Bitcoin: introduction to the halving effect

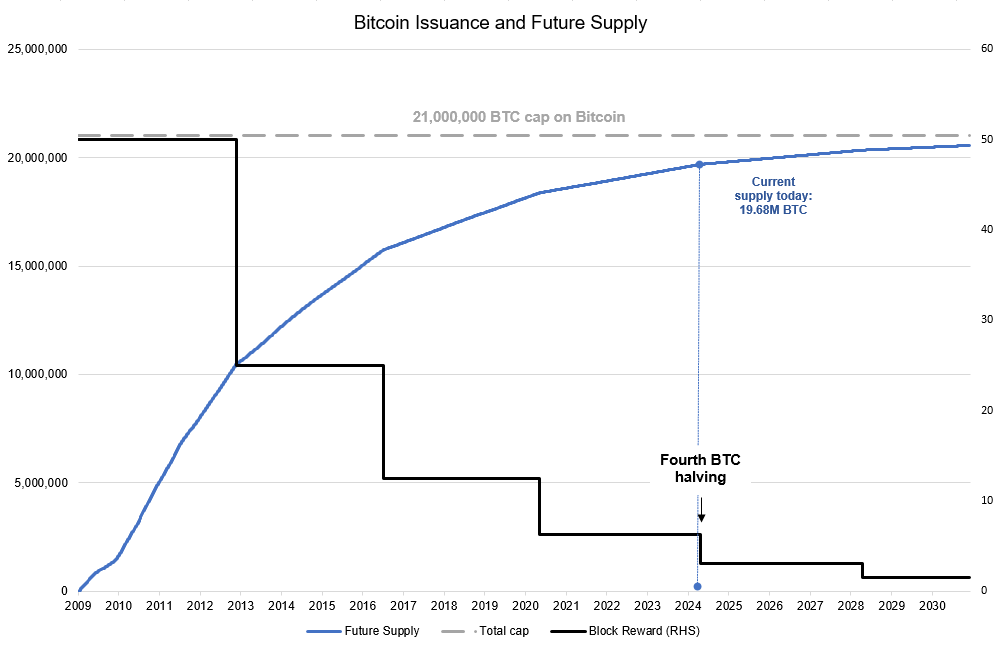

The Bitcoin halving , also known as halving , is a scheduled event that occurs approximately every four years and reduces the number of Bitcoins generated per block mined by half. This event will next take place in April 2024 and represents a pivotal moment for the Bitcoin ecosystem, with potential significant consequences for pricing, mining and overall adoption.

Offer implications:

- Supply Reduction: The halving will reduce the rate of creation of new Bitcoin, leading to a decrease in overall supply. This could theoretically influence the price, as less availability of a valuable asset could increase its value.

- Increased Scarcity: With limited supply, Bitcoin could become a rarer and more sought-after commodity, fueling demand and potentially pushing the price higher.

- Long-term stability: Reducing supply could contribute to greater stability in Bitcoin's price, smoothing out the wild fluctuations that have characterized its history. The pure market becomes more and more

Normally the halving leads to an increase in the value of Bitcoin or, in general, of the cryptocurrency concerned, but this does not necessarily happen. However, let's move on to give some indications on what could happen in terms of mining and evaluation of the cryptocurrency.

Implications on Mining

-

- Mining less profitable: As mining rewards halve, the profitability of Bitcoin mining may decrease. This could push some miners to abandon the network, potentially causing centralization of mining. There could be a selection especially because those who have older and therefore less profitable machines may not consider it interesting to renew the server park

- Increased Mining Difficulty: To compensate for the reduction in rewards, Bitcoin mining difficulty will automatically increase. This will make the mining process more challenging and energy-intensive.

