Crack Evergrande: 340 billion dollars of debt and a complex and uncertain restructuring plan

Nothing symbolizes the demise of China Evergrande Group like the Hong Kong tower purchased for a record $1.6 billion. Once a jewel in the builder's crown, lenders are still looking to sell the building nearly a year after evicting it through insolvency

By now, however, the property's negative reputation is consolidated and not even changing its name or renovating it is attracting potential buyers. Evergrande's financial problems have even begun to affect the operation of the building, which is located in Hong Kong's busy Wan Chai district. Three of the 11 elevators were out of order because the developer hadn't paid the contractor, said Godfrey Cheng, senior deputy director of Savills (Hong Kong) receivership agent

This is just a snapshot of where debts have pushed China Evergrande into, and the latest news is not good. The real estate developer, whose troubles contributed to the collapse of the country's key real estate market, said its debts had climbed further to about $340 billion by the end of last year.

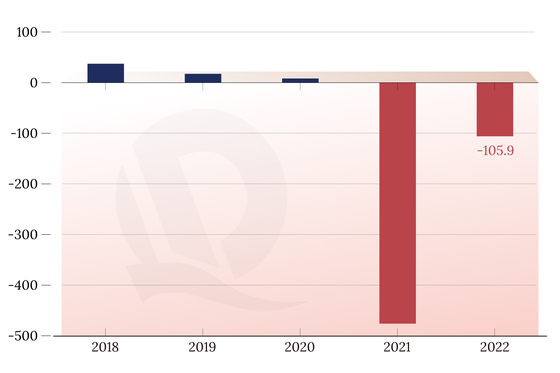

In a filing to the Hong Kong Stock Exchange, Evergrande said it had losses totaling about $81 billion in 2021-2022, and that its revenues fell by about half in 2021.

Chinese leaders are trying to revive economic growth which fell to 3% last year, the second lowest level since the 1970s. Regulators stepped in to oversee Evergrande's debt restructuring but apparently withheld a bailout to avoid sending the wrong message to companies about the need to reduce their debts.

The continuing troubles of Evergrande, said to be the most heavily indebted real estate developer globally, do not bode well for a recovery in the real estate sector, a major driver of business activity, whose loss of momentum weighed on China's faltering recovery after the lifting of COVID-19 restrictions late last year.

A flood of debts already in default

As part of its debt restructuring plan, Evergrande is dealing with two sets of creditors with claims of approximately $20 billion that are already in default:

- Class A: The first group includes $17.1 billion of claims held by global hedge funds in 11 dollar-denominated bonds issued or guaranteed by Evergrande, maturing from January 2022 to June 2025. There is also a private loan, which matured in January 2022, with 15% annual interest.

- Class C: The second group concerns $2.93 billion , based on deficiency claims estimated at 20% of $14.7 billion of liabilities. These are repurchase obligations, margin loans, structured loans and private loans denominated in yuan, Hong Kong dollars and US dollars, as well as guarantees provided to onshore creditors.

How will Evergrande repay its creditors in the restructuring plan?

Evergrande plans to issue new bonds for both classes of creditors, as well as hybrid notes convertible into treasury shares and shares of the two key units involved in real estate management services and new energy vehicles.

For class A creditors, Evergrande will issue new bonds with a maturity of between 10 and 12 years, paying 2-3% interest per annum (or additional new bonds in lieu of coupon payments). Furthermore, it will issue new bonds with a 5 to 9 year maturity, paying an annual coupon of 5-7%, which can be chosen by both classes of creditors.

Both categories of creditors will have the opportunity to receive a package of securities comprising

- New bonds to be converted into Evergrande shares equal to 29.9% of its capital expanded after five years

- New bonds convertible into a 21.6 percent stake in Evergrande Property Services after two years

- New tradable bonds with a 38.9 percent stake in Evergrande New Energy Vehicle Group after two years.

Essentially, the deal involves the distribution of more than $15 billion of new bonds and the conversion of at least $4.25 billion of debt into equity in the three companies. However, all of this requires a great deal of trust on the part of creditors that the entire restructuring plan will go through, which requires that the market does not collapse and that it is possible to finish the developments under development, which is not certain and requires additional resources

If the plan fails Deloitte expects foreign unsecured bondholders could take between 2.05 cents and 3.53 cents on the dollar of debt, while holders of dollar-denominated bonds would get only between 5.92 cents and 9.34 cents on the dollar. A real bloodbath. But when they bought the stock at 15%, it seemed like a good deal.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Crack Evergrande: 340 billion dollars of debt and a complex and uncertain restructuring plan comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/crack-evergrande-340-miliardi-di-dollari-di-debiti-e-un-piano-di-ristrutturazione-complesso-e-incerto/ on Fri, 21 Jul 2023 14:16:45 +0000.