The ESM needs to be reformed, but because it loses money and costs a lot of money

Last week, parliament's rejection of the ESM reform sparked a debate in the media which, obviously, sided massively against the parliament which committed the sacrilege of refusing to rectify the treaty changes because they were deemed not convenient for the our country.

Yet the ESM, as an institution, should be reformed, but not in the sense of what was agreed between the countries, assigning it greater powers also on the definition of the solvency of individual countries. It should be reformed because its management generates significant losses and does not shine for efficiency and cost-effectiveness.

First of all, let us remember that, by statute, the management bodies of the ESM enjoy, like those of the ECB, total and absolute civil and criminal immunity. Why is such broad immunity necessary?

Furthermore, let us remember that the ESM is an international organization born from the ashes of a private body, the EFSF, which manages a fund that can reach up to a maximum of 700 billion, but which has currently paid out only 80. The payment of the funds it's not just virtual-accounting: the money has actually been paid, and here the trouble begins.

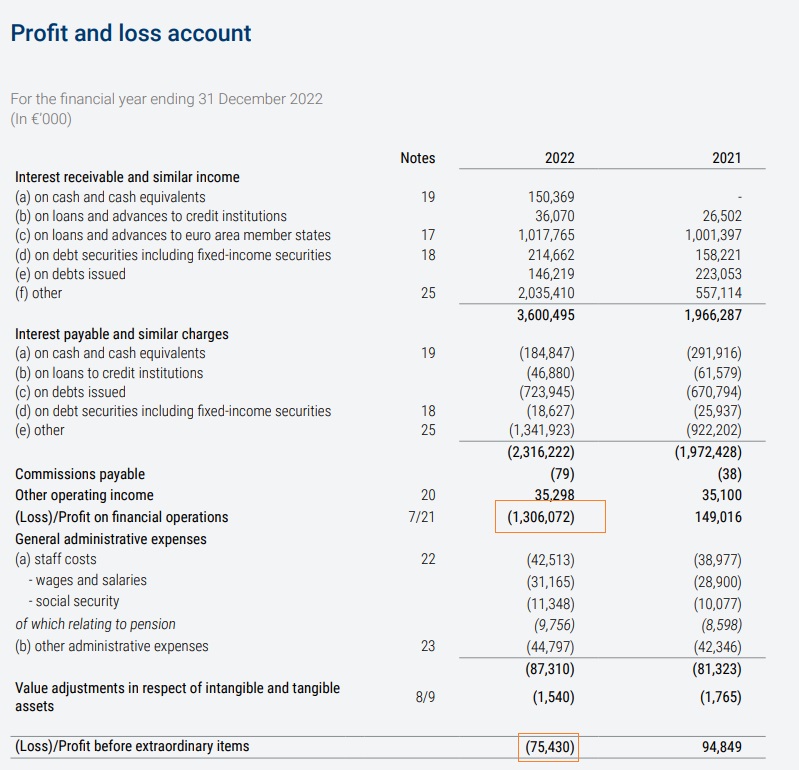

Because the ESM does not manage this liquidity particularly efficiently. Let's take the financial statements closed on 31 December 2022:

In 2022, the ESM, without having any losses on credits, therefore without losses linked to its lending activity, managed to grind out losses of 75 million euros, at the basis of which there are losses for financial operations amounting to 1.3 billion EUR. For an institution that would like to boast the ability to judge the solvency of the public debts of various countries and be able to repay them, this is a little bit. Certain,

The ESM boasts 228 employees who, on average, cost 184 thousand euros each, contributions included. After all, the organization is based in Luxembourg, where the cost of living is high. Why was an international organization not located, for example, in Madrid, Lisbon or Rome, where the lower cost of living would certainly have allowed savings in operating costs? To issue securities under Luxembourg law? For this, a simple delegation was enough. Perhaps to avoid hurting the eyes of employees with the effects of their actions. But let's continue.

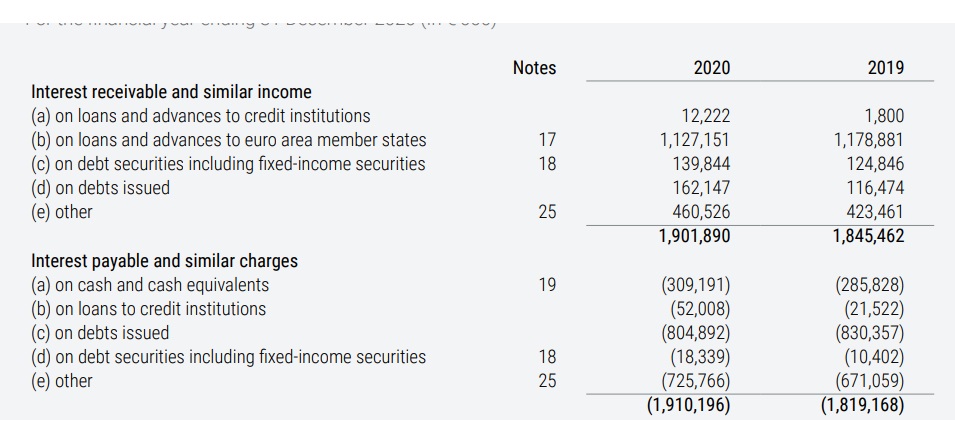

In 2020, when ECB rates were negative, the enormous liquidity in the hands of the ESM, managed in a banal way, generated well over 300 million in losses.

The liquid deposits, left deposited at the ECB, generated significant losses, yet something could have been done to avoid these losses. However, in the end, the very fact that the Board of Directors is, literally, untouchable, prevents the stimulus towards more efficient policies in the use of funds. In the end, no one pays for mistakes except citizens' taxes.

The reform of the treaties, as set out, does not improve the efficiency of the ESM as an institution one cent. It makes it more powerful, but not better. The parliament, whatever the newspapers say, did very well to reject the reform. If the problem were faced honestly, a reform could also be set up, which however would be completely different from the one currently under discussion.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The ESM must be reformed, but because it loses money and costs a lot of money comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-mes-deve-essere-riformato-ma-perche-perde-denaro-e-costa-un-mare-di-soldi/ on Tue, 26 Dec 2023 06:30:54 +0000.