but to man and his behavior "in favor" of nature…

RAVI BATRA AND THE DEPRESSION THAT WON'T COME: Economist Ravi Batra topped the New York Times Best Seller List in 1987 with his book The Great Depression of 1990. From the title one can easily deduce what the main thesis of the book was: An economic crisis is imminent and it will be very hard. After all, the book was published in the aftermath of the 1987 financial crisis. Fortunately, his prediction did not come true, at least in the USA. Indeed, the 1990s were a period of relative stability and strong economic growth, with the US stock market growing at an annualized rate of 18%. Not bad for an economic depression, right?

ALAN GREENSPAN AND INTEREST RATES: In September 2007, former Fed Chairman Alan Greenspan published a memoir entitled "The Age of Turbulence: Adventures in a New World." In the book, he argued that the economy was heading for double-digit interest rates due to expected inflationary pressures. According to Greenspan, the Fed would have been forced to drastically increase its target interest rate to meet the 2% inflation mandate. A year later, the Fed Funds rate was at an all-time low, reaching the zero lower bound shortly after. Obviously he had not foreseen the crisis of the real estate markets first and of the subprime securities afterwards.

PETER SCHIFF AND “THE END OF THE WORLD”: Financial commentator Peter Schiff became famous in the aftermath of the 2007-2008 financial crisis for predicting the collapse in house prices as early as 2006. Since then, he has been predicting economic catastrophes every other day, with very limited success. There are many examples of failed predictions to draw from. For example, in a 2010 video, Schiff predicted that Quantitative Easing (the unconventional monetary policy undertaken by the Fed between 2008 and 2014) would lead to hyperinflation and the eventual destruction of the dollar.

Unfortunately for Schiff, the average annual inflation rate since QE began has been 1.68%, slightly below the Fed's 2% target. The problem is that all finance-related economists overstate the inflation-link. quantity of money, underestimating the preponderant weight of the real economy.

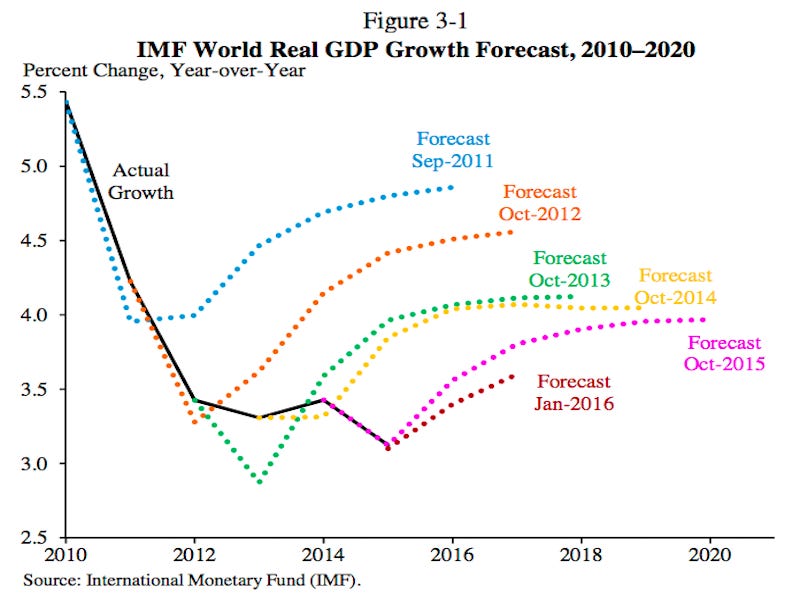

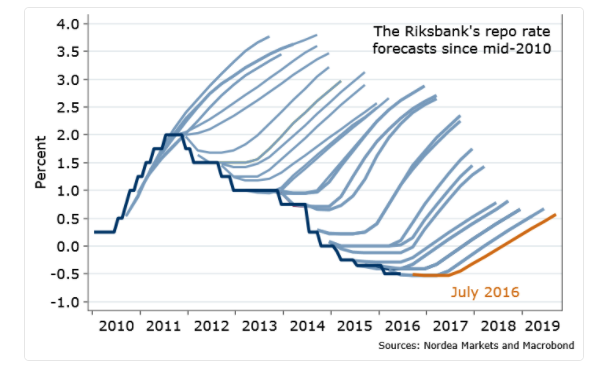

BONUS: ALL THE FORECASTS OF CENTRAL BANKS AND INTERNATIONAL ENTITIES. A man in the street can make predictions and get them wrong, and that would not worry. The problem arises when supranational entities or central banks make a sensational mistake in forecasting, because this means that these entities will apply the wrong economic policies. Here are some of the most sensational examples:

- the growth forecasts of the International Monetary Fund

- ECB inflation forecasts

- Inflation forecasts made by Swedish Riskbank

So specialized bodies with trained staff, at least theoretically, regularly get their forecasts wrong. Luckily they are the good ones…

So economic forecasts are a bit like weather forecasts, always perfect ex post.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article 6+1 economic predictions that have been proven blatantly false comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/61-predizioni-economiche-che-si-sono-dimostrate-clamorosamente-false/ on Sun, 01 Jan 2023 10:52:13 +0000.