Auto credit: insolvency increases in the US amid the explosion of junk loans

The New York Fed's Center for Microeconomic Data has released the Quarterly Household Debt and Credit Report for the fourth quarter of 2023, which says something very interesting.

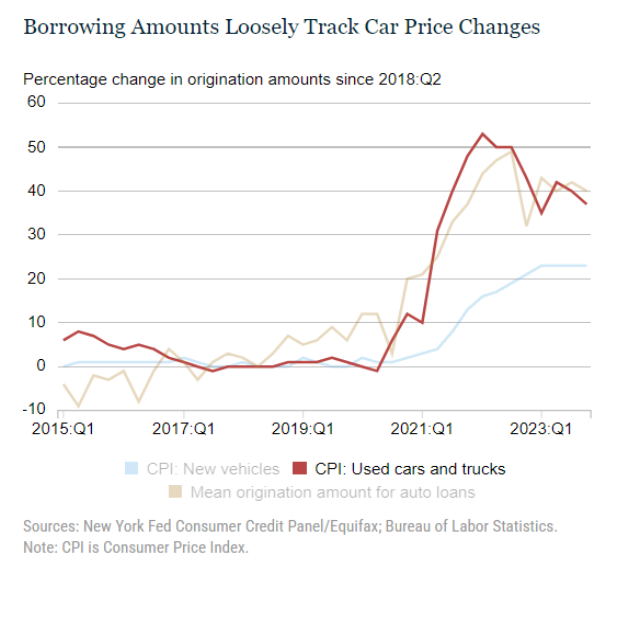

Household debt balances grew by $212 billion in the last quarter, but, moving on to the specific sector of auto lending, which saw a small but significant explosion in 2021-22, and then declined in development as inflation reduces

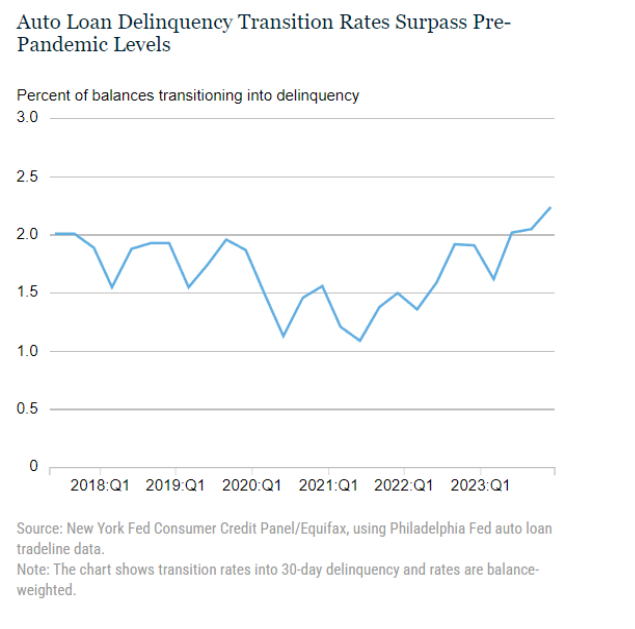

The problem is that there has been a significant increase in the number of insolvencies, i.e. loans that are not repaid, and which have reached 7.7% of the total, higher than pre-covid values and a level that, frankly, does not had been seen again since 2010, i.e. since the end of the financial crisis:

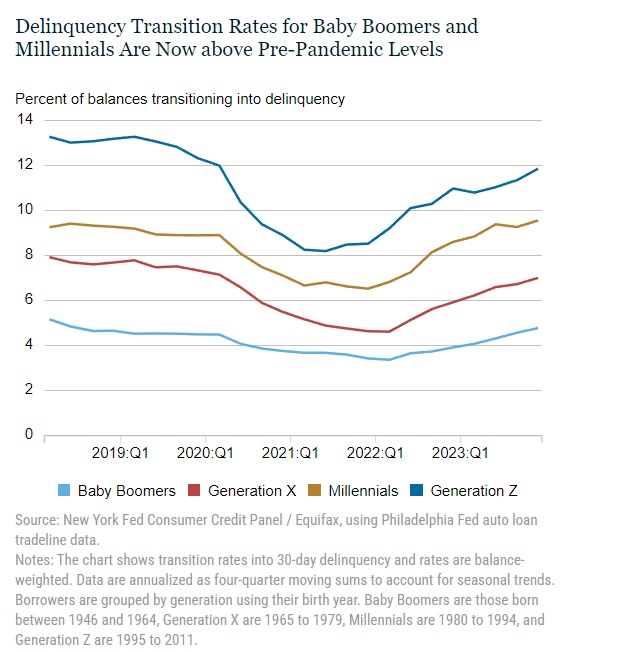

Young people are in greater difficulty, as they have higher insolvency rates

For generation Z the situation is complex: 12% are unable to repay their car debts.

This is also due to the sharp increase in the weight of installments for car loans, and this is not because they buy Ferraris or Rolls Royces, but because on the one hand car prices have increased, on the other, as loans are made to risky families , sub prime, are loaded with an abnormal interest cost. These are families who probably won't pay back, so the cost goes through the roof.

An Edmunds report last year showed that the percentage of drivers with monthly payments above $1,000 jumped to an all-time high of 17.1% in the second quarter of 2023 compared to 16.8% in the first quarter. The reason is that the average amount financed for a new vehicle is around $40,000 and auto loan rates are at an all-time high.

“The double whammy of relentlessly high vehicle prices and daunting borrowing costs presents a significant challenge for buyers in today's auto market,” Ivan Drury, Edmunds' insights director, said last year.

This brings us to two posts from X user Clown World. The post shows what appears to be a car dealership sharing several images online of new customers financing vehicles with payments equal to their monthly mortgage payments.

One person purchased a 2023 Tahoe with monthly payments of $2,550 for a term of 84 months!

In the first case, a car worth a maximum of 50-70 thousand dollars is sold at a theoretical price of 2,140 thousand dollars with interest. In the second case, a car worth around 67 thousand dollars costs, with interest, 288 thousand dollars. Why these differences? Simply because they are "junk loans", "garbage loans", that is, loans destined not to be repaid due to their absurdity. In five years these cars will be worth a fifth of their current value: what sense will there be in continuing to pay them off? It made more sense to rent.

But the US economy is doing GREAT, don't try to say otherwise.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Auto credit: insolvency increases in the USA amid the explosion of junk loans comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/credito-auto-negli-usa-aumenta-linsolvenza-in-mezzo-alleplosione-di-prestiti-spazzatura/ on Sun, 11 Feb 2024 15:11:30 +0000.