China: it’s not over with Evergrande. Now the giant Country Garden is shaking

Since taking the top spot in China Evergrande Group's crisis in 2017, Country Garden has remained the nation's largest developer in China by contract sales. It employs more than 200,000 people in the real estate sector. A colossus based in Foshan, in southern China, and which operates mainly in the construction of large complexes in medium-sized cities.

And, like Evergrande, Country Garden has also relied heavily on access to finance in the offshore, ie Western, credit market; in fact not only Evegrande, but practically all of the fellow developers who have filled themselves with borrowed money to fuel growth over the last decade which is now facing an abrupt halt. According to Bloomberg , it has the largest pool of US dollar bonds outstanding among China's largest non-defaulted real estate companies, with approximately $ 11.7 billion outstanding, according to data compiled by Bloomberg.

Founding President Yeung Kwok Keung transferred his controlling stake to his daughter Yang Huiyan in 2005. She is now the company's vice president and is the richest woman in China, according to the Bloomberg Billionaire Index.

Or at least it was, because some Country Garden's US dollar bonds plunged to all-time lows in the wake of a report that the company failed to get enough investor support on converting certain bond classes. an operation that would have improved its capitalization. Longer-dated bonds have been trading as low as 69 cents on the dollar as of late Friday.

The company tried unsuccessfully to place $ 300 million in convertible bonds, and this was one factor in the fall on fears of funding difficulties. According to Bloomberg, while Country Garden is not facing imminent redemption pressures – it has $ 1.1 billion worth of dollar bonds maturing this year and had 186 billion yuan (S $ 39.5 billion) of liquidity available in June. last year – risks could emerge if it has limited access to finance. The problem is precisely the trust that is the basis of such a giant based on credit: if it trembles, disaster is approaching. Trust is serious business.

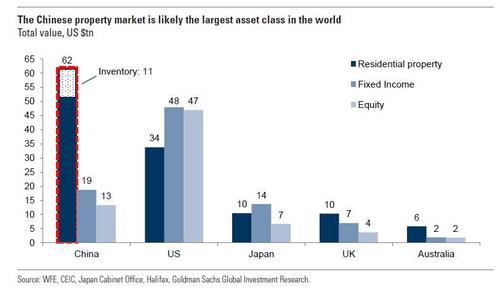

another huge problem is that Country Garden has 3,000 large construction sites open in countless cities and if it had financial problems it would also affect general economic activity. Without considering the risk related to the highly unbalanced Chinese financial system towards real estate and related investments

The developer sold bonds and asset-backed securities in the local market in December, reflecting support from investors and regulators, and held the ratings of all 3 major rating firms last year. Country Garden holds both investment grade and high yield credit ratings of the top 3 risk assessors, making it a so-called crossover name that could be vulnerable. With the elimination of the weaker operators, the speculative market could attack Country Garden. It has the equivalent of an investment grade triple B rating at both Moody's Investor Services and Fitch Ratings, and the highest possible speculative rating at S&P Global Ratings. However, the borrower is likely to “strengthen its financial resilience by controlling debt growth and maintaining disciplined land acquisitions,” S&P analysts wrote in a September report that reaffirmed its rating. Which seems easy to say, but difficult to do at the moment, also given the failure to place the last bond.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: it's not over with Evergrande. Now the giant Country Garden is shaking comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-non-e-finita-con-evergrande-ora-trema-il-colosso-country-garden/ on Tue, 18 Jan 2022 12:11:29 +0000.