China: the economy is going into deflation. What will happen to the Yuan Renminbi?

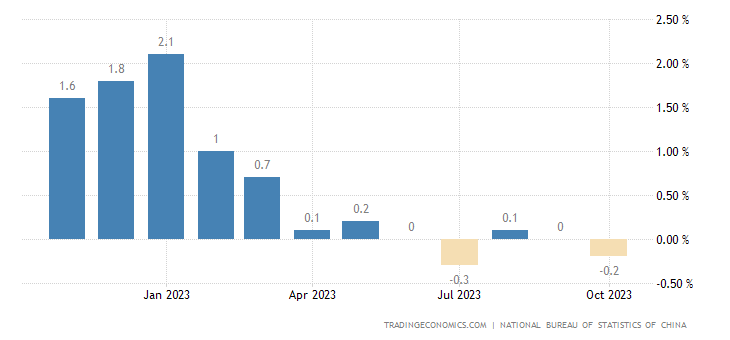

In recent days we have talked about the current Chinese economic peculiarity, that is, of being a country that has gone into deflation , both on a monthly and annual basis:

Even if in the last six months there has been a general decline in inflation, few countries have had the "pleasure", so to speak, of going into deflation, and this is even more particular for a country in which the Central Bank , PBOC, has not been particularly concerned with fighting inflation itself.

How will this inflationary trend affect the national currency, the Yuan Renminbi, against the dollar and other currencies?

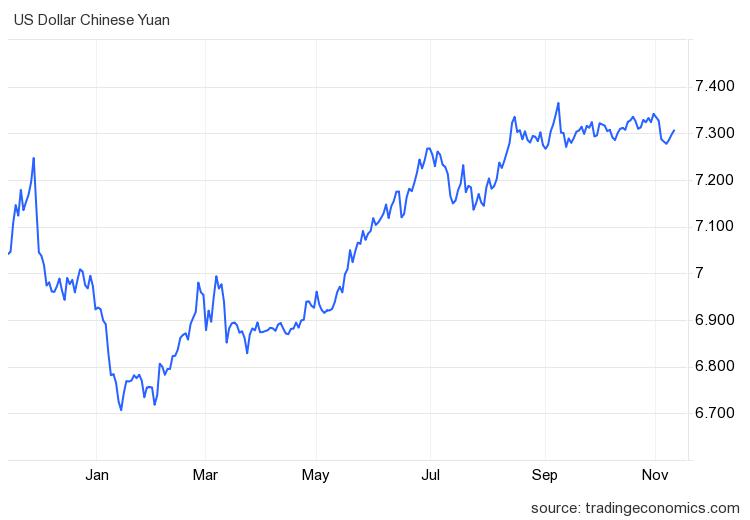

A deflationary environment should be consistent with a strengthening currency with less inflation relative to the other, but this is not true for the Yuan. Let's see how Beijing's currency has weakened and continues to weaken:

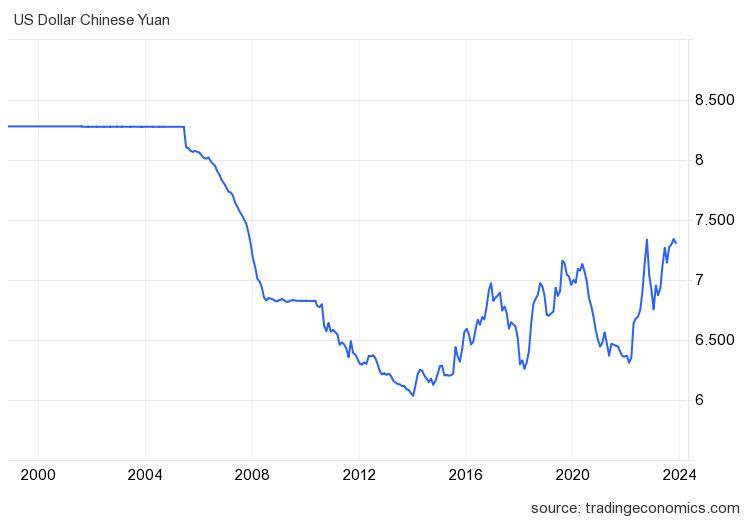

If we analyze a twenty-five year perspective, which practically includes the moment in which exchange rates became free market, it is clear that we are at the lowest values for the last 15 years.

If we compare the Yuan with two other Far Eastern currencies, the South Korean Won and the Japanese Yen, however we see a completely different and much more stable trend.

The Yuan is slowly strengthening towards the Yen

And now the Won

With the won the trend sees a strengthening of the Korean currency in the last 18 months, also consistently with the industrial and financial strengthening of Seoul.

The future

Wanting to venture some predictions, I believe that the course of the Yuan will be more consistent with that of the Japanese Yen and the Korean Won, because all these economies present considerable industrial strength and in the international economy and instead of fragilities linked to demography, which presents common problems in all these cases.

If, however, the forecast is linked to the dollar then it becomes more uncertain also because it is linked to international factors, which are not always predictable in advance. Assuming there are no further surprises, we should see a stable or slightly weakened Yuan Renminbi for most of 2024. Going into more detail, I think we will have:

- USD-Yuan between 7.3 and 7.4 in December and January 2024

- USD-Yuan between 7.3 and 7.5 until March;

- USD-Yuan between 7.2 and 7.4 from April to September

- USD-Yuan between 7.3 and 7.5 from September to November

- USD-Yuan between 7.5 and 7.8 for the end of 2024 and January 2025.

The weakening that I foresee will occur if there is no solution to the Chinese real estate problem and will also occur following the election of the new US president, a fact which usually leads to a strengthening of the stars and stripes currency because it clarifies the political framework at least for four years.

We'll see if I'm right or not.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China: the economy is going into deflation. What will happen to the Yuan Renminbi? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-leconomia-va-in-deflazione-che-succedera-allo-yuan-renmimbi/ on Sun, 12 Nov 2023 09:00:28 +0000.