China: exports drop, more than expected and more. Is the economy performing as it should?

The Chinese economy is sending mixed signals. On the one hand we have had some positive signs from industrial production, on the other, however, exports are slowing down, and the use of credit is also not brilliant.

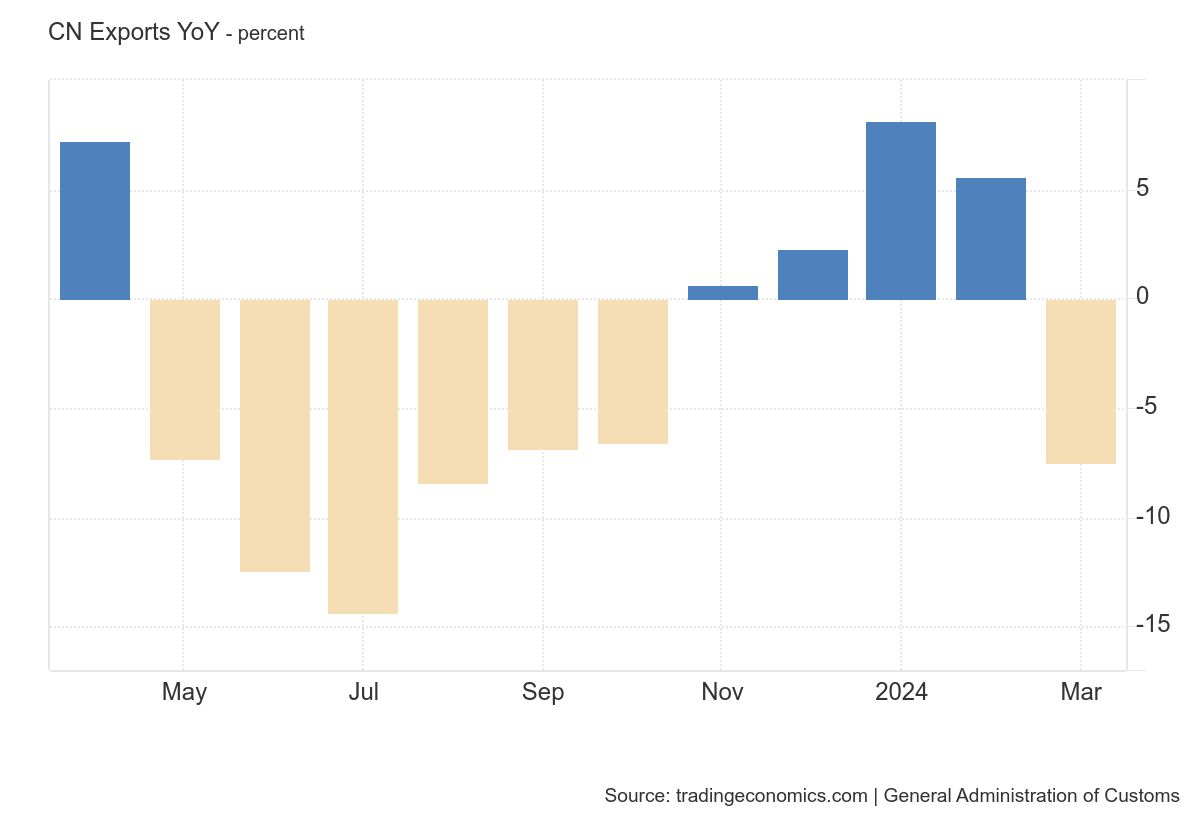

Let's start with exports: Exports from China fell 7.5% year-on-year to $279.68 billion in March 2024, sharply reversing the trend from 5.6% growth the previous month and worse of market forecasts that predicted a 3% decline, highlighting an uneven recovery in the country and extinguishing hopes that global demand will continue to drive growth in the world's second-largest economy.

The decline in exports was accompanied by a stronger base effect compared to March last year, when the country recorded robust growth of 10%. For the first three months of the year , exports grew 1.5% y/y , reaching $807.50 billion.

Among trading partners, cumulative exports for the first quarter were markedly lower to European Union countries (-5.7%), South Korea (-9.8%) and Australia (-8. 9%), and contracted to a lesser extent towards the United States (-1.3%). D

On the other hand, shipments to ASEAN countries increased by 4.1%, as a strong increase in exports to Vietnam (18.5%) offset declines in Singapore (-7.2%) and in the Philippines (-14.4%).

Here is the relevant graph:

There are other signals, coming from the credit sector, which show a complex situation to say the least, where growth is not explosive and therefore does not require new investments or even additional working capital.

