China: strong monetary stimulus, while the West does the exact opposite

SHANGHAI, CHINA – AUGUST 31: (CHINA OUT) A Chinese man identifies a new issued 100 yuan note with an old one issued in 1999, at a bank on August 31, 2005 in Shanghai, China. Authorities issued new yuan notes today that largely resemble bills in circulation but with new marks meant to foil currency counterfeiters. New 100, 50, 20, 10 and 5 yuan notes, as well as a 1 jiao coin (10 Chinese cents), were available from the People's Bank of China. The design of the new bills, bearing a portrait of former Chinese leader Mao Zedong, remains the same as the last-issued 1999 series but incorporate new watermarks and other minor changes that will make it harder to duplicate, according to state media. (Photo by China Photos / Getty Images)

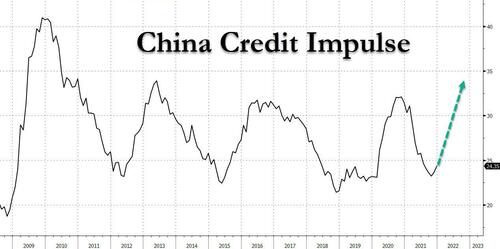

While the US discusses whether the Fed will lower overnight, China goes against the grain, releasing its latest monthly credit data which showed that China's financial system injected just under $ 1 trillion of total new credit in January. . All as expected when the first economic slowdowns were felt

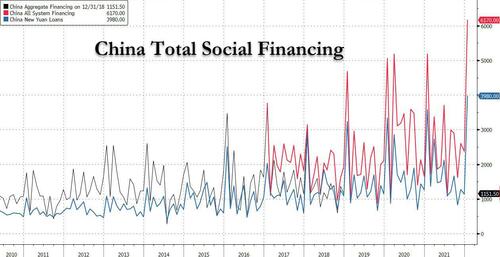

… In January, Beijing showed just how serious the stalled Chinese economy's desire to revive is, when the last amount of total social funding and RMB loans accelerated substantially and wiped out market expectations. In fact, as shown below, both new TSF (total social financing) and RMB loans were the highest ever recorded with the former up by 6,170 trillion …

… With Goldman writing that seasonality and, more importantly, easing of policies contributed to the acceleration.

As a reminder, in recent months, the PBOC has reduced RRRs, official interest rates and LPRs, and has also led commercial banks to speed up loan extensions. Sector-wide RMB loan growth data painted a less positive picture than headline data, as short-term loan growth was even faster than medium- to long-term loan growth and medium- to long-term household loans -long term they showed only modest acceleration. Last but not least, M2 growth also exploded upwards, sweeping expectations away. so we have a devastating combination:

- short-term debts, for consumption and not for investment,

- easing monetary policy

The result is a launch of demand, but also inflation!

Here are the highlights of the current Chinese situation:

- Total social funding: RMB 6.170 billion in January, vs. consensus: RMB 5400 billion;

- New CNY loans: RMB 3980 billion in January vs. 3700 billion RMB. Outstanding CNY loan growth: 11.5% yoy in January vs December at 11.6% yoy.

- TSF loan growth: 10.5% yoy in January, up from 10.3% in December. The implied monthly growth of TSF shares rose to 13.9% from 9.4% in December.

- M2 Monetary Fund: 9.8% yoy January vs. Bloomberg consensus of 9.2% yoy and up from 9.0% yoy in December

All the conditions for a strong economic revival, but above all a policy that does the exact opposite of what is about to happen in the USA and what will happen in Europe, if the ECB follows the directions of the Germans. Even more economic momentum for China in a slowing world. It seems like a conspiracy to make the CCP happier …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: strong monetary stimulus, while the West does the exact opposite comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-stimolo-monetario-forte-mentre-loccidente-fa-lesatto-contrario/ on Fri, 11 Feb 2022 07:00:29 +0000.