Ciampi’s monetary constitution (1981 speech)

If he were still alive, Carlo Azeglio Ciampi would have turned 100 on 9 December 2020.

Former governor of the Bank of Italy, ex-president of the council and ex-president of the republic as well as one of the main " fathers of the euro " with relative change of economic paradigm.

To remember who Ciampi was and what interests he worked for, we are going to re-read the final extract of the conclusions of the annual report on 1980 , delivered on May 30, 1981, available on the Bank of Italy website .

In this speech the then governor stated the principles of the " monetary constitution " to be implemented in the years to come, among the pieces there was also divorce.

Enjoy the reading

THE TEXT OF THE "CONCLUSIONS"

Dear Participants,

the intent to fully explain the recent economic events and to give an account of the Bank's work will not have concealed the tension with which those events have been experienced and the concern in the face of the difficulties of our economy, which international events make more complex.

1980, together with the positive legacy of a growth in investments unknown for years, and the signs of a renewed commitment of entrepreneurs and workers, left a serious situation for the currency , the good of all, an indispensable good for the expansion of economic ties and civilians that unite us in a society.

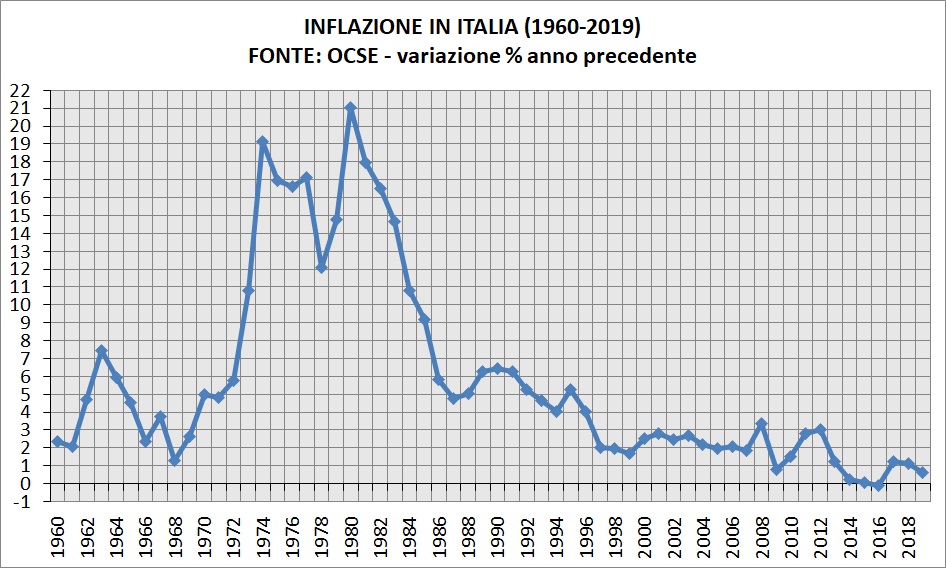

Inflation is no longer tolerable, the underlying component of which continues to rise and distances us from the countries to which we are united by history and culture.

An inflation of no less than 10 per cent for nine years, from two to around 20 per cent, has not only resulted in massive and blind transfers of wealth and inefficiencies due to uncertainty and relative price volatility; it has altered the very essence of money , largely emptying it of its function as a store of value, leaving it with only a humiliated function of numerary and means of payment .

A complex exchange economy cannot live without a reliable measure of value in the present and for the future. To escape the deception of a currency that corrodes itself quickly and unpredictably, it adopts as its own yardstick, through a multiplicity of practices and institutions, the very set of goods and services it produces. Under these conditions, even the successes of the traditional monetary maneuver risk turning into tactical episodes that do not avoid the strategic defeat represented by the consolidation of inflation.

When this process has been going on for years, it is not with the friction of scarce liquidity or a non-accommodating exchange rate that monetary equilibrium is restored. The return to a stable currency requires a real change in the monetary constitution , which involves the function of the central bank, the procedures for public spending decisions and those for the distribution of income.

