China sells a lot of US government bonds, tired of US monetary policy uncertainties

The FED's confusion about cutting interest rates and the need to support the Yuan is causing more and more US government bonds to be sold by Beijing and the UK could soon overtake China as the second largest holder of government bonds. stars and stripes.

The world's second largest economy https://www.scmp.com/economy/china-economy/article/3259463/china-unloads-more-us-treasury-bills-odds-fed-rate-cuts-grow-slima February, with a total of $775 billion at the end of the month, according to data released by the U.S. Treasury Department on Wednesday.

Japan cemented its place as the top buyer with an addition of $16.4 billion of notes to its coffers in February, for a total of $1.168 trillion in US debt, while the United Kingdom's holdings are rose to 700.8 billion dollars from 691.2 billion dollars in the same period.

“ Chinese overseas investment has focused on US Treasuries in the past, [but] there is room for the Chinese government to further reduce its holdings in the future ,” said Zhao Xijun, a finance professor at Renmin University in Beijing.

“ Beijing is concerned about the impending rate cut in the United States, which will impact yields .” Perl what scares Chinese investors is the uncertainty of US moves.

Following Federal Reserve Chair Jerome Powell's speech on Tuesday, economists expect U.S. policy rate cuts to be further delayed, if not even increased, with reductions in late 2024 if not as early as 2025.

The U.S. dollar index hit a six-month high of 106 on Wednesday. This forces those who can to sell US securities to defend their currencies. Below is a graph showing the jump in the Dollar Index which tracks the strength of the dollar

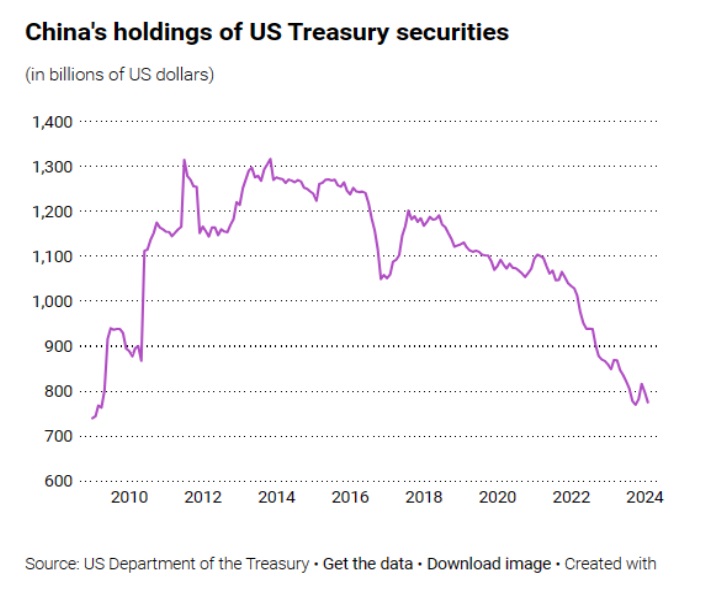

Beijing, vigilant in protecting its assets abroad, has reduced its investments in US Treasuries by 25 percent since the start of 2021, amounting to $280 billion.

Its position hit a 14-year low of $769.6 billion in October 2023, a decline commonly attributed to a conscious effort to diversify its holdings. Here is a chart that clearly shows the trend of China's ownership of US stocks

Zhao noted that changes in overseas investments are very dependent on the context, recalling that Beijing increased its investments in gold – an asset known for its reliability – after an analysis of the external environment.

Analysts confirmed that China's moves to diversify its assets are in line with rapid changes in geopolitics and its uneven relations with the United States.

Alicia Garcia-Herrero, chief Asia-Pacific economist at Natixis, said further sales were possible, although U.S. Treasury Secretary Janet Yellen raised the issue with her Chinese counterparts during an official visit earlier in month.

“I think the moment it said the United States would take 'nothing off the table' in response to China's overcapacity, [Beijing] wanted to send a signal of seriousness on the issue of selling US Treasuries,” he said.

All of this comes after a trip by Treasury Secretary Yellen

Officials from China and the United States met in Washington on Tuesday to exchange views on financial stability, regulatory cooperation, cross-border payments and combating money laundering under the recently established bilateral financial working group. However, no details were provided.

Garcia-Herrero noted that Europe and Japan's combined holdings are larger than China's, meaning the US "could mitigate the sell-off" without "much of an impact." However, China could have a problem in controlling the devaluation of the Yuan, without having sufficient US government bonds to sell.

However, there is also an image problem: if China were no longer the world's second largest investor in US government bonds, it would send a strong signal of lack of friendship with Washington and lack of trust in its government.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China sells many US government bonds, tired of US monetary policy uncertainties comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-vende-molti-titoli-di-stato-usa-stanca-delle-incertezze-di-politica-monetaria-usa/ on Fri, 19 Apr 2024 07:00:41 +0000.