China bans the sale of securities at the beginning and end of the session. Will the next blow be a complete ban on treatment?

What happens if sales are banned? Evidently the stock market doesn't fall, but that's not good news at all . China has banned major institutional investors from reducing stock holdings at the open and close of each trading day, as part of the government's strongest attempt to prop up the nation's $8.6 trillion stock market.

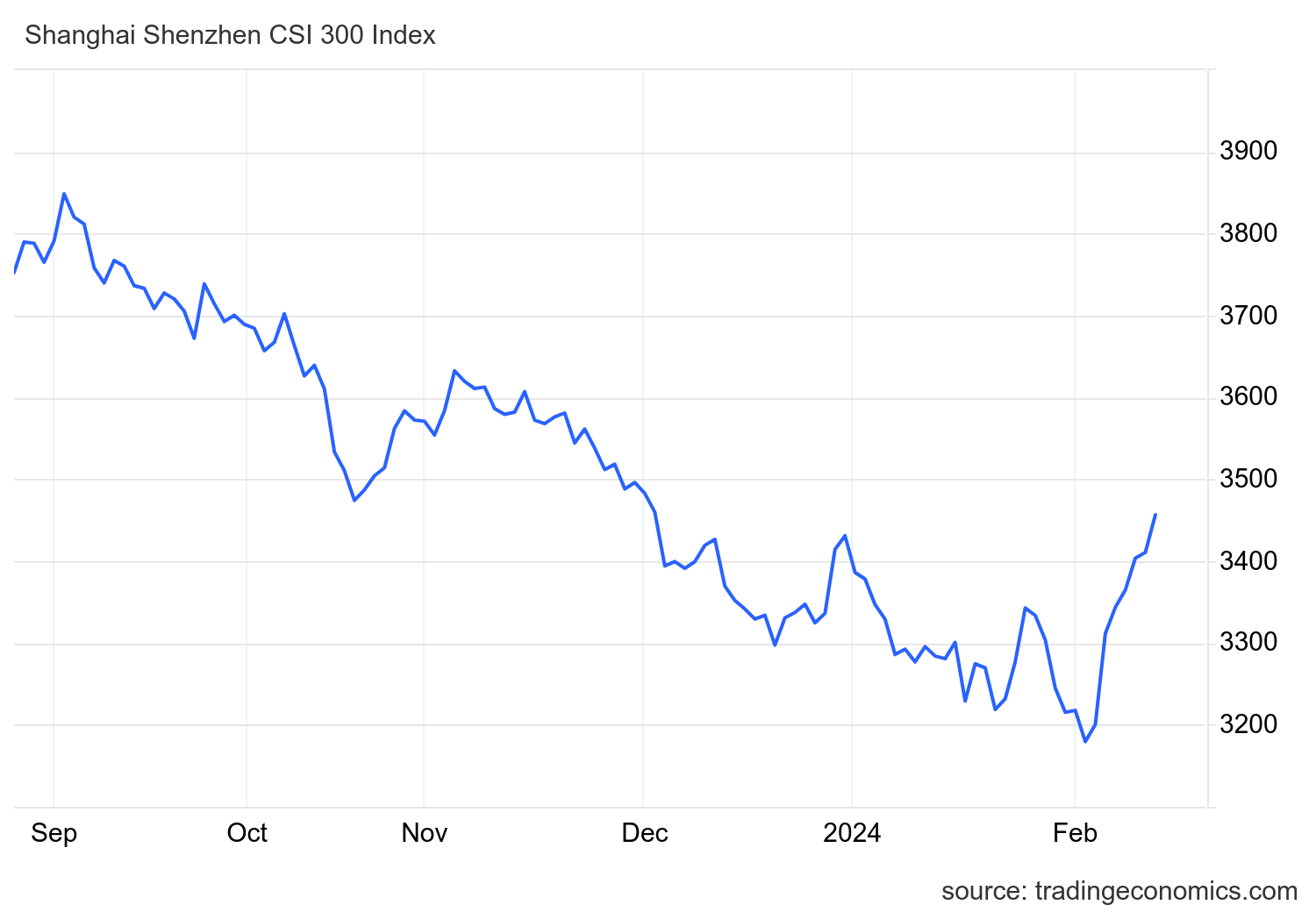

In reality, as the SHS 300 index indicates, the stock market has recovered slightly in the last month, but, evidently, the authorities fear that this situation cannot continue:

The order from China's securities regulator was recently delivered to major asset managers and proprietary trading desks of brokerage firms, people familiar with the matter said.

The China Securities Regulatory Commission, led by new president Wu Qing, also created a task force with national stock exchanges to monitor short selling and issue warnings to companies profiting from betting.

Although the authorities have been tightening limits on bearish bets for months, the ban on net selling at the open and close represents a significant government tightening of market activity that risks undermining popular strategies used by hedge funds and other institutional investors. Companies affected by the ban cannot sell more shares than they buy during the first and last 30 minutes of trading, the people said. What will the next step be? The ban on selling outright?

It's unclear how much the ban applies across the financial sector, and there's no indication that it will affect individual investors who account for a large portion of Chinese stock volume. However, excluding major institutions during two of the most-watched moments of the trading day could make it easier for government-backed funds to influence the market, particularly the closing levels of benchmark indexes.

Known for his tough cracks on brokerage firms as a CSRC official in the mid-2000s, Wu is resorting to more drastic measures to prevent the stock market crash from extending into a fourth year. The plunge, which pushed China's benchmark CSI 300 index to five-year lows earlier this month, has become one of the most visible symbols of waning confidence in President Xi Jinping's ability to revive a struggling economy with deflation and a persistent real estate crisis.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China bans the sale of securities at the beginning and end of the session. Will the next blow be a complete ban on treatment? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-vieta-le-vendite-dei-titoli-a-inizio-e-fine-seduta-il-prossimo-colpo-sara-il-divieto-completo-di-trattazione/ on Wed, 21 Feb 2024 21:05:14 +0000.