China: household debt reaches a dangerous level

Chinese households are showing a rise in debt, contributing to the nation's economic slowdown and raising questions as to whether Beijing's new consumer boost can actually be effective.

The nation's household debt added 63.5% to the nation's gross domestic product (GDP) in the second quarter, up from 61.9% at the end of last year, according to a report by the National Institute of Finance and Government. development (NIFD) released on July 23rd.

It is approaching the 65% red line previously used by the International Monetary Fund as a financial risk warning point. Let's remember that the Chinese GDP is always viewed with a certain suspicion because it is linked to communications from local administrators who have an interest in showing constant and significant growth.

Chinese household debt is mainly in the form of mortgage loans, which reached 38.8 trillion yuan ($5.38 trillion) at the end of June; as well as consumer loans, credit card debt, private loans, and loans used to finance business operations.

“Effective demand for both household consumption and investment has declined,” wrote Zhang Xiaojing and Liu Lei, two researchers at the Beijing-based think tank.

Zhang is also a government adviser to head the Institute of Finance and Banking of the Chinese Academy of Social Sciences.

“Weak household spending is mainly due to their slow income growth and ultimately slow economic growth,” they said.

China has seen a rapid increase in the household leverage ratio since 2008, when policy makers in Beijing rolled out a 4 trillion yuan stimulus package and monetary easing to counter the financial crisis.

The leverage ratio at the end of 2008 was only 17.9%.

The Bank for International Settlements estimated that China's household debt reached $10.76 trillion by the end of last year, or 61.3% of its GDP .

This has already surpassed the 55.2% seen in Germany by the end of 2022, 36.4% in India and 47.7% for the emerging economies average, and China is now rapidly approaching the leverage ratio by 74.4 percent in the United States and 68.2 percent in Japan.

The National Development and Reform Commission also launched 20 consumer stimulus measures earlier this week, easing restrictions on car purchases and property sales, promising to improve the nation's consumer environment.

Consumption contributed 32.8% of China's GDP growth in 2022, down from 58.3% in 2021, as market entities and households were hit hard by zero-Covid controls.

The problem is that, with this level of debt, it will be very unlikely that there will be an effective stimulus to restart household consumption: debt is traditionally seen as a stigma in China. The current level is already very high, but it is because it is linked to real estate mortgages. How can young people, often unemployed, be persuaded to get even more into debt to increase consumption in a situation of great uncertainty?

China is starting to be a mature economy, even if it lacks some of the foundations that have allowed Japan and South Korea a transition that is not easy, but not too painful either. However, each country is different from the others and needs its own solutions, and the Chinese one cannot pass, in this case, from a bank credit crunch, because this would worsen the credit and consumption capacity of families.

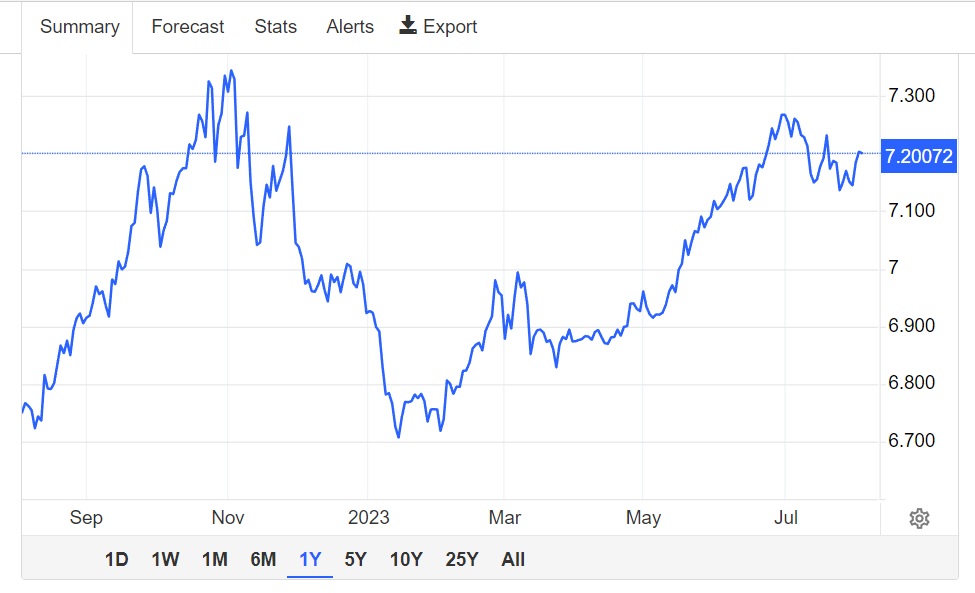

It would be better to bail out the banks, even with bailout purchases, than to impose a squeeze. Meanwhile, the Yuan is devaluing, facilitating exports and, basically, making it easier to tolerate a little more debt

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article China: household debt reaches a danger level comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-il-debito-delle-famiglie-arriva-ad-un-livello-di-guardia/ on Thu, 03 Aug 2023 08:30:04 +0000.