The first condition is that the power of money creation is exercised in complete autonomy from the centers where spending is decided. There was a time when this need arose with respect to the productive system and it was then that the publicistic nature of central banks and the separation between bank and business were clarified. Today, that need must be satisfied above all with regard to the public sector, freeing the central bank from a condition that allows cash deficits to solicit a breadth of liquidity creation that is inconsistent with the growth objectives of the currency.

This requires a review of the ways in which, in our legal system, the issuing institution finances the Treasury : the overdraft of the treasury current account, the practice of the residual purchase of ordinary bonds at auctions, the subscription of other securities issued by State. In particular, it is urgent that the Bank of Italy cease the hiring of the BOTs not allotted at auctions . ( NDR – the divorce made with Andreatta )

But in a rapidly changing democratic society, where the aspiration for a higher standard of living is strong, the social dialectic intense, the imbalances still widespread and deep, the pressures to create liquidity push the currency almost fatally over the threshold. stability if no defenses are put in place in the very areas where demand arises.

The second condition is therefore procedural rules that place the major spending decisions in the perspective of monetary equilibrium . A fundamental principle of economic and political freedom prohibits subtracting the content of those decisions from the choices of families, businesses, the entire community expressed in Parliament and the Government. And the very existence of money, non-finalized purchasing power, is an expression of this freedom. But society must organize itself to prevent spending decisions from being made prey to that common asset which is monetary stability . To do this, it must discipline the ways of choosing without dictating any content of choice, just as other norms establish the ways, and therefore the possibility itself, of moving without commanding the goal.

There are, of course, the individual decisions through which income is divided between savings and consumption, and these are defined in their structure. The fiscal instrument can give those choices the necessary guidelines to register them in a coherent framework of compatibility. But much more than in family budgets, the breakdown of the monetary equilibrium is determined in the spending decisions of the public sector and in those of income distribution within the firm. It is there that the relationship between uses and resources tends to the point of making the increase in prices and the devaluation of debts a necessary perverse instrument of recomposition.

Public spending decisions must be given rules that force substantial compliance with the coverage obligation . At one time, the coherence between the expenditure, prerogative of the sovereign, and the taxes borne by the people was ensured by the dialectic between the executive and the parliament. The people having become sovereign, the budget constraint worked for a long time according to the rigid rule of balance. The disappearance of this constraint has led public finances to a situation in which the economic equilibrium has no other anchor than the self-governing capacity of the community. Article 81 of the Constitution intended to strengthen this guarantee, but its implementation has too often proved incapable of preventing expenditure, instead of exercising a careful stabilizing function, from freeing itself from the constraint of coverage. Forms must be solemnly sought and defined, such as the obligation to balance current income and expenses , with which to concretely implement the principle set out in the Constitution.

Methods and references are also needed in business spending decisions. A transformation economy, which imports raw materials and exports manufactured goods at international prices, has labor as the main cost factor to govern , in the double component of wages and productivity. Our legal system entrusts this government to the social partners, through the bargaining system.

For the importance of the economic and monetary effects, for the vastness of the interests involved, for the representative and delegation institutions that operate there, collective, national and company bargaining is a real moment of economic policy , comparable to that through the which is defined as public sector expenditure, and as needy of criteria that prevent the drift towards monetary instability.

Like any explanation of the freedom of economic initiative, the freedom of bargaining cannot but suffer from the limit of the general interest. Today the very mechanisms of negotiation, the fragmentation into different levels, the non-acceptance of macroeconomic references that operate as a general compatibility constraint, make it extremely difficult for the social partners to take decisions that mean at the same time a choice of equitable distribution of income and respect for monetary stability. It is necessary to seek and define institutional forms through which collective bargaining returns to be an instrument of governing the dynamics of income and the condition of work rather than the destruction of money .

Less and less reliance will have to be placed on automatisms that demean the parties' ability to bring their wills together and prove insensitive to changes in economic and social conditions. In moments of greater acceleration of the inflationary movement, it was believed to find a surrogate for stability in the use of indexation ; it is precisely its spread that sanctions and consolidates the ruin of the currency.

