Bank of Japan: interest rates unchanged, but target rate on 10-year bonds doubles. Soft exit from QE

In the end, the outgoing Governor of the Bank of Japan, Kuroda, also had to give in to inflationary pressures, but he did so in a very soft way, even if his actions had an impact on the markets.

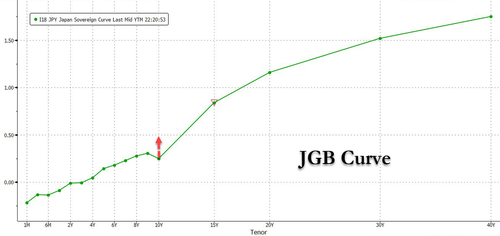

At its December meeting, the Bank of Japan (BoJ) kept its key short-term interest rate at -0.1% and 10-year bond yields around 0% by unanimous vote, as expected. At the same time, the central bank adjusted the tolerance range for yield curve control as part of efforts to ease some of the cost of prolonged monetary stimulus. The board said it will widen the range of 10-year government bond yields from the current +/-0.25 percentage point to +/-0.5 percentage point. In addition, the 10-year government bond float rate was widened from 0.25% to 0.50%. The Bank will therefore allow a greater fluctuation of the securities before intervening. therefore taking a much “Softer” position on its interest rate control policy.

This should make it possible, at least in the short to medium term, to control that famous "little tooth" that has arisen on the interest rate curve of Japanese government bonds according to maturity, which saw the 10-year bond practically off the curve because it was the only bond subjected strictly controlled by the central institution.

Meanwhile, the BoJ deemed the economy likely to recover as the impact of COVID and supply-side issues ease, while downward pressures persist from high commodity prices and a slowdown in overseas economies . Japanese-calculated core inflation (all items except fresh food) is expected to rise in 2022, due to rising costs of food, energy and durable goods, before declining mid-fiscal year 2023 .

The move obviously strengthened the yen against the dollar, but the effect could wear off in the future

So there is a different way to control inflation than the brutal one followed by the ECB; a path of easing in the control of the interest rate curve that is light and progressive, but effective, also because Chinese inflation is in any case much lower than in Europe. Yesterday, the PBOC, China's central bank, even announced an injection of liquidity into the market through a review of the bank refinancing rate. So we have two schools in the world: the Western one which tries to contain inflation through the recession, and therefore with serious social repercussions, and the Eastern one which tries to do so by maintaining balanced growth. I leave it up to you to decide which school is better.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Bank of Japan: interest rates unchanged, but target rate on 10-year bonds doubles. Soft exit from QE comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/bank-of-japan-tassi-di-interesse-invariati-ma-raddoppia-il-tasso-obiettivo-sui-titoli-a-10-anni-uscita-morbida-dal-qe/ on Tue, 20 Dec 2022 08:00:49 +0000.