China: the Central Bank cuts medium-term interest rates to a record level to stimulate the economy

The People's Bank of China (PBoC) cut its 1-year benchmark lending rate (LPR) by 10 percentage points to a record low of 3.45%, while unexpectedly maintaining the 5-year rate, a benchmark for mortgages, at 4.2%.

Monday's decision followed the central bank's surprising cut in short-term lending rates and the medium-term policy rate last week as it attempted to strike a balance between helping China's faltering economy and containing of further weakness in the yuan.

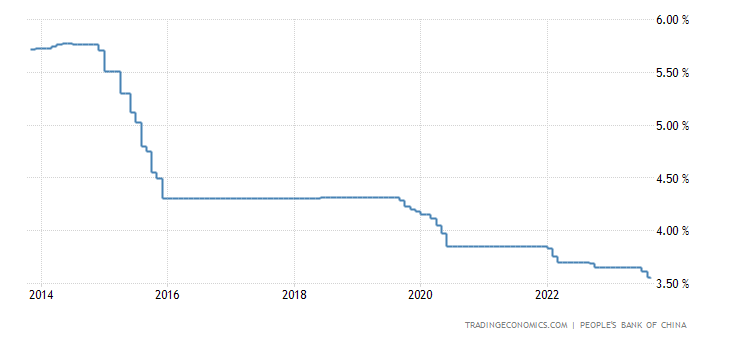

The PBoC has repeatedly pledged to free up more liquidity for the economy amid a slowdown in business activity, rising deflationary prospects and weak trade results. Here is the graph showing the record level reached by this benchmark rate in China

Premier Li Qiang recently said that achieving China's annual economic goals is not optional and stressed the need to expand domestic demand, support private enterprises and attract foreign investment.

Why hasn't the long-term rate been lowered?

The long-term rate, a reference on mortgages, has not yet been lowered, probably because, despite the crisis, the PBoC does not want to fire all its cartridges in a single shot, but leave something to be used in the future.

The government also doesn't want to inflate the housing bubble any further. However, the Chinese demographic trend is consistent with a decline in real estate values. Postponing it too much, leaving the market with excessive prices, will not avert the crisis, but will simply postpone it and could make the solution even more painful.

Let's not exaggerate on the spillover effect of the crisis

As problematic as the crisis in China may be, combining various factors, from demographics to a non-optimal international situation to internal economic imbalances, it can still be effectively addressed by the government with economic and monetary stimuli available and which Beijing seems to be willing to use.

There is often talk, even on these pages, of the possibility of overflowing the crisis in the West. Despite the various individual cases mentioned in the media, often to justify the western crisis already underway, these are limited movements. The reasons for the economic and financial problems of the USA and Europe must not be sought in Beijing, but in the industrial, fiscal and monetary policy errors of the advanced countries. The fault lies not with the PBoC, but with the ECB and the FED.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article China: the Central Bank cuts medium-term interest rates to a record level to stimulate the economy comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-la-banca-centrale-ribassa-a-un-livello-record-gli-interessi-a-medio-termine-per-stimolare-leconomia/ on Mon, 21 Aug 2023 09:30:09 +0000.