Monetary stability is too precious and too fragile a commodity for the front that defends it to be weakened by ensuring individuals or groups the safe conduct of automatic protection , especially when it is frequent and indifferent to the origin of inflationary impulses. ( Editor's note – get it rabble? The governor can't think of you! )

In the country of the Community that more than any other has been able, in recent years, to keep prices stable, the explicit prohibition of any form of indexing is sanctioned , not only in collective agreements, but also in the form of clauses that in individual contracts link to any index the pecuniary obligations of the parties. In the same country ( NDR – West Germany ) that stability, affirmed and defended, is also expressed in the ability to move the currency freely across borders .

Central bank autonomy, strengthening of budgetary procedures, collective bargaining code are prerequisites for a return to a stable currency.

For ten years now, even the indirect link to gold through the convertibility of the dollar and the fixed exchange rate ( NDR – the end of the Bretton Woods agreements ) has been terminated , the lira, like other currencies, has become an even more intangible asset and abstract, guaranteed in its value by nothing but the strength of the economy and the capacity of the social body to organize and govern .

A status of the currency is essential for the reconquest of a stable meter of all present and future assets and to guarantee us from the risk of falling back to structures that have not helped us to fight inflation, when they have not strengthened it.

These are the problems that the gravity and urgency of the economic situation require us to face in their complexity and entirety. The debate of recent times indicates that the choices have matured in minds and that concrete steps can already be taken in the indicated directions . In order for its effectiveness not to be dispersed, that debate must urgently be translated into a desire for realization today. More than technical refinements, we need the ability to free ourselves from prejudices, mistrust, short-sighted defense of particular interests. And this capacity has its root in the civil conscience, the last irreplaceable safeguard of a stable currency as well as of any other order of a free and just society.

FROM THE MONETARY CONSTITUTION TO THE EURO

A simply subversive discourse: the state must not have monetary sovereignty because, in his opinion, it would use it badly. So it is right that it should be managed by an oligarchy that does not answer to anyone for its actions.

Central bank autonomy and budget constraints are the cornerstones of economic and monetary union and, again in the name of Maastricht, in 92 we also abolished the escalator .

The indexation system, in fact, allowed nominal wages to grow faster than prices (except in 1982) but for Ciampi this was a "substitute for monetary stability".

What is the difference between the stability of the currency and its "surrogate"? That money is an " immaterial and abstract " good, work that measures and gives value to money is instead a very concrete asset on which people's lives depend.

And to be part of the single currency, a system that fights inflation in the absence of inflation, we have devalued and precarious work since 1992 , to pursue the fetish of price stability.

