Brazil and China agree to sink the dollar. But the Euro will suffer

This month, Russia and China are stirring up fresh fears in Washington. This is mainly due to their spectacularly managed displays of diplomatic unity around the Ukraine and much more.

But there is also a question of money: during Xi Jinping's visit to Moscow last week, Vladimir Putin pledged to adopt the renminbi for "payments between Russia and the countries of Asia, Africa and 'Latin America', in an attempt to replace the dollar.

This comes as Moscow is already using the renminbi increasingly for its growing trade with China and adopting it in its central bank reserves to reduce its exposure to American "toxic" assets.

In this already negative news is added another blow to the Dollar, coming right from the "Backyard" of the USA, South America. According to the Brazilian government, China and Brazil have reached an agreement to trade in their own currencies, completely abandoning the US dollar as an intermediary, AFP reported.

The deal, Beijing's last salvation against the almighty greenback, will allow China, the main rival of US economic hegemony, and Brazil, Latin America's largest economy, to conduct their massive trade , which amounts to 150 billion dollars a year, and financial transactions directly, exchanging yuan for reais and vice versa instead of going through the US dollar. In this way, China extends its bilateral dollar-free agreements beyond countries such as Russia, Pakistan and Saudi Arabia, now including exporting powerhouse Latin America.

Brazil's Trade and Investment Promotion Agency (ApexBrasil) said: "We expect this to reduce costs … promote even more intense bilateral trade and facilitate investment." China is Brazil's largest trading partner, with a record $150.5 billion (S$200 billion) of bilateral trade last year.

The deal, which follows a preliminary deal in January, was announced after a high-level China-Brazil trade forum in Beijing. Brazilian President Luiz Inacio Lula da Silva was due to attend the forum as part of a high-profile visit to China, but had to postpone his trip indefinitely on Sunday due to pneumonia.

The Industrial and Commercial Bank of China and Bank of Communications BBM will carry out the international transactions, officials said.

Of course, we are still a long way from the yuan replacing the USD as the global reserve currency, if only because the US dollar remains the currency of international finance and credit lines, but its reference in the evaluation of products and materials resources, let's say in the mercantile and real economy, is decreasing more and more. Savings stay in dollars for now, but until when? Because trust in the dollar, from the point of view of savings, investments and finance, is real as long as there is trust in its ability to manage the credit system so that it is secure and one's public debt is controllable. A new financial crisis at this moment risks being fatal for the dollar.

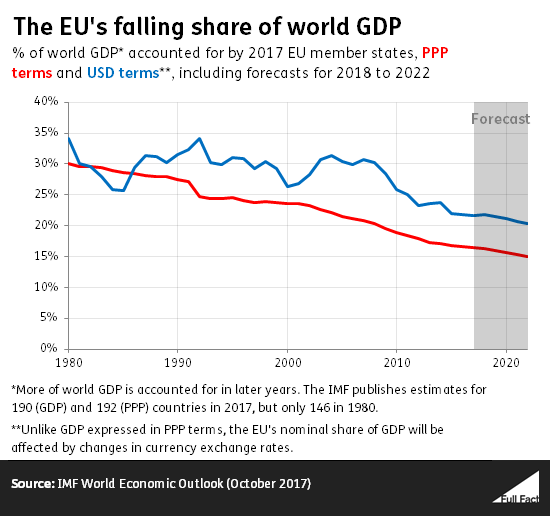

On the other hand, the one destined to a certain and rapid decline is the Euro: the European currency does not enjoy the status of reference for world finance and savings, while the share of the GDP of the Euro countries compared to the world GDP is continuously declining, as is is Europe's weight on world trade.

Therefore the Euro cannot enjoy the status of the Dollar in finance, nor the mercantile advantage of the Yuan. Not only that, but the environmental policies of forced and only European reduction of emissions, with the CBAM system of external duties to offset internal taxes on carbon, will cause a further drop in the EU's weight on international trade, further weakening the of the Euro. In the end, however, in a multi-currency world, the Euro will be relegated to a perfectly secondary role, marking yet another failure of the economic policies of the last 20 years.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Brazil and China agree to sink the dollar. But the Euro will suffer from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/brasile-e-cina-si-accordano-per-affondare-il-dollaro-pero-a-patire-sara-leuro/ on Fri, 31 Mar 2023 14:24:29 +0000.