Could the housing crisis in Germany become a credit crisis?

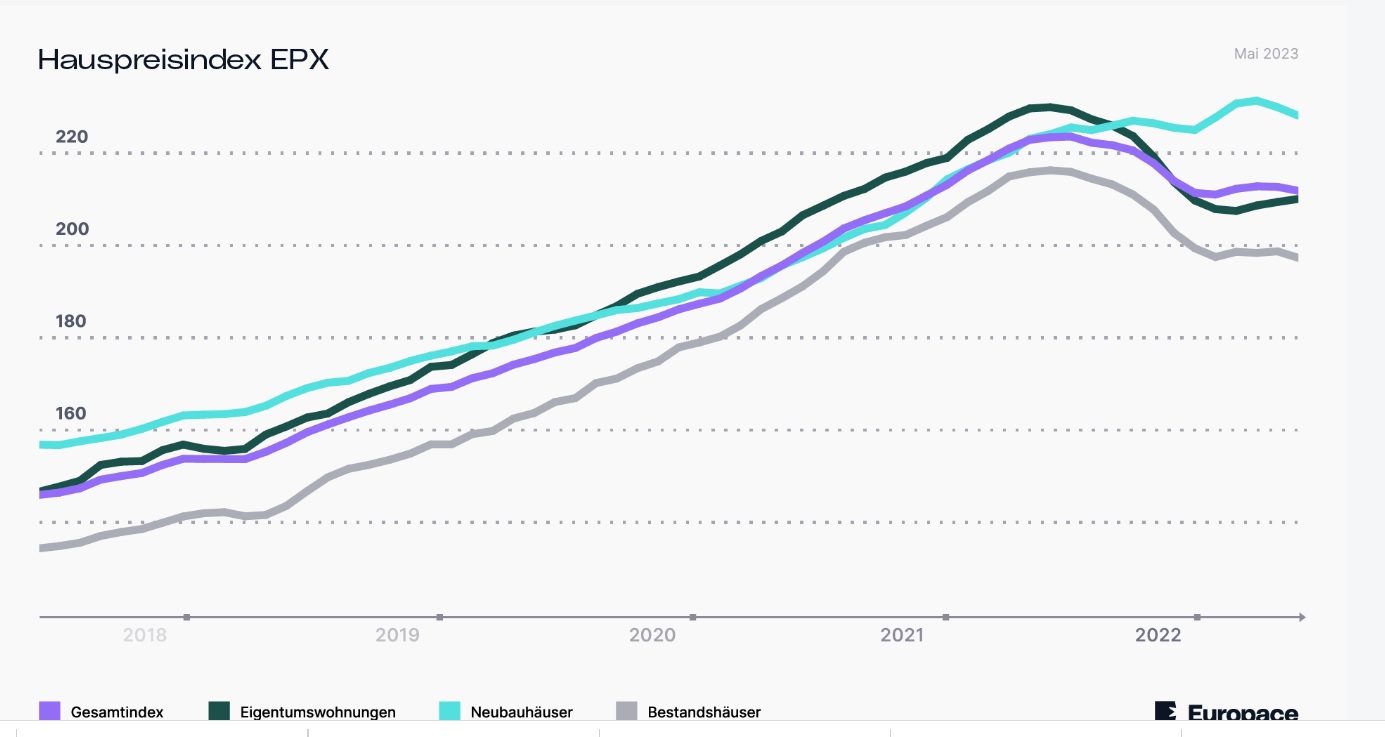

There is now no doubt that the German real estate market is deflating with a worrying rapidity and unique in Europe, if not in the industrialized world. According to the Global Property Guide Germany saw a price drop in nominal terms of 8.51%, meaning a decline in real terms to be an impressive 14.61% in May. An impressive drop which is confirmed by the Europace website, especially as regards already built homes, while the prices of new homes continue to remain high and stable.

Why doesn't the decline affect new properties? Only because this sector enjoys public contributions linked to green policies. A sort of small 110%, indeed very small, but which in any case favors new houses with certain environmental characteristics (insulation, heat pumps, etc.) over existing buildings, many of which need to be renovated to adapt them to these new standards.

All this does not bode particularly well both for the market and for the credit sector. The rise, not yet completed, of the interest rates wanted by the ECB, strongly affects the real estate sector.

