A hedge fund earned 700 million from the Gamestop case

The bulk of Hedge Funds have lost between 15% to 50% of their capitalization from speculation against the Gamestop (GME), there is a fund that has made a nice profit, although probably unexpected.

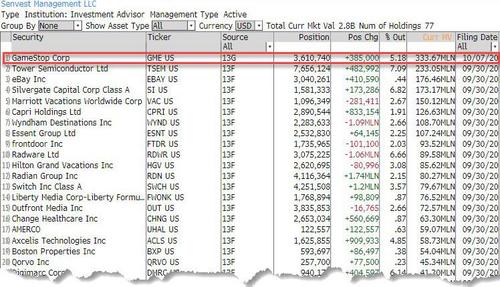

The Senvest Management fund earned $ 700 million with GameStop. Because? Since GME was Senvest's largest holding since October 7, 2020, an oddity considering that many colleagues in the same industry at the time considered it a potential candidate for bankruptcy. A seemingly risky move, but at Senvest Management they had a plan.

Senvest managers Richard Mashaal and Brian Gonick began buying GSE shares in September, the Wall Street Journal report reveals, accumulating 3.6 million shares in a few weeks and making Gamestop the fund's biggest backlog. Mashaal told the Journal: “When he started his march, we thought, something is happening. But we had no idea how crazy this thing was going to be. "

GameStop has grown into the company's most profitable investment in terms of dollars earned and internal rate of return. The Senvest fund saw its value rise from $ 1.6 billion to $ 2.4 billion following the GameStop move and, for the month of January, its return was over 38%; making it the most profitable fund according to HSBC's Hedge Weekly.

Therefore, it was not only the very small speculators who invested in Gamestop, but also large funds took positions which then proved to be successful. In the end, it was enough to do a little homework to make good money.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article A hedge fund earned 700 million from the Gamestop case comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/un-hedge-fund-a-gudagnato-700-milioni-dal-caso-gamestop/ on Sat, 06 Feb 2021 07:00:41 +0000.