Consistency: JP Morgan Recommends Chinese Stocks That Was “Incomprable” Two Months Ago

JP Morgan Chase & Co sign outside headquarters in New York… A sign is seen outside the headquarters of JP Morgan Chase & Co in New York, in this file photo taken September 19, 2013. JPMorgan Chase & Co said on Tuesday it is aiming to save around $ 1.4 billion in annual expenses by cutting costs and simplifying businesses mainly in its consumer- and investment-banking units. REUTERS / Mike Segar / Files (UNITED STATES – Tags: BUSINESS)

"Do as I say, do not do as I do" is the motto of many investment banks. In this case, however, JP Morgan has outdone herself. Two months ago, the investment bank reported that Chinese technology stocks were " Uninvestable ", it could not invest in them:

As risk management becomes the most important consideration for global investors in relation to their China Internet investment strategy as they assess China's geopolitical risks and incremental concerns about regulatory risks, we believe China Internet is not investable in a perspective. 6-12 months with an unpredictable share price outlook, depending on the market's perception of China's geopolitical risks, macro recovery and Internet regulatory risk. In our view, the sector-wide sell-off could continue given the lack of valuation support in the near term. We downgrade 28 hedging securities to Neutral or Sell. The only name with an OW (buy) rating in our hedging portfolio is Kuaishou.

This did not go absolutely well in terms of the relationship with the Chinese authorities, who reacted indirectly, but strongly. In April, Bloomberg reported that JPMorgan was removed as the senior underwriter for Kingsoft Cloud Holdings' Hong Kong share offering after one of the bank's analysts halved the share price target for the Chinese tech firm. a punishment for taking punishment against Chinese technology stocks. But the humiliation for JP Morgan didn't stop there: an even more embarrassing moment emerged last week when Bloomberg reported that the harsh note about JPMorgan's "non-investable" shares, hard-written, should never have been published. the.

According to Bloomberg, " JPMorgan's editorial team charged with overseeing the bank's research demanded that" non-investable "be removed from 28 reports written by tech analyst Alex Yao and his team before they were released on March 14. " Too bad that a distraction then forgot to correct all versions of the press release! A disastrous revision error.

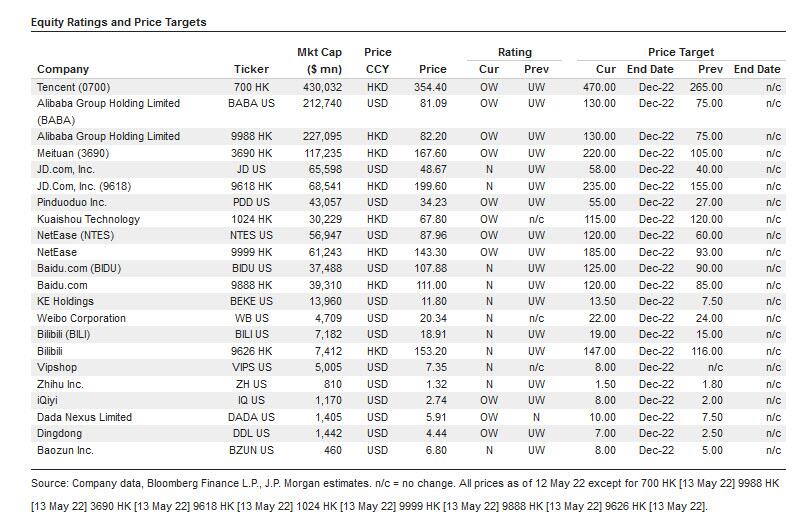

To end the fool yesterday, the same team that had defined the Chinese technological shares as “Uninvestable” or “Incomprable” decided to define them as “ Buyable ” inviting you to put money on them. OW is an indication to buy, UK to sell. If you see the following table you will see how many UWs have become OW.

therefore even the big investment banks are wrong, indeed, perhaps they are a little more wrong than the average. In the end, a good way of investing should be based on a mix of knowledge and prudence which, we know, is not very widespread. As much of the crypto world demonstrates, people follow fashion rather than head.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Consistency: JP Morgan recommends Chinese stocks that were “Incomprable” two months ago comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/coerenza-jp-morgan-consiglia-azioni-cinesi-che-due-mesi-fa-era-incomprabili/ on Tue, 17 May 2022 10:00:47 +0000.