A theory for a cash coin

by Nicoletta Forcheri

In the two previous appointments we have described the origin of “ debt money ” in the accounts and historically. This nature of debt money is currently expressed in the discrepancy between anachronistic accounting – which still describes the monetary creation as if it were covered by gold or other underlying assets and therefore is marked as a liability of the issuer – and the procedure for issuing this currency. , which is fiat , ie theoretically without any need for cover, or reserve.

Before proceeding, it is necessary to understand that money is fundamentally symbolic in nature: without the scriptural symbol , money does not exist, both for our bank deposits and for physical cash . Think of the coin minting (without which the coin becomes a piece of metal) and the denomination of the banknotes (without which, the banknote becomes waste paper). And it wouldn't even exist for cryptocurrencies that are based on encrypted digital writing, the blockchain .

If the currency is of a symbolic nature ( scriptural / accounting ) it means that it coincides with the accounting entry itself which currently, due to this discrepancy, does not account for the act of monetary creation if not confused with the original deed of sale of an asset, sovereign debt securities , customer obligations (mortgages) , stocks , banknotes , foreign currencies and even goods and services from the sovereign issuer . It could be said that both in the mortgage and in the deposit, for example, the money is ghost , and disguises itself as a bill , confusing itself with the payment instruments (bank transfer , check , credit card , app . Etc.).

Therefore one of the fundamental flaws of this monetary paradigm is that, as written by KPMG in the 2016 Money Issuance report, monetary creation is not distinct from the act of its introduction – which in the current system takes place mainly with credit – while in the system ideal for many Keynesians and as outlined in this paper it should take place above all on the occasion of debt monetization, productive investments and public spending, tax discounts. Each monetary issue, separate from the act of its issue, therefore becomes a political decision in the head of a technical committee that represents politics. The hic of the KPMG model is that money remains the issuer's liability for accounting purposes and therefore does not leave the banking accounting peculiarity.

Other scholars recommend the classification of monetary creation in equity . Among these, Costa and Bossone in “ Is currency the capital or debt of the issuer? "( Www.economepolitica.it of 22/01/2018), to obviate the historical and accounting error of recording central bank banknotes and bank deposits in general as liabilities, put forward the proposal to mark monetary creation as equity – in the same way as the share capital payment – and in particular as undistributed dividends .

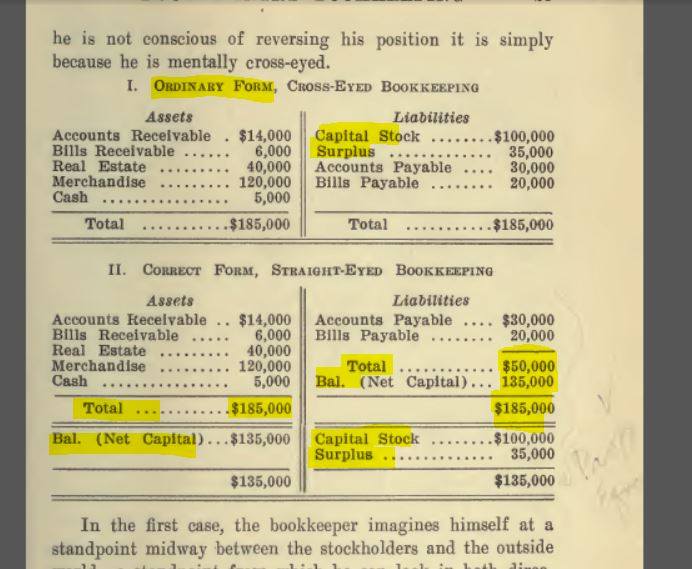

Even in this solution, however, the income deriving from monetary creation continues to be recorded in the liabilities , ie in the “credit” of the issuer's balance sheet . In fact, as rightly explained by Van Cleve in " Principles of Double Writing Book-keeping" (1913) , with a reasoning that is difficult to contest, the net assets ( share capital , equity , reserves , undistributed dividends ) should be a balance , because difference between assets and liabilities , and therefore should not really enter the zero sum between credits and debts of a company. If the capital of a company is a debt towards “itself”, it is not a real liability , but it is the assets owned by the legal person that owns the company. The fundamental mistake is to put in the same category of liabilities the debts of a company to the outside – real liabilities – and those to itself – property .

