China: bad economic data, so the interest rate is lowered.

China's economic data for July released by the central statistics office is very bad. Among the latest monthly data:

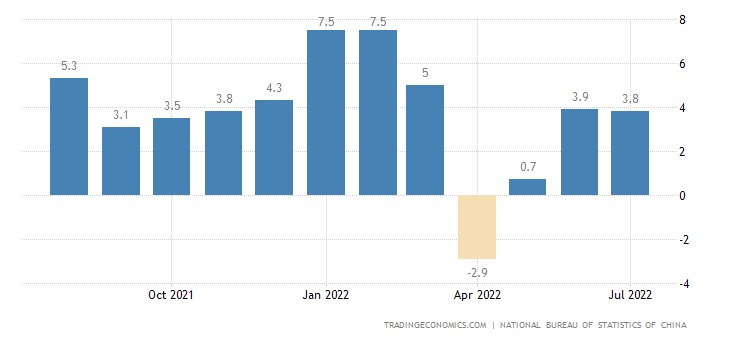

- Chinese industrial production grew 3.8% yoy in July 2022, below the market consensus of 4.6% and following a 3.9% increase in June. The latest figure marked the third consecutive month of industrial production growth, amidst signs of a fragile economic recovery due to COVID-19 restrictions. Production grew less both for the manufacturing sector (2.7% against 3.4% in June) and for the extractive sector (8.1% against 8.7%), despite the strong recovery in utility production (9 , 5% versus 3.3%). Among manufacturing industries, production progressed further for chemical raw materials and chemicals (4.7% versus 5.4% in June), communications (7.3% versus 11.0%), automotive industry (22.5% against 16.2%) and the production and supply of electricity and heat (10.4% against 3.2%). On the contrary, there were decreases in the production of the food processing industry (-0.8% vs -0.3%), textiles (-4.8% vs -3.9%) and general equipment (- 0.4% vs 1.1%).

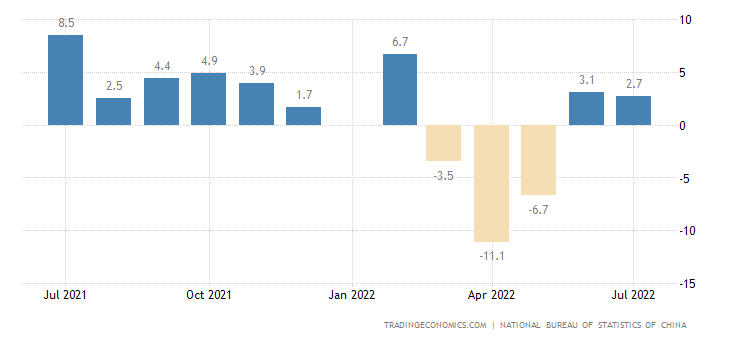

- Retail sales grew at an annual rate of 2.7%, also down from 3.1% in June and far missing the market's estimate of 5.0%. A real disaster

- Investments in fixed assets gained 5.7% in the first seven months of the year, lower than the 6.1% in June and the 6.2% forecast by economists.

- On the bright side, just like in the US, the worse the economy gets, the more the unemployment rate falls, which fell to 5.4% from 5.5% in July.

A few moments before the data were released, the Chinese central bank unexpectedly cut its key interest rates in a feeble attempt to support the crisis-ridden economy, weighed down by the Covid lockdown and the worsening of the housing crisis.

The PBOC cut the one-year political lending rate by 10 basis points to 2.75% and the seven-day repo rate to 2% from 2.1%, surprising Chinese observers. , while all 20 economists surveyed predicted that the one-year medium-term lending rate would remain unchanged. All other major benchmark rates are expected to follow a similar 10bps cut in the coming days.

The move puts the PBOC in contrast with the central banks of half the world, from India to the USA to Europe, but it was an obligatory move, considering the state of the national economy. According to Goldman, the detailed breakdown of July's loan data highlighted weakening demand for credit: loans to households and businesses slowed in July compared to June and interbank rates have fallen to very low levels in recent weeks. Up to now the Communist Party has allowed local administrations to intervene, but by now it seems evident that this is no longer enough. Residential construction, hugely important in China, is collapsing, with residential property sales falling by 28.6% in July and something needed to be done nationwide. Unfortunately, this decline will not be enough, but we do not doubt that the CCP and its operational tool, the PBOC, will be ready to intervene as soon as possible. .

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: bad economic data, so the interest rate is lowered. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-dati-economici-pessimi-quindi-si-abbassa-il-tasso-di-interesse/ on Mon, 15 Aug 2022 07:15:47 +0000.