After 16 years we have returned to the great financial crisis

With almost deliberate attention, the FED is recreating the situation that led to the 2008 financial crisis, what was known as the “Great Crisis, but which risks being overcome due to its negative effects, and we will explain why later.

US mortgage rates hit their highest level in 20 years…

Mortgage rates topped 7% this week, hitting their highest level in more than two decades.

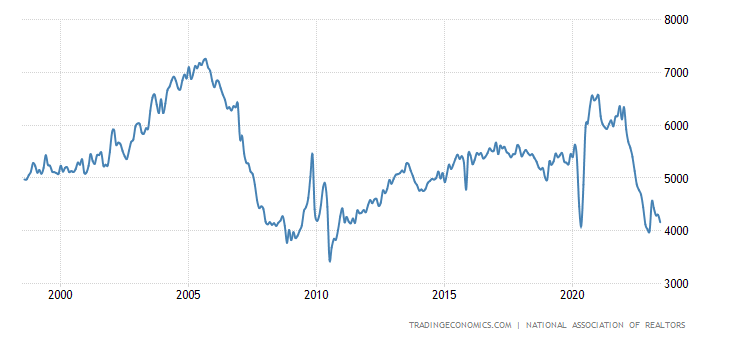

The average rate on the popular 30-year fixed-rate mortgage rose to 7.09% this week, from 6.96% the previous week, Freddie Mac said on Thursday. This is the highest point since the first week of April 2002 and marks only the third time rates have exceeded 7% since then. The last few times were in October and November of last year when the rate hit 7.08%. Here is the graph from Tradingeconomics

It goes without saying that high mortgage rates have hampered the real estate market even more severely than in 2007 in recent months, because absolute real estate values are higher.

… Sales of existing homes plummet

Midway through this year, existing home sales were down a whopping 18.9% compared to the same period in 2022…

Total sales of existing homes1 – completed transactions that include single-family homes, townhouses, condominiums and cooperatives – decreased 3.3% from May to a seasonally adjusted annual rate of 4.16 million in June. Year-on-year, sales decreased by 18.9% (compared to 5.13 million in June 2022).

There are certainly many people who would like to buy a home, but who, due to rising mortgage rates, cannot afford to do so.

Homes have become extremely inaccessible in this country. According to Redfin, the percentage of teachers who can afford to buy a house near the school where they work has dropped to just 12%…

According to data from Redfin, the number of teachers who can afford an affordable home in their school district has plummeted to just 12%, from 17% last summer and 30% in 2019, amid the worst crisis in the country. housing affordability for a generation now.

Redfin's analysis of median teacher salaries for 2022 in 50 major cities for more than 70,000 PreK-12 public and private schools revealed that no teacher in San Jose and San Diego can afford homes within "commuting distance" of their school , which means that home and work are 20 minutes away during typical peak hours.

The damage has already been done.

Just yesterday we were talking about the huge problem American workers' expectations of wage growth are. Huge problem, of course, for the Fed, not for those who have to pay the bills and buy food and fuel for the car. But these requests for increases will lead to an even tougher, anti-inflationary and restrictive position of the Fed.

Most Federal Reserve officials signaled at their July policy-making meeting that high inflation still poses an ongoing threat that may necessitate further hikes in interest rates this year. In Jackson Hole, where they are gathered, you will see how the thinking heads of the American Central Bank will support this vision.

Minutes of the July 25-26 US central bank meeting, released Wednesday, showed central bank officials noted that inflation remains well above the Fed's 2% target and policymakers they need to see “further signs that aggregate demand and aggregate supply are moving towards a better equilibrium to be confident that inflationary pressures are easing”. This means further increases in mortgage rates. Can the economy handle it?

Economists have predicted that mortgage rates could rise above 8% if the economy continues to show signs of strength and the US Federal Reserve decides to raise interest rates again. If the Fed doesn't change course, the housing market is bound to implode.

The implosion of real estate would be neutral in itself, if it did not bring with it the crisis of the financial system, and the agency Fitch warns that we could soon see a large downgrade of the rating of the banking sector, including giants like JPMorgan Chase.

In many ways, I feel like we're seeing a repeat of 2008. The Fed seems ready for all of this, and will go like a tank down this road. Americans are far less ready, with 72% saying they don't feel financially secure, but ultimately the Fed doesn't care.

Citizens are not seen as living beings, each protagonist of his own personal drama, but as mere pawns that can be maneuvered on a huge chessboard and can be sarified. The ECB is even worse in this type of reasoning. So rest assured, it will steer the West towards disaster caused by an inflationary policy that they have caused.

The Americans and you will pay the price. They, never.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article After 16 years we have returned to the great financial crisis comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/dopo-16-anni-siamo-ritornati-alla-grande-crisi-finanziaria/ on Tue, 22 Aug 2023 12:48:39 +0000.