The former are real liabilities , the latter are the balance , normally active , otherwise the company is liquidated.

Then the legal person that is the legal status of the issuing bank is also phantom, because when we talk about a joint stock company , for example, in reality it will be some privileged shareholders who will attribute the monetary revenues to the detriment of the other shareholders, " minorities "or" subordinates ". We are therefore in the paradigm of a ghost currency attributed to a ghost person, fictio juris , where some shareholders or privileged shareholders take advantage of a legal vacuum regarding the accounting of monetary creation.

In the first example, the current balance sheet (1913) with the equity (Capital stock + surplus) in the liabilities and the equivalent asset in counterpart. In the second case, the adjusted balance sheet according to Van Cleve, with the net worth as BALANCE. (Taken from Principles of Double Writing Book-keeping), Van Cleve (1913).

In the first example, the current balance sheet (1913) with the equity ( Capital stock + surplus ) in the liabilities and the equivalent asset in counterpart. In the second case, the adjusted balance sheet according to Van Cleve, with the net worth as BALANCE . ( Taken from Principles of Double Writing Book-keeping), Van Cleve (1913).

The double entry is a figurative and binary language, give and take: in the left column the debtors are put – to give – and to the right are the creditors – to have -. It is a figurative language where all the voices become people who must give or must have , debtors and creditors, including items such as Goods , Cash and Capital are personified .. Not only " dude must tot a caio ", but according to the transactions described, commodities , cash and capital also enter the binary language of give and take as if they were debtors and creditors.

The rules of double entry are basically three: 1) for each operation there are those who must give (debtor) and those who must have (creditor), 2) those who gave must have and those who had must give 3) the sum of the debit and having must be zero . The first principle is the figure of the accounting entry , the second simply means that everything is marked in the accounting language as if it were debt (re) or credit (re) , including ownership of cash and gold, or real estate and buildings, which debt and credit have nothing. The third principle is logical for the operations of give and take – the debt owed by the debtor is identical to the amount due to the creditor – it becomes counterintuitive to describe operations other than the quid pro quo, such as equity or cash.

The 2017 KPMG-Iceland study "Money Issuance" had identified the problem of money in the accounting coincidence between the act of monetary creation and the introduction of the same, with the first deed of sale by the issuer of currencies , bonds , other securities , even goods and services. However, KPMG's solution is only partially valid, since while restoring the power to create it only to the Central Bank , and to a political committee the decision to do so, it continues to mark it among its liabilities .

So I asked myself the question: when is money not a debt to the community, but its property? I was reminded of the example that Luca Pacioli gives in his Treatise on double entry , when he says that your cash money that you have in your purse, you mark them in the Cassa as due to yourself, that is, the Cassa owes to myself , Cash in debit, debtor and I myself in credit , creditor . The case, however, must be mine and there must be a natural person, not a legal fiction. That is: " All cash money that you find yourself to be your own, that is, that you have earned at different times in the past, or that you have been left by your dead relatives, or donated by some prince, you will make yourself a creditor and a cash debtor ".

So, an epiphany came to me. The created coin must be marked in the cashier as the property of each member of the community. However, the cashier must be a bank controlled by citizens, co-owned by them, and not a central bank controlled by private banks, – as now in Italy – nor controlled by a state (legal person) and not the sum of citizens, as in China .

| Give | To have |

| Cash must give tot | I must have from the Cashier |

| The cashier is MINE, it's my bag. | |

The case for bank accounting in Italy, according to Circular 262 of the Bank of Italy, is item 10 on the balance sheet and is entitled Cash and cash equivalents of which form part of legal tender currencies including banknotes and coins abroad, and demand deposits to the CB (Central Bank) of the country.

Extrapolating the case to a self-determining people, in a given territory, the cashier will be either the Central Bank or the Treasury , acting through the Central Bank as an instrumental body, its department controlled similarly to the other Treasury offices, and the Treasury will have to be a joint fund for the profits and capital of all the citizens who are members of the country.

