China: 5 commodities that show that the recovery is not so solid

China's economic recovery after the stop due to Covid is faltering. Investors had high hopes earlier this year that the world's second-largest economy would roar again and help offset the weakness in the global economy. However, six months later, those same hopes have all but vanished.

Reinforcing this impression is also the Hang Seng China Enterprises index which fell by almost 20% after the peak at the end of January. However, alongside the Stock Exchange there are some raw materials which indicate that the growth of the economy is less intense than expected. The cause is difficult to identify, and may well be a mix of motivations, from an aging population to changes in the supply chain to a boom in private debt.

However, based on international data and provided by Bloomberg and other sources, let's see which are the 5 commodities that show the overall weakness of Chinese growth

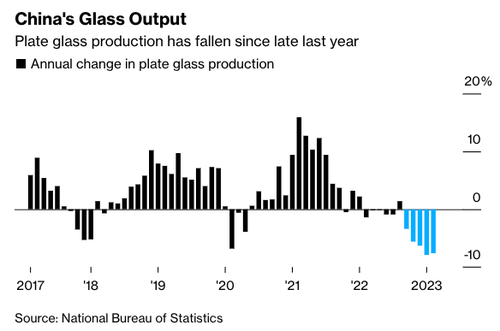

The glass

China accounts for more than half of the world's plate glass production, thanks to the rapid growth of high-rise buildings and vehicle sales in recent decades. As in other sectors, low margins and supply shortages have stumped producers for years, forcing them to cut production in recent months.

This year the situation seems even more difficult. Glass futures on the Zhengzhou Commodity Exchange have tumbled nearly 20% in the past month, a time when demand usually recovers. The reasons are to be found in China's faltering property market and weaker-than-expected vehicle production in April.

Such a sharp drop in glass production is an indicator of a certainly not brilliant real estate sector.

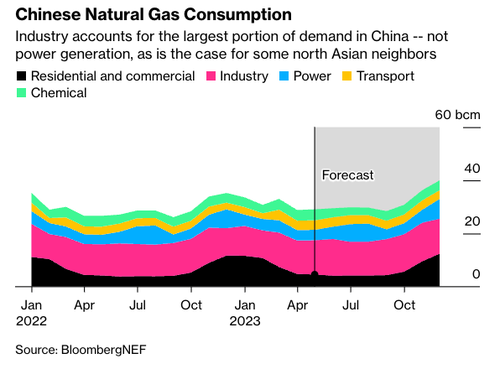

LNG transported by truck by land

China has a large demand for liquefied natural gas, transported by sea from mega-projects in far-flung places like Qatar and Australia, or by pipelines criss-crossing mainland Asia. But the last kilometers to reach the final consumer are often traveled by trucks crossing Chinese cities, a barometer of the immediate needs of industries, from glass producers to ceramic factories.

The price of this type of asset fell to its lowest level in two years. Demand is so weak that major seaborne liquefied natural gas importers are even offering to resell their shipments overseas.

A recovery in demand is expected, but forecasts are bound to be proven wrong.

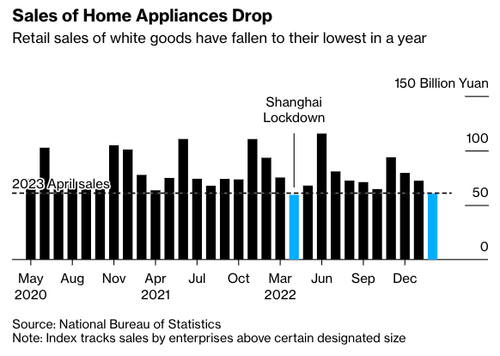

styrene

There is a raw material, styrene or styrene, which is used both for consumer goods and, on a large scale, for the real estate sector. The price of styrene monomer, a material used for the plastics, polystyrene and rubber that go into household appliances such as refrigerators, has fallen. Over the last decade, China has been the fastest growing market in the world, with production capacity exceeding 40% of the global total.

Dalian futures fell last week to their lowest since February 2021, after a nearly 5% decline in home appliance sales in the first quarter, according to the National Appliance Information Center. According to Wu Haitao, director of the center, the problems are the slowdown in personal income growth and a longer repurchase cycle for household appliances.

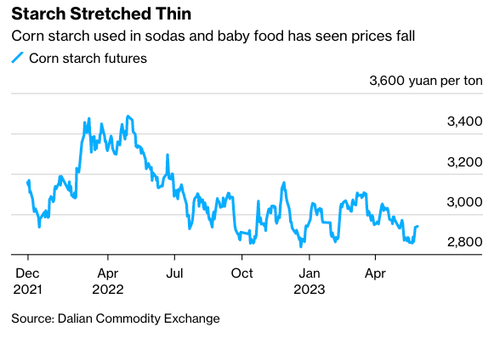

Cornstarch

Cornstarch has a wide variety of uses, in soft drinks, as a thickening agent for sauces, and in the paper and textile industries. China produces nearly 50 million tons annually.

Although retail sales outperformed other economic measures in the months following the lifting of Covid Zero restrictions, they grew at a slower-than-expected pace in April. China's declining population is one of the causes of this slowdown: corn starch is a key ingredient in infant formula.

Wood pulp

Shanghai wood pulp futures went into free-fall in February, after the sudden recovery in paper mill production after the Lunar New Year holiday was accompanied by a recovery in imports. Domestic demand, which was expected to pick up after China reopened, failed to keep pace.

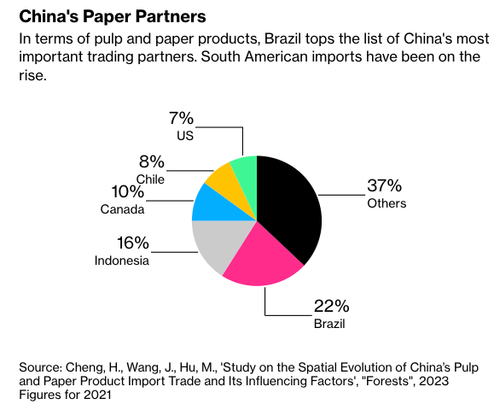

As with many other commodities, China is the largest producer and consumer of wood pulp, used for packaging, publishing and household products. But the market is so large that much of the pulp and paper has to be sourced overseas.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article China: 5 Commodities Showing That The Recovery Isn't So Solid comes from Scenarios Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-5-materie-prime-che-mostrano-come-la-ripresa-non-sia-cosi-solida/ on Sat, 03 Jun 2023 08:00:05 +0000.