China: new peaks in exports. Usa: new trade super deficit

Even though China is in a difficult situation, caught on the one hand by the energy crisis and on the other by outbreaks of ever more widespread covid outbreaks, Despite this, the “Factory of the World” exports like never before, setting new records.

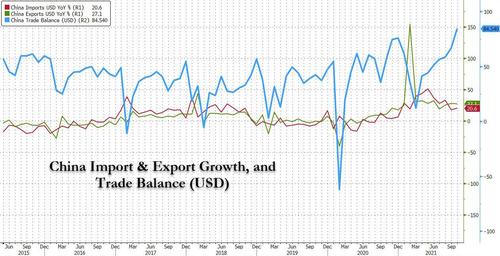

Chinese export growth is still strong, albeit slightly declining to 27.1% yoy in October, above the consensus expectation of 22.8%, implying a sequential 2.6% increase in October ( a modest slowdown from + 3.0% in September). At the same time, imports increased by 20.6% on an annual basis, disappointing expectations of a 26.2% increase, indeed with a drop of 3.7% (compared to -0.7% in September). As a result of much greater growth in exports than imports, the monthly trade surplus increased further to a record $ 84.5 billion in October, supporting the appreciation of the Chinese yuan in October, although the economy China has slowed sharply in recent months.

While Chinese trade growth has remained well above pre-pandemic levels, its exports have already exceeded the level reached in 2020 and this is one of the causes of congestion in eastern US ports.

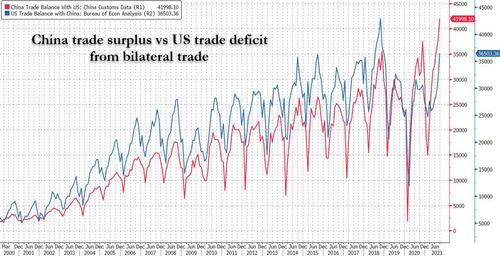

Looking at the data, we find that China's exports to the European Union and the United States have grown faster than other trading partners. The nation's trade surplus with the United States rose to 2.08 trillion yuan ($ 325 billion) in the 10 months to October from 1.75 trillion yuan a year earlier, partly due to Chinese imports of US soybeans slowed due to weather-related problems in recent months.

Broken down by major export destinations, export growth to South Korea was resilient and reached 33.1% yoy in October (vs. 27.9% in September). Exports to India also increased 46.4% yoy in October, similar to 46.2% yoy in September, all despite the Himalayan crisis. Export growth to ASEAN rose to 18.0% yoy (vs 17.3% in September). Among the major DMs, export growth to the US slowed significantly to 22.7% yoy in October (vs. 30.6% yoy in September) while exports to the EU accelerated to 44. , 3% yoy from 28.6% yoy in September. Exports to Japan grew by 16.3% yoy (vs + 15.2% yoy in September).

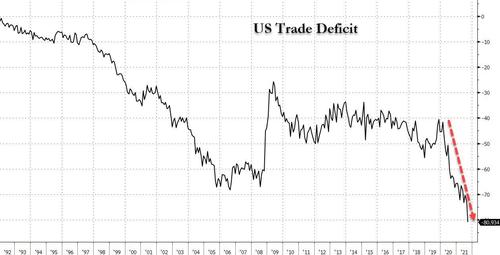

It is no coincidence that a few days after the announcement of a record trade deficit for the US (so much for all those Chinese tariffs), China recorded the largest trade surplus ever . As reported last week, in October, the United States had a trade deficit of $ 80.9 billion, the highest on record, and double its pre-covid levels.

So China pulls, indeed the desire for “Green” of other countries probably helps Chinese exports that run on coal even more. This is creating ever greater imbalances which will, sooner or later, have to be addressed.

Furthermore, curiously, as we pointed out earlier, a look at the bilateral trade deficit between the US and China shows that the recent divergence in the data continues, with China reporting a larger trade surplus than US reports as a deficit, a ' reversal of the observed pre-covid trend (we discussed this extensively in “A bizarre discrepancy is blowing up trade" data "between the United States and China").

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: new peaks in exports. Usa: new trade super deficit comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-nuovi-picchi-dellexport-usa-nuovo-super-deficit-commerciale/ on Mon, 08 Nov 2021 08:00:56 +0000.