Can Banking Crises Lead to the End of the Dollar as the Benchmark Currency?

Could the crisis in the US banking system be the first step towards the end of the dollar as the world's reference currency, due to the loss of confidence in the issuers of dollar-denominated securities? This is a possibility being explored by AsiaTimes , which believes this will be the end result of the current crisis. That doesn't mean there will be more high-profile bankruptcies like Credit Suisse. Central banks will keep moribund institutions alive.

But the era of dollar reserves and floating exchange rates, which began on August 15, 1971, when the United States broke the link between the dollar and gold, is about to end. The pain will move from the banks to the real economy, which will be starved of credit.

The geopolitical consequences will be enormous.

The seizure of dollar credit will accelerate the shift to a multi-polar reserve system, benefiting the Chinese renminbi as a competitor to the dollar.

Gold, the “barbaric relic” John Maynard Keynes abhorred, will play a greater role because the dollar's banking system is dysfunctional and no other currency – certainly not the tightly controlled renminbi – can replace it. Now that it is close to the all-time record price of $2,000 an ounce, gold is likely to go higher again.

The greatest danger to the dollar's hegemony and the strategic power it gives Washington is not China's ambition to expand the renminbi's international role. The danger comes from the exhaustion of the financial mechanism that has allowed the United States to accumulate a negative net asset position of $18 trillion over the past 30 years.

Germany's largest lender, Deutsche Bank, hit an all-time low of €8 on the morning of March 24, before climbing back to €8.69 by the end of the trading day, and its credit default swap premium – the cost of the insurance on its subordinated debt – soared about 380 basis points above LIBOR, or 3.8%.

This is equal to what was recorded during the 2008 banking crisis and the 2015 European financial crisis, although not as much as during the March 2020 Covid lockdown, when the premium exceeded 5%. Deutsche Bank won't fail, but it may need some official backing. It is possible that he has already received such support.

This crisis is quite different from the one in 2008, when banks leveraged trillions of dollars of dubious assets based on "deceptive loans" to homeowners. Fifteen years ago, the credit quality of the banking system was rotten and leverage was out of control. Today the quality of bank credit is the best in a generation. The crisis stems from the now impossible task of financing America's ever-expanding foreign debt.

It is also the most anticipated financial crisis in history. In 2018, the Bank for International Settlements (a sort of central bank for central banks) warned that $14 trillion of short-term dollar loans from European and Japanese banks, used to hedge currency risk, were a bombshell. clockwork waiting to explode (“Has the derivative volcano already started to erupt?”, October 9, 2018).

In March 2020, dollar credit seized a rush for liquidity as the Covid lockdowns began, causing a sudden shortage of bank funding. The Federal Reserve put out the fire by opening multibillion-dollar swap lines to foreign central banks. On March 19, it expanded those swap lines.

As a result, the global banking system's dollar balance sheet has exploded, as evidenced by the volume of foreign credit in the global banking system. This has opened up a new vulnerability: counterparty risk, i.e. the exposure of banks to huge amounts of short-term loans to other banks.

The chronic current account deficits of the past 30 years amount to a goods-for-paper exchange: America buys more goods than it sells, and sells goods (stocks, bonds, real estate, and so on) to foreigners to make up the difference. But at this point there is a quality problem of the issuers of these securities.

Today, America has an $18 trillion net debt to foreigners, roughly equal to the cumulative sum of these deficits over 30 years. The problem is that foreigners who own US assets receive dollar cash flows, but have to spend money in their own currency.

With fluctuating exchange rates, the value of dollar cash flows in euros, Japanese yen or Chinese renminbi is uncertain. Foreign investors have to hedge their dollar income, i.e. sell US dollars short against their currencies.

