Brazil cuts interest rates: the monetary tightening is already over and inflation is lower than in the EU

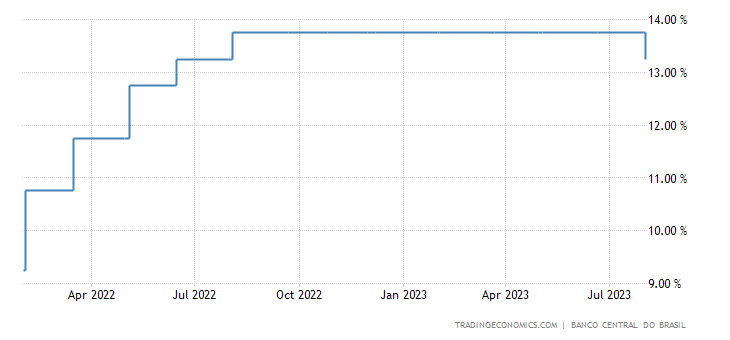

End of monetary tightening, but in South America, as reported by Brazil. Brazil's central bank cut its key Selic rate by 50 bps to 13.25% at its August meeting, after keeping borrowing costs on hold for the eighth consecutive session as the market expected a 25 bps .

The Committee reiterates the need to persevere with a restrictive monetary policy until the disinflation process already successfully underway is consolidated, but also the anchoring of expectations around its objectives.

The Committee noted that inflation projections stand at 4.9% in 2023, 3.4% in 2024 and 3.0% in 2025, showing a path of moderation. The Committee also underlines that the overall magnitude of the easing cycle over time will depend on the evolution of inflationary dynamics. Here is the interest rate chart:

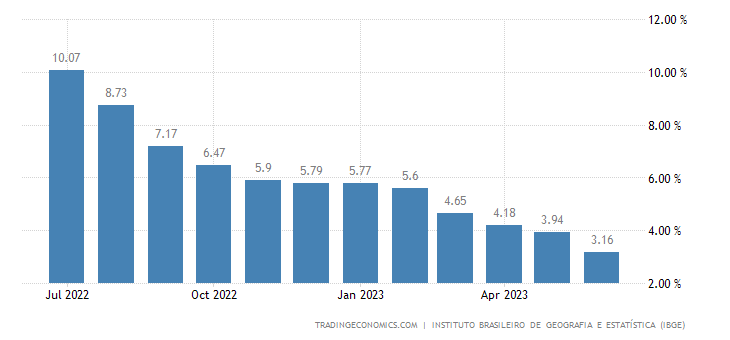

The hard truth is that Brazil, certainly a country not known in the past for moderating price growth, has managed to control inflation much better than dour European rulers. The inflation rate in the euro area is 5.3%. in July.

Brazil's annual inflation rate fell to 3.16% in June 2023 from 3.94% the previous month, the lowest since September 2020 and broadly in line with market expectations, 2% lower than for the Euro area.

It was the fourth month in a row that Brazil has recorded an inflation rate below the central bank's upper tolerance band of 4.75%, which explains the interest rate cut.

The moderation of overall inflation was mainly driven by a more marked drop in transport prices (-5.68% vs. -4.75%), of which fuel (-26.35% vs. -25.86 %) and further cooling in food and beverage prices (4.01% vs. 5.54%), aided by a bountiful harvest, and this will have made consumers happy.

There was also a slowdown in the prices of clothing (9.66% vs 11.11%), healthcare and personal care (10.37% vs 11.62%), personal expenses (6.97% vs 7.11%), among others. Month-on-month, Brazilian consumer prices fell 0.08% in June, the first drop since last September, matching market estimates. The downward pressure was mainly exerted by the prices of food and beverages (-0.66%), transport (-0.41%) and household items (-0.42%). Here is the graph

Someone at the ECB should start asking why Brazil controls inflation better than the European authorities do, and starts to pose a problem of supply side economics, putting aside the ideological and inefficient distortions that are currently guiding the economic policy of the EU. Otherwise, the Euro, born to curb inflation, will end up becoming a very light currency compared to the Brazilian Real…

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Brazil cuts interest rates: monetary tightening already over and inflation is lower than in the EU comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-brasile-taglia-i-tassi-di-interesse-gia-finita-la-stretta-monetaria-e-linflazione-e-piu-bassa-che-nella-ue/ on Thu, 03 Aug 2023 07:30:26 +0000.