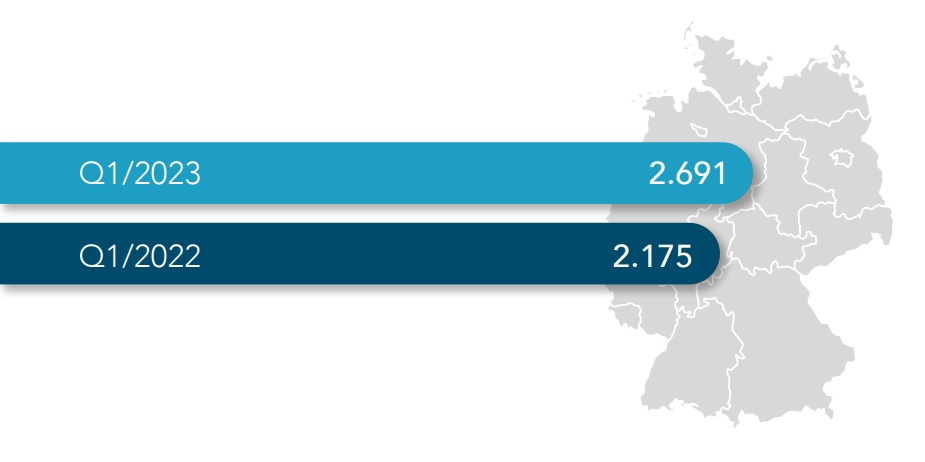

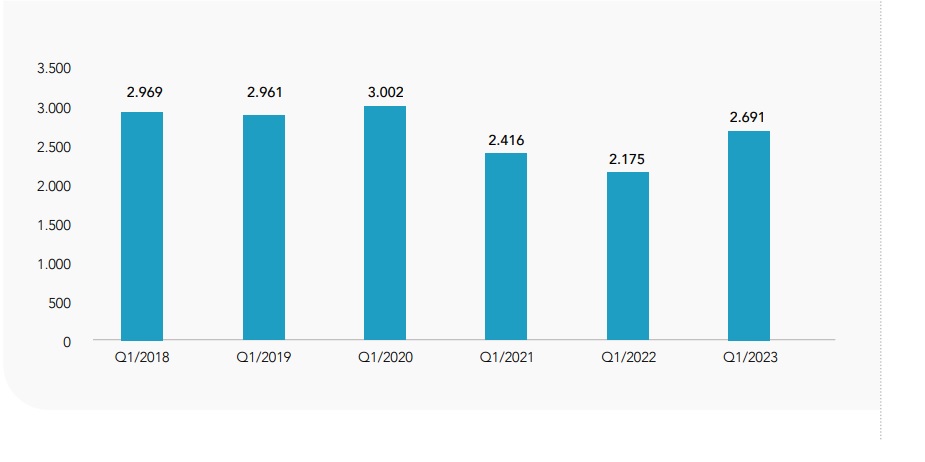

There was an increase in bankruptcies in the first quarter of 2023 compared to 2022

In reality this increase, in itself, would not be particularly worrying, because it followed a partial block of procedures applied during the covid-19. Let's say that bankruptcies are returning to a pre-epidemic level

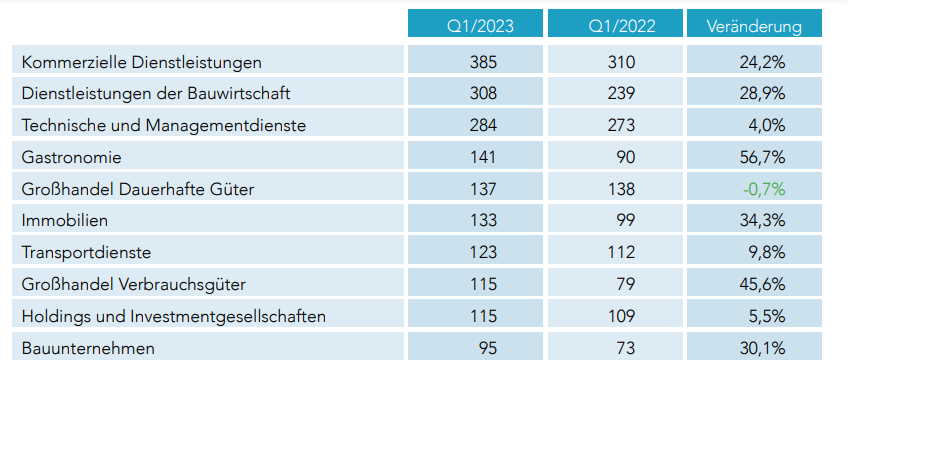

However, if we analyze these data more deeply, we can see how they affect the real estate and the service sector

In first place in bankruptcies we have the catering sector, with a +56.7%, in second place the wholesale sector, with a +45.6%, but in third place we have the real estate sector with a +34.3 %. A substantial increase that indicates the crisis in the sector. 4

Now the problem is clear:

- the increase in interest has two effects, the first is a drop in real estate investments, with a drop in cash flows for the banks;

- the second an increase in insolvencies, therefore in the losses of the credit sector;

- in any case, the buildings executed have a value lower than the estimated value;

- however the market is not receptive and prices are falling;

- there is an increasing number of families who believe they cannot meet their mortgages, who sell their real estate assets as negative, and who therefore voluntarily decide not to fulfill the mortgage;

If the decline in real estate prices continues and is still accompanied by high interest rates, there is a very high risk that the real estate crisis will turn into a credit crisis. This is why Germany has accepted the reform of the ESM: it hopes that someone else will pay for its crisis …

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Can the housing crisis in Germany become a credit crisis? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-crisi-immobiliare-in-germania-puo-diventare-una-crisi-del-credito/ on Mon, 26 Jun 2023 10:00:14 +0000.