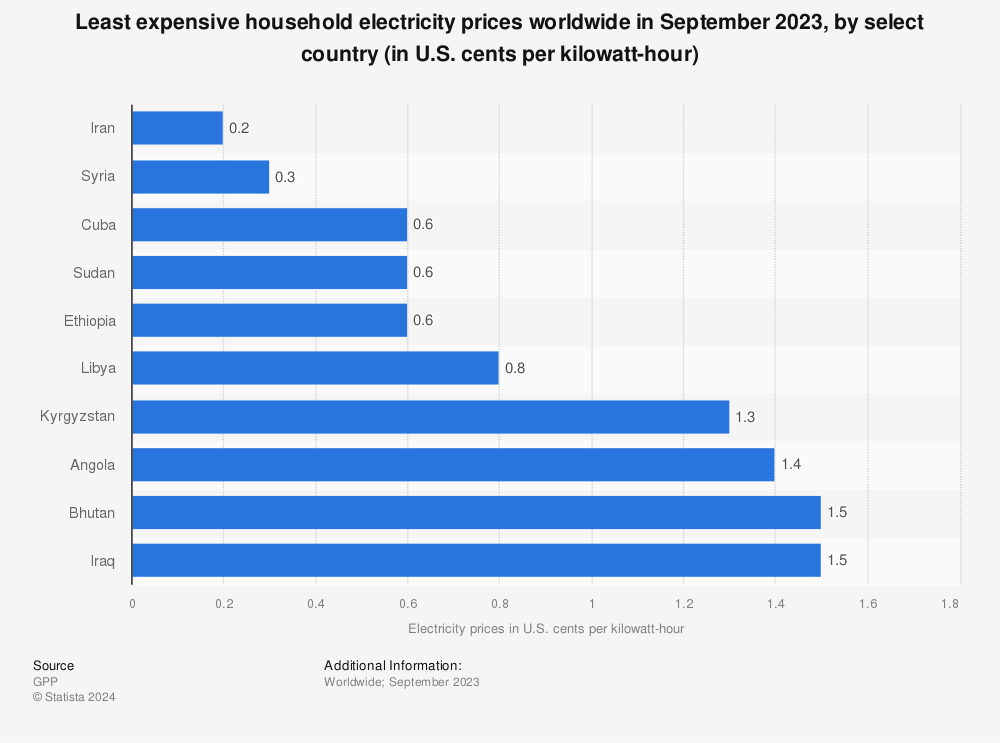

- Evolution of Mining: The halving could incentivize the adoption of more efficient mining technologies and the emergence of new business models for mining. Furthermore, the cost of energy factor could lead to the relocation of miners to areas with more convenient and abundant energy, because energy doubles its weight on bitcoin.

Statistician source of the graph

Forecasts:

It is difficult to predict with certainty the exact implications of the 2024 halving, as the Bitcoin market is complex and influenced by multiple factors. However, past halving events have historically had a positive impact on the price of Bitcoin, with periods of significant growth following the event. At least four years will certainly pass before the next halving, so at least the offer will enjoy a period of stability.

It is important to note that the halving is just one of many factors influencing the price of Bitcoin. Other factors, such as general market performance, regulation, institutional adoption and technological innovation, will continue to play an important role in determining the future value of Bitcoin. We have just recently seen how the adoption of Bitcoin-based ETFs has led to a notable increase in its price.

Unfortunately, due to the hoarding effect, the increase in value may not be positive from the point of view of adoption on a large scale: a BTC with prospects of revaluation is also an asset that is locked in a safe and is not used in transactions. BTC transactions will not be able to take off if it is kept in a safe, but some virtual currency could have practical use, exchangeable for Bitcoin, which comes to enjoy transactional qualities that make it easily usable in payments.

In conclusion, the 2024 Bitcoin halving is a significant event with potentially far-reaching consequences for the Bitcoin ecosystem. While the reduction in supply could lead to lower profitability for miners and greater scarcity of Bitcoin, it could also contribute to greater price stability, increased demand and its greater financialization. Predictions for the post-halving price are uncertain, but past events suggest that the event could have a positive impact on the value of Bitcoin. Only time will tell how the market will evolve after this key event.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Bitcoin: introduction to the halving effect comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/bitcoin-introduzione-alleffetto-dellhalving/ on Sat, 20 Apr 2024 07:00:09 +0000.