Covid? For the markets it is the past. Inflation (or stagflation) is worse

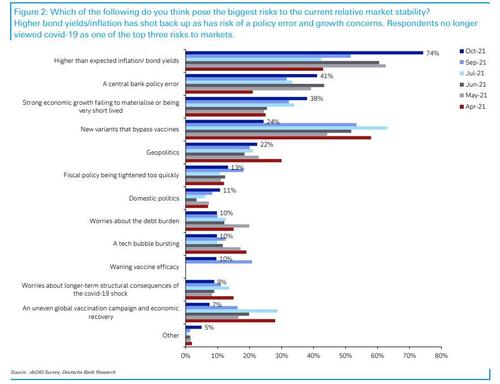

According to Deutsche Bank's latest monthly survey of 600 global market participants, for the first time since June, the largest perceived risk to markets is no longer covid. Instead the first three risks are:

i) increase in inflation and bond yields,

ii) central bank policy errors

iii) failure to achieve strong economic growth or its very short duration (ie stagflation and / or recession).

New covid variants that bypass vaccines have plummeted from 1st place, which it occupied in the previous three months, to 4th place in October.

Here are some other interesting answers:

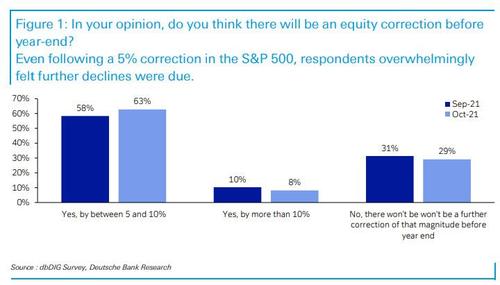

When asked if there will be an equity correction before the end of the year, only 29% said no, while the solid majority, or 63%, expect a decline of between 5 and 10% before the end of the year. year. Only 8% expect the next decline to be greater than 10%.

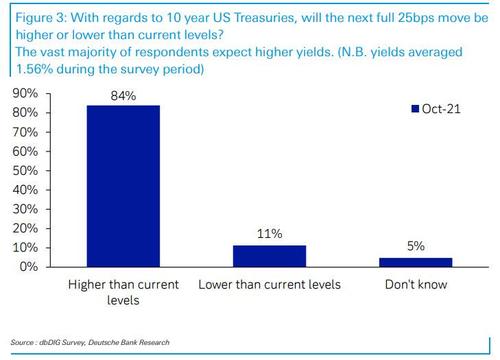

The most likely catalyst for the next correction is higher rates. At least that's what the next question in the survey suggests: A whopping 84% of respondents expect the next 25 basis point move in 10-year yields to be higher and only 11% lower. Only 5% of the respondents were honest.

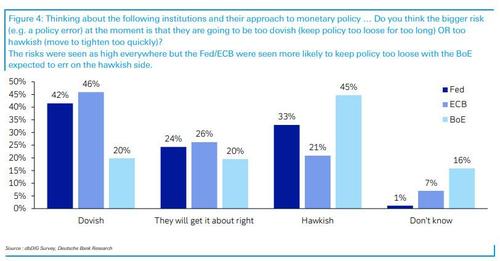

DB then asked respondents whether they believe the political error of the major central banks – Fed, ECB, BOE – is too accommodating or aggressive. Risks were seen as high everywhere, but the Fed / ECB was more likely to keep policy too loose with the BoE expected to give in to the various hawks.

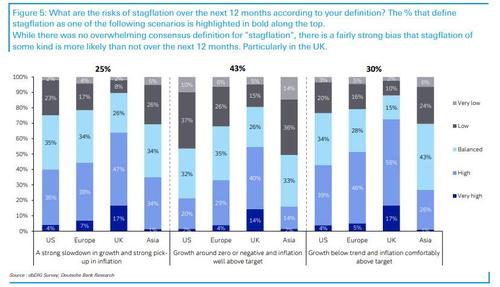

The next question is the one we addressed over the weekend, which is what is Wall Street's fluid definition of stagflation. While there was no overwhelming consensus definition for "stagflation," there is a strong enough bias that a stagflation of some kind is more likely than not in the next 12 months. Particularly in the UK, where the price of gas and energy in general is skyrocketing. 43% of the interviewees see it capable of eliminating world growth and sending inflation beyond targets.

In short, for industry analysts, covid-19 is now the past, but its consequences are not, especially in the energy sector and linked to production bottlenecks. A nice puzzle that risks sending the entire stock market to a peak soon, sending government bonds skyrocketing instead. A threat to world markets, which are expected to be sharply readjusted from many quarters

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Covid article ? For the markets it is the past. Worse inflation (or stagflation) comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/covid-per-i-mercati-e-il-passato-peggio-linflaizone-o-la-stagflazione/ on Tue, 12 Oct 2021 10:00:06 +0000.