China: the economic crisis for Covid is deeper than expected …

After Friday's catastrophic new credit data, which recorded the lowest number of new loans in half a decade, and following this morning's report that Chinese authorities have allowed a further cut in interest rates on mortgage loans for new homebuyers in yet another push to bolster the housing market and revive a weak engine of the world's second largest economy, few were expecting upside surprises from Monday's economic data dump outside of China, but even fewer were expecting something as negative as the one just reported from Beijing.

With Europe, the UK and the US on the brink of recession, China boldly took the step to get there first, with Beijing reporting that the Chinese economy contracted sharply in April as the Covid epidemics and lockdowns have dragged industrial and consumer sectors down to their weakest levels since early 2020 as millions of residents have been confined to their homes and factories have been forced to shut down production, while the unemployment rate locale has risen to the 2nd highest level in modern history.

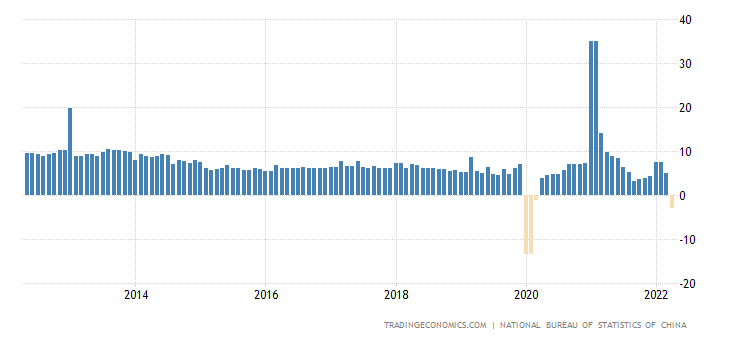

Industrial production fell 2.9% in April y / y, far worse than the median consensus estimate of a 0.5% increase, only the second monthly contraction since 1990 and the largest decline ever recorded! As we see practically unheard of in the last 10 years, except for the brief parenthesis of the first outbreak of Covid, which had sent the world into lockdown.

But this is not the only negative sign:

- retail sales fell by 11.1%, almost double the market estimate of a 6.6% decline.

- The unemployment rate rose to 6.1%, higher than the forecast of 6% and just under the 6.2% unemployment rate reached in February 2020 during the peak of the covid crisis.

- Fixed investments for the period from the beginning of the year were the only positive aspect, up by 6.8% and, while also missing the 7.0% estimate, it could have been much worse without strong public investments.

zerohedge

Meanwhile, other data shows that the private housing market remains in shock

- Total value of home sales -32.2% yoy 3.32 trillion yuan

- Total area of homes sold down 25.4% yoy to 337 million sq m

- The total value of real estate sales fell by -29.5% yoy at 3.78 trillion yuan

- The surface area of new real estate constructions drops by 26.3% yoy to 397mq

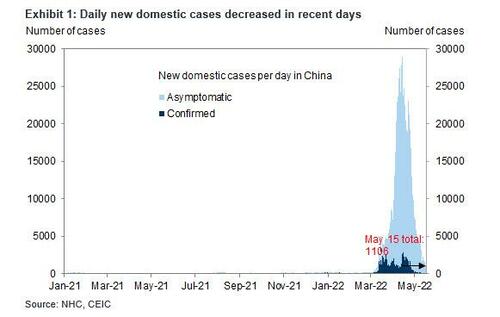

The good news is that the shockingly negative economic data is a direct result of Beijing's Zero Covid policy, which has taken a huge economic toll on Chinese people and businesses. Despite growing anger and social outrage, Beijing has insisted on sticking to its Covid Zero strategy to curb infections, even as Omicron's high transmissibility exposes cities to a greater risk of repeated closures and reopenings than previous strains. We can speak of "good" news because, as the graph below shows, at this rate Covid will soon no longer be a relevant factor in China, although I will condemn the country to total isolation, given that Omicron is endemic elsewhere …

"The Covid outbreaks in April had a big impact on the economy, but the impact is short-term," the National Bureau of Statistics said in a statement. "With progress in Covid controls and policies to stabilize the economy coming into effect, the economy is likely to recover gradually."

While the latest credit crunch was seen by many as the trigger for more easing and rate cuts, monetary stimulus proved less effective due to tight virus restrictions. Meanwhile, the PBOC left its one-year official loan interest rate unchanged on Monday, despite expectations from a growing number of economists that Beijing has no choice but to cut rates further as inflationary pressures and concerns about capital outflows reduce the possibility of further easing. However, this could lead to tensions on the Yuan.

However, if the Chinese economy also contracts, we will have as a result that we should see a slowdown in the global economy and this makes further and numerous increases in US rates less likely.

There was more good news: As previously mentioned, in the midst of all this terrible economic data outside China, Bloomberg has blown up news suggesting that the Chinese plague of Covid may be on the verge of extinction:

- Shanghai aims to fully resume normal production and life orders by mid to late June by normalizing Covid control measures, Deputy Mayor Zong Ming said in a briefing.

- Shanghai will gradually resume rail transit and bus services from May 22, Zong says

- There were no Covid communities spread in 15 of the 16 districts of the city: Zong

- Only about 980,000 inhabitants will remain in lockdown.

Positive news, but in the meantime, for now, China is slowing down, taking us with it

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: the economic crisis for Covid is deeper than expected … comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-la-crisi-economica-per-il-covid-e-piu-profonda-di-quanto-ci-si-aspettasse/ on Mon, 16 May 2022 11:30:13 +0000.