Bad signs from US public debt: the worst auction since 2014

Dollar inflationary fears coincided with a massive 7-year government bond auction just yesterday. The result could only be disastrous, and in fact it went just like that.

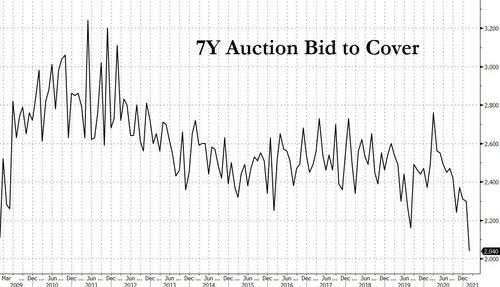

First of all, there was a sharp drop in demand for the security compared to previous auctions:

On average, the bond supply / demand ratio is 2.35. The last auction saw the value of 2.305. Yesterday's auction is equal to 2,045, such a low value that has not been seen for many years. The index that there is no interest in US stocks, at least at this interest rate level.

Indirect orders also fell to historic lows, a sign that there is minimal interest from foreign investors.

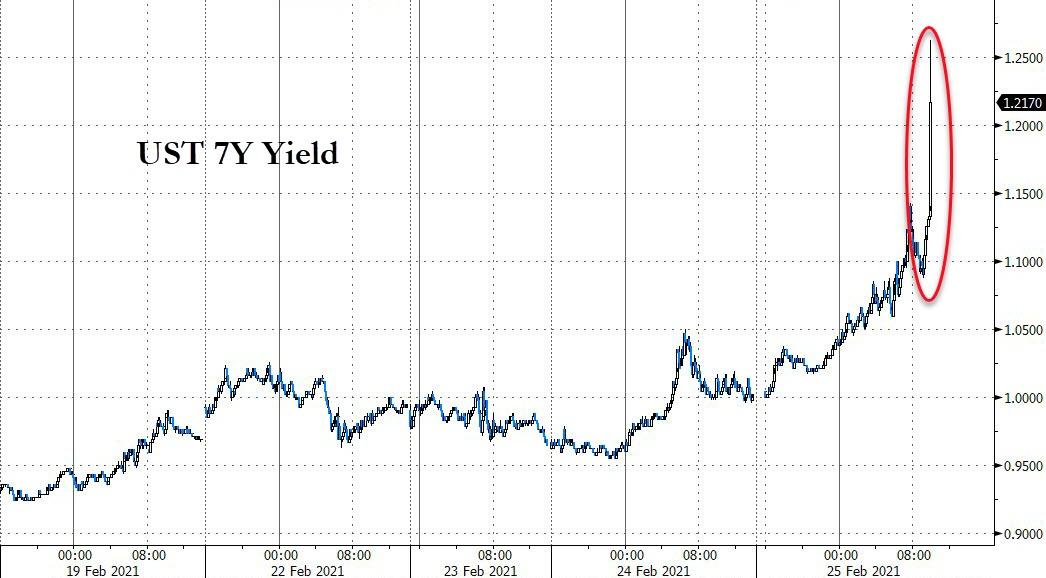

The trend in interest rates is therefore obvious:

The lack of demand caused US government bond prices to spike to a peak of 1.6% before returning to lower, but still high, levels around 1.214%.

At this point the Fed must look carefully at future US government bond auctions and will be faced with two choices:

- letting interest in government bonds grow, increasing tensions over its financing and risking blowing up the financial bubble;

- intervening on the markets and containing interest, however, increasing the monetary stimulus and risking further inflation, at least on the value of the assets, that is, to inflate the bubble even more.

A situation not easy to solve …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Bad signals from US public debt: the worst auction since 2014 comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/brutti-segnali-dal-debito-pubblico-usa-la-peggior-asta-dal-2014/ on Fri, 26 Feb 2021 07:00:53 +0000.