China continues to experience ever sharper deflation. The post-covid recovery at risk

Deflationary pressure in China continues to intensify: November consumer prices fell much more sharply than in October, marking the steepest decline in three years.

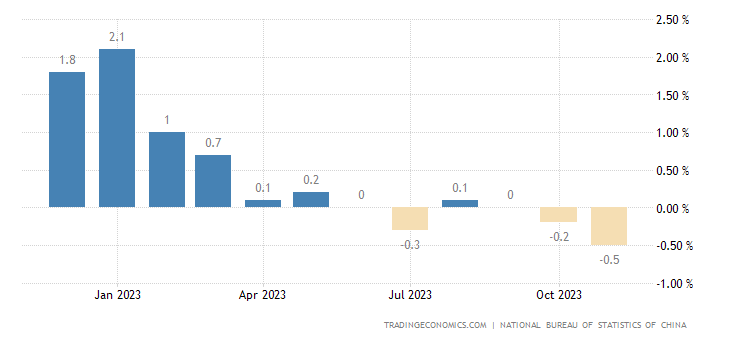

The consumer price index, the main indicator of inflation, fell 0.5% year-on-year in November, according to the Bureau for National Statistics (NBS). The decline in October compared to a year earlier was 0.2%.

The year-on-year decline in CPI was the strongest since November 2020, due to the difficult recovery in domestic demand.

NBS chief statistician Dong Lijuan attributed the decline to downward pressures on energy and food prices.

Year-on-year core inflation, excluding food and fuel prices, remained at 0.6%, the same as October, highlighting the difficulties in reviving China's post-Covid recovery. Therefore a minimum of wage mobility remains present,

Here is the relevant graph

“Deflationary pressure has intensified because domestic demand remains weak. This highlights the importance of a more favorable fiscal policy to stimulate domestic demand and avoid a further negative price spiral,” said Zhang Zhiwei , president and chief economist of Pinpoint Asset Management.

China's producer price index (PPI), which measures the costs of producing goods, fell for the 14th consecutive month, falling 3 percent year-on-year in November, after a decline of 2.6 percent. % in October.

On a monthly basis, the PPI fell 0.3%, following a flat reading in October.

China's economy is grappling with many internal and external difficulties, despite the lifting of all pandemic restrictions earlier this year. These include the slowdown in domestic consumption, the risks of local government debt, the real estate sector in difficulty and exports in crisis due to the slowdown in global growth.

A series of measures taken to stabilize the Chinese economy have so far failed to halt the downward trend. International ratings agency Moody's Investors Service cut the outlook for Chinese sovereign bonds from stable to negative on Tuesday, citing costs of bailing out local governments and state-owned enterprises and supporting the real estate sector. Beijing said it was "disappointed" by the downgrading.

Moody's, however, kept its rating of China's sovereign bonds unchanged at A1, meaning they are still medium to high investment grade.

Meeting with representatives from outside the ruling Communist Party on Wednesday, President Xi Jinping said China's economic recovery was still "at a critical stage."

On Friday, chairing a meeting of the Politburo , the party's top decision-making body, on key economic and political tasks for the next 12 months, Xi said economic recovery and improving market expectations were top priorities.

Xi also called for efforts to stabilize economic fundamentals to help attract foreign capital and stimulate trade growth, as well as to counter negative narratives about the Chinese economy, state news agency Xinhua reported.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China continues to experience ever sharper deflation. The post-covid recovery at risk comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-prosegue-in-deflazione-sempre-piu-secca-la-ripresa-post-covid-a-rischio/ on Mon, 11 Dec 2023 14:02:11 +0000.