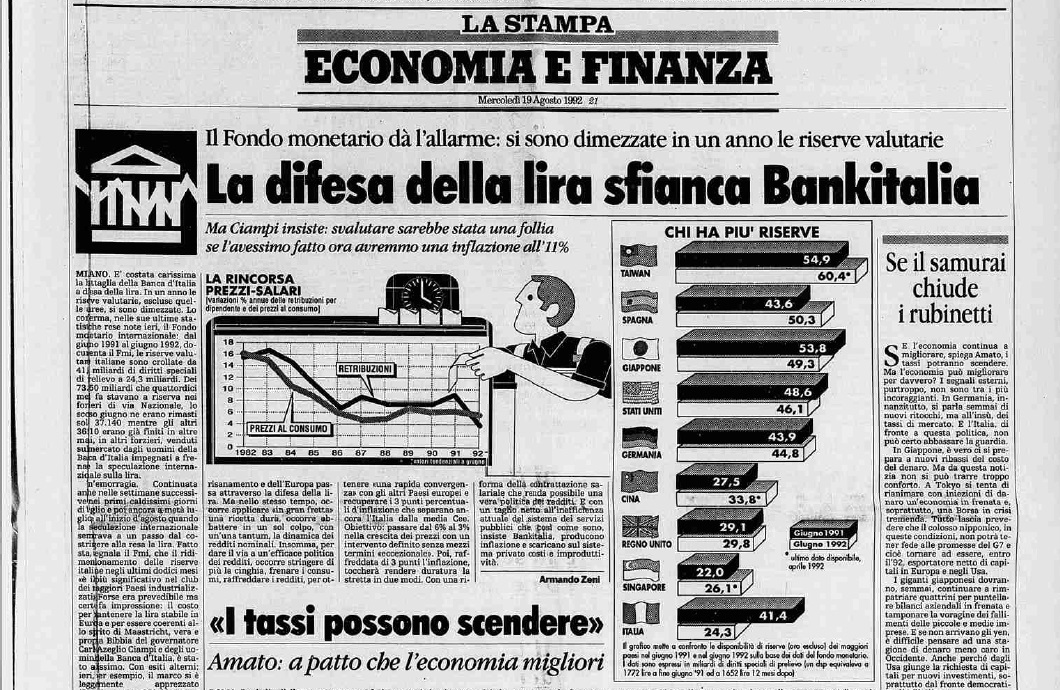

And still with regard to 1992, how can we fail to mention his useless defense of the lira in the narrow band of the EMS, justifying himself behind the bugbear of inflation, which only produced the waste of foreign exchange reserves .

It should be noted that, in a couple of his speeches as president of the republic, Ciampi peacefully admitted that the euro was a transfer / renunciation of sovereignty , and they were speeches to the nation with unified networks!

But come on, in the last years of his life he will have regretted something … But no! In fact, that 1981 speech, from which we started, was claimed in this 2011 letter on the occasion of the 30th anniversary of the Bank of Italy-Treasury divorce.

He continued to be an extreme defender of the single currency: on the eve of the financial coup , on October 29, 2011, he gave us pearls like “ without the single currency we would be in much more serious trouble ” in an interview with Sole 24 Ore.

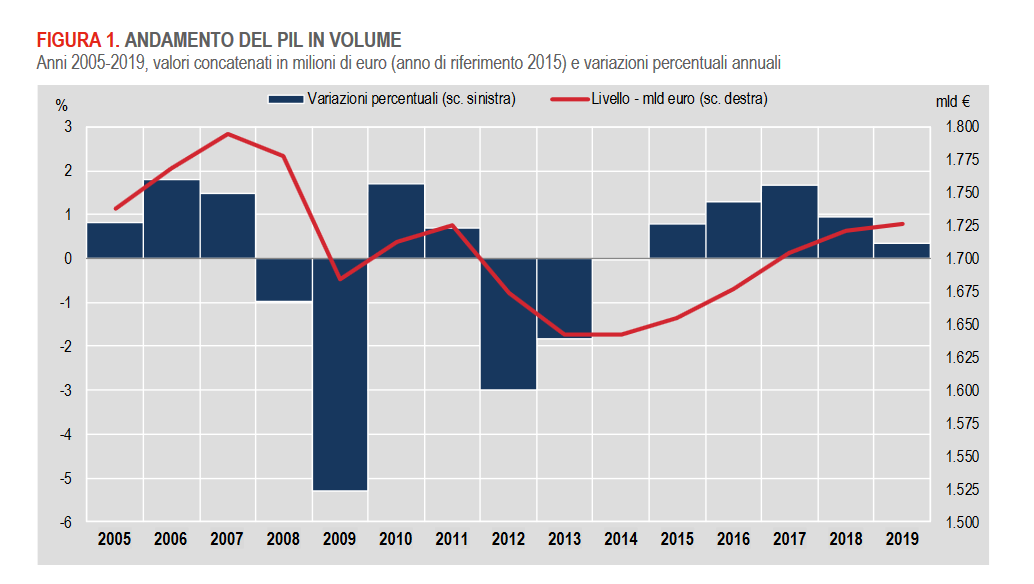

Too bad that at the time the only crisis area on the planet was the eurozone , while the rest of the world was continuing to recover from the global recession of 2008.

In 2019, Italy was still seeing the real GDP of 2007 through binoculars, it had barely recovered the values of 2011.

At the end of the fair, to "celebrate" one of the main culprits of the current economic disaster , the one that already existed before the covid, there are two explanations: either you belong to the 1% that has grown rich in these years of crisis, or you are simply ignorant fans.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Ciampi's Monetary Constitution (1981 speech) comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-costituzione-monetaria-di-ciampi-discorso-del-1981/ on Wed, 09 Dec 2020 07:00:06 +0000.