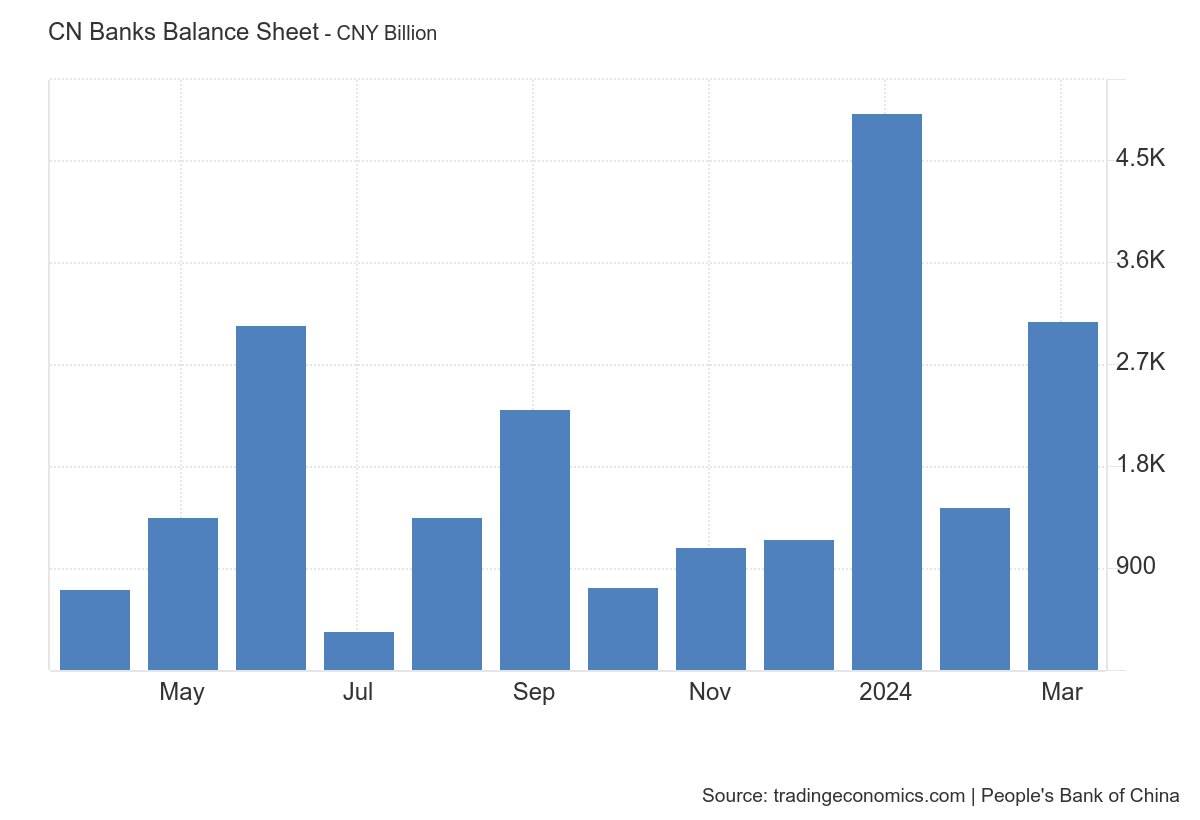

Chinese banks extended CNY3.1 trillion in new yuan loans in March 2024, more than double February's CNY1.45 trillion, but below forecasts of CNY3.56 trillion.

The reading is also lower than the CNY3.89 trillion in March 2023, in another sign of weakness in credit demand. March is usually a strong month for lending, because banks tend to extend more credit at the end of each quarter to meet lending targets.

New yuan loans reached CNY9.46 trillion in the first quarter of 2024, compared to a record CNY10.6 trillion in the first quarter of 2023.

Meanwhile, total social financing, which is a broad measure of credit and liquidity, rose to CNY4.87 trillion in March, up from CNY1.52 trillion in February and forecasts of CNY4.7 trillion of CNY.

The M2 money supply increased 8.3% from a year earlier, compared to 8.7% in February and forecasts of 8.7%. Growth in outstanding yuan loans slowed more than expected to 9.6%, a record low, compared with 10.1% in February and a forecast of 9.9%.

Here is the relevant graph:

Obviously China's recovery is not what one would expect, perhaps, as the export trend indicates, not exactly the fault of China itself. Exports to the USA have increased very modestly, while exports to the EU have dropped significantly, a sign that depending on the outside for growth risks being dangerous, when the other partners are in crisis or are doing everything they can to get there. Among other things, from these data, it does not seem that Western markets are being invaded by products made in China, or rather they are more than usual.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China: exports drop, more than expected and more. Is the economy performing as it should? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-cala-export-e-piu-delle-attese-e-non-solo-leconomia-sta-marciando-come-dovrebbe/ on Fri, 12 Apr 2024 15:45:09 +0000.