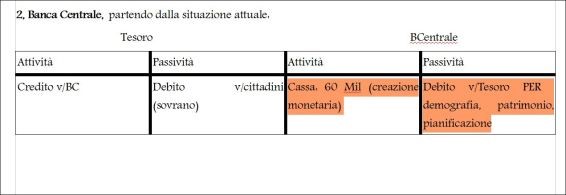

The coin will be marked on the assets side of the cashier and as a counterpart there will be demography, assets, public works. That is the present, the past and the future of a communitas , with a criterion of monetary production partly linked, according to a calculation, to the demographic variable, GDP and assets , and partly decided sovereignly as regards services and public Works.

The act of monetary creation is therefore distinguished from credit by the fact that the money created is not a security, and is placed in the issuer's cash box, offset by the liability towards the "sovereign" which is the People.

The Treasury is just the People's Bank.

The act of monetary creation – here the issuer is the Treasury – is therefore distinguished from credit by the fact that the money created is not a security, and is placed in the issuer's cash box, offset by the liability towards the "sovereign" who it is the People. The Treasury is just the People's Bank.

Proper accounting for a non-debt fiat currency. The monetary creation is recorded in the cash register of the CB (agent or similarly controlled Treasury office), in counterpart to the debt of the same creation towards the Treasury, which records it as a credit, and in counterpart as a debt towards sovereign citizens. The pyramid has overturned!

The currency will no longer be covered by reserve assets but will be destined for humans who will reverse the monetary value with their work. Not only that: this currency will be "solid" as it will in any case be guaranteed by a shared patrimony that will not already be the underlying asset of the currency , but the purpose of monetary production: its formation and its enhancement for the good of all citizens. This is the real paradigm shift, if one gets out of money ontologically and accounting for debt .

Only once the coin has been marked in the justified cash box – not covered – by the number of citizens and the works to be carried out, can it be introduced into the company in the form of 1) Profit sharing income to all citizen shareholders 2) Expenses for the maintenance of the country's assets and for investments and services 3) In the credit circuit .

A portion of the money created will therefore enter the credit circuits, but unlike the current credit, commercial banks will only lend the amounts they have received from the Citizens' Fund ( Treasury or Central Bank ), truly entering the commercial bank's Cassa in return for a debt. to the Treasury or the Central Bank , in turn debt to citizens.

When the loan is taken out , the commercial bank will replace the cash in cash object of the loan with a credit , while the liabilities will remain the amount owed to the Treasury (or the Central Bank ) which owes it to the citizens, contrary to what happens today. where the liability is towards the borrower customer .

This means that when a citizen receives a sharing income or a sum for a mortgage , the currency he will receive – in any form including a deposit – will actually be in his or her cash box, and not as today, under Article 1834 , deposits are owned by the bank, and therefore a customer credit . The comparison is that of safe deposit boxes , where the values placed inside are accounted for as ours, and not as a bank debt , with a separate account management: it does not matter that the money is physical, electronic, digital, plastic … if it is marked as the cash of the person who holds it means that it is not of the issuer, even if the subject of a loan and due in installments for the repayment.

This resolves the accounting peculiarities detected by Richard Werner where banks – contrary to standard companies – when dispensing an amount, for example, with a withdrawal or a transfer from bank to bank, do not reduce the 'active cash but reduce the liability marked for deposit . The banks, with this accounting correction, will be forced to really deduct the amount disbursed from the cash, and would truly become the intermediaries they should be. And finally: upon repayment of the loan, the sum would return to the bank's cash – canceling the bank's credit – but the debt to the citizens' bank would remain (directly the Treasury , or the Central Bank on behalf of the Treasury ) until the sum is deducted. from the cash to return it to their sovereign citizens through their common fund , the Treasury .

Nicoletta Forcheri @ October 2020

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article A theory for a cash coin comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/una-teoria-per-una-moneta-cassa/ on Tue, 03 Nov 2020 15:29:22 +0000.