Central Banks want to bring gold home after US sanctions on Russia

A growing number of countries are repatriating gold reserves as a hedge against the kind of sanctions the West has imposed on Russia, according to an Invesco survey of central banks and sovereign wealth funds released Monday reported by Reuters.

Last year's financial market turmoil has caused widespread losses for sovereign wealth fund managers who are "fundamentally" rethinking their strategies in the belief that higher inflation and geopolitical tensions are here to stay. More than 85% of the 85 sovereign wealth funds and 57 central banks that took part in the annual Invesco Global Sovereign Asset Management study believe that inflation will now be higher in the next decade than in the last.

Gold and emerging-market bonds are seen as good bets in that context, but so is the West's freezing of nearly half of Russia's $640 billion in gold and foreign exchange reserves last year in response to the he invasion of Ukraine seems to have triggered a change.

The poll showed that a "substantial share" of central banks were concerned about the precedent that had been set. Nearly 60% of respondents said it made gold more attractive, while 68% kept reserves at home compared to 50% in 2020.

One central bank, quoted anonymously, said: "We kept it (the gold) in London… but now we've moved it into our own country to keep it as a safe haven and to keep it safe." Rod Ringrow, head of official institutions at Invesco, who oversaw the report, said it was a widely held view.

“'If it's my gold, then I want it in my country' (has) been the mantra we've seen for the last year or so,” global bank officials say. No one trusts the USA anymore.

We need to diversify

Geopolitical concerns, coupled with opportunities in emerging markets, are also encouraging some central banks to diversify away from the dollar.

A growing 7% believe rising US debt is also bad for the greenback, though most still see no alternative to it as the world's reserve currency. Those who see the Chinese yuan as a potential competitor fell to 18%, from 29% last year. An unexpected weakness, linked to internal debt.

Nearly 80% of the 142 institutions surveyed see geopolitical tensions as their biggest risk over the next decade, while 83% cited inflation as a concern for the next 12 months.

Infrastructure is now seen as the most attractive asset class, especially those projects involving the generation of renewable energy.

Concerns over China mean India remains one of the most attractive countries for investment for the second consecutive year, while the trend of "near-shoring", in which companies build plants closer to where they sell their products , is boosting countries like Mexico, Indonesia and Brazil.

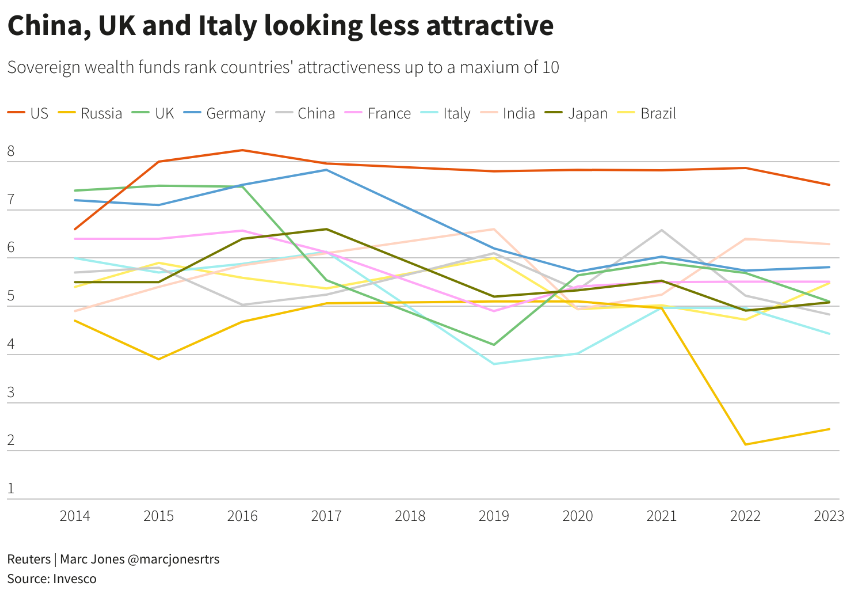

Apart from China, Britain and Italy are seen as less attractive, while rising interest rates coupled with home working and online shopping habits that have taken hold during the COVID-19 outbreak have so that property is now the least attractive private good.

Ringrow said the best-performing asset funds last year were those that recognized the risks posed by inflated asset prices and were willing to make substantial portfolio changes. It would be the same going forward.

"Funds and central banks are now trying to deal with rising inflation," he said. “It is a great epochal change”.4

Meanwhile, Italy and China are seen in decline as places of financial investment by the heads of the Central Banks

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Central Banks Want to Bring Gold Back Home After US Sanctions on Russia comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-banche-centrali-vogliono-riportare-loro-a-casa-dopo-le-sanzioni-usa-alla-russia/ on Mon, 10 Jul 2023 10:00:40 +0000.