De-Dollarization: what is this global trend

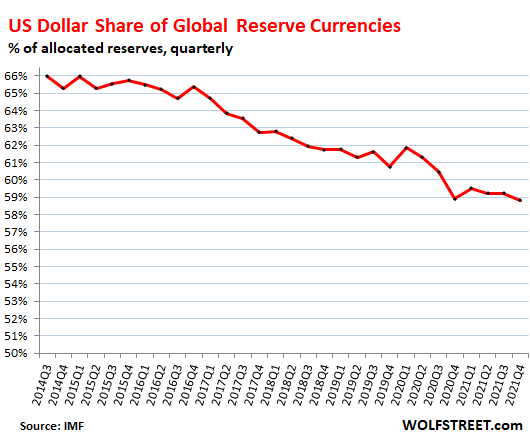

De-dollarization is the process of reducing other countries or markets' dependence on the U.S. dollar, often with the goal of weakening the economic and political power of the United States. The dollar is the dominant currency in international reserves and global trade, thanks to the Bretton Woods agreement of 1944 which established it as the reference currency for the international monetary system. However, in recent years, some countries such as China, Russia and Brazil have sought to diversify their reserves and their trade in other currencies, such as the yuan, the ruble or the euro, to challenge the status of the dollar and reduce its influence . This trend is known as de-dollarization and has several causes and consequences.

The causes of de-dollarization are mainly geopolitical and economic in nature. On the one hand, some countries want to reduce their vulnerability to sanctions and pressure from the United States, which can use the dollar as a weapon to punish or influence their adversaries or competitors. For example, Russia suffered a freeze on its dollar reserves and a blockade from the SWIFT payments system after the annexation of Crimea in 2014. China suffered from trade tariffs imposed by the Trump administration and feared losing its access to the US capital market. Brazil has suffered the devaluation of its real due to the economic crisis and dependence on dollar imports. On the other hand, some countries want to increase their weight and role in the global economy by proposing their currencies as alternatives to the dollar. For example, China has promoted the yuan as a trading currency for oil and other raw materials, as well as for New Silk Road projects. Russia has favