China: cut in compulsory reserves in foreign currency, but the manufacturing forecast index rebounds

China is trying to balance the need to resume a growth path, through targeted stimuli to the economy, and the defense of the Yuan which, currently, is still very close to the historic lows of recent years, exchanging over 7 Yuan for a dollar . Here is the related graph updated to date

The defense of the Yuan has not been a successful policy so far. The latest move by the monetary authorities seeks to give a little push in favor of the Chinese currency.

China has reduced the amount of foreign currency deposits banks are required to hold as reserves for the first time this year, to 4% from 6%, with the statute taking effect from September 15.

Reducing foreign reserve requirements has been a key part of China's program to prop up the Yuan over the past two years.

The move – which followed a bolder-than-expected deposit rate cut to ease potential pressure on the CNY – increases the amount of foreign currency available in the local market. According to UBS estimates, a 2% cut in the FX RRR would free up around $19 billion. The resulting increase in USD supply should drive USD/CNH lower, and it did, although it is worth noting that after the previous RRR cut in September, CNH initially strengthened by around 1% before weakening by 3% over the next three weeks.

The measure is equivalent to the sale of foreign reserves on the local money market by the Central Bank, only that these resources are made available by a plurality of institutions which now no longer have to hold certain dollar reserves. However, the measure has some limitations:

- it is not a move that can be repeated many times. The reserve requirement can only be lowered a couple more times;

- banks now have fewer foreign exchange reserves on hand. The problem of a possible devaluation is only postponed.

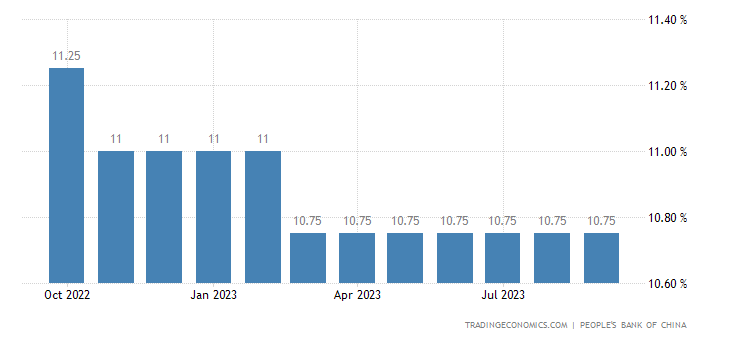

In the meantime, however, the reserve requirements ( RRR ratio ) for banks have not been revised, remaining at 10.75%, so there is no further stimulus in Yuan.

Not all bad news though. The forecast Caixin manufacturing index rises above 50%, which indicates an expansion of the industrial production sector.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article China: cuts in foreign currency reserves, but the manufacturing forecast index rebounds comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-taglio-alle-riserve-obbligatorie-in-valuta-ma-rimbalza-lindice-previsionale-manifatturiero/ on Fri, 01 Sep 2023 08:00:03 +0000.