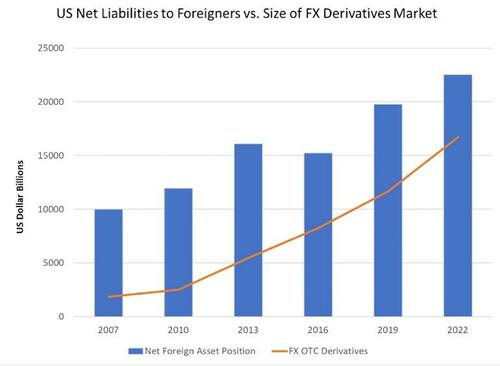

That is why the size of the foreign exchange derivatives market has grown along with America's liabilities to foreigners. The mechanism is simple: If you receive dollars but pay in euros, you sell dollars against euros to hedge the exchange rate risk. but your bank has to borrow the dollars and lend them to you before they can sell them. Foreign banks have borrowed about $18 trillion from US banks to finance these hedges. This creates a giant vulnerability: If a bank looks suspicious, as Credit Suisse did earlier this month, banks will withdraw credit lines in a global rush.

Prior to 1971, when central banks kept exchange rates at a fixed level and the United States covered its relatively small current account deficit by transferring gold to foreign central banks at a fixed price of $35 an ounce, all this did not it was necessary.

The breaking of gold's peg to the dollar and the new regime of floating exchange rates allowed the United States to run massive current account deficits by selling its financial products to the world. The populations of Europe and Japan were aging more rapidly and were very wealthy and consequently had a greater need for retirement assets and financial products. but this balance is about to end,

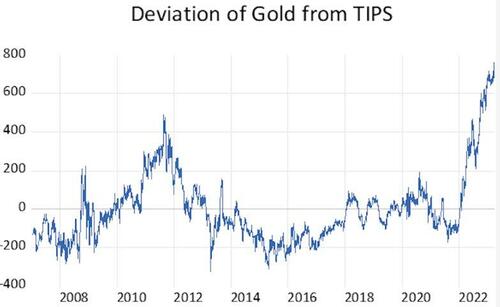

A safe indicator of global systemic risk is the price of gold, and in particular the price of gold relative to alternative hedges against unexpected inflation.

Between 2007 and 2021, the price of gold followed inflation-linked US Treasuries (“TIPS”) with a correlation of around 90%.

As of 2022, however, gold has risen while the price of TIPS has fallen. Something similar happened in the aftermath of the 2008 global financial crisis, but last year's movement has been much more extreme. Below is the residual of the gold price regression against the 5 and 10 year TIPS.

Graphic: Asia Times

If we look at the same data in a scatterplot, it is clear that the linear relationship between gold and TIPS remains in place, but has shifted both its baseline and its slope.

Indeed, the market fears that buying inflation protection from the US government is like passengers on the Titanic buying shipwreck insurance from the captain. The gold market is too large and diversified to be manipulated. No one has much faith in the US consumer price index, the gauge against which TIPS payments are determined.

The dollar reserve system will shut down not suddenly, but slowly in painful agony. Central banks will intervene to avoid dramatic bankruptcies, but bank balance sheets will shrink, credit to the real economy will decrease and international lending in particular will evaporate.

At the margin, local currency financing will replace dollar credit. We've already seen this happen in Turkey, whose currency imploded in 2019-2021 as the country lost access to dollar and euro funding. This phenomenon, also due to the European monetary tightening, will spread worldwide.

To a large extent, Chinese trade finance has replaced the dollar and underpinned Turkey's remarkable economic turnaround last year. Southeast Asia will rely more on its own currencies and the renminbi.

It is no coincidence that last year's Western sanctions on Russia prompted China, Russia, India and the Persian Gulf states to find alternative ways of financing. This is not a monetary phenomenon, but an expensive, inefficient and cumbersome way of bypassing the dollar banking system.

As dollar credit dwindles, however, these alternative arrangements will become permanent features of the monetary landscape and other currencies will continue to gain ground against the dollar until the dollar is reduced to little more than a regular currency, while for the Euro the decline will be even more painful and linked to the industrial decline.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Can banking crises lead to the end of the dollar as the benchmark currency? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-crisi-bancarie-possono-condurre-alla-fine-del-dollaro-come-moneta-di-riferimento/ on Mon, 27 Mar 2023 06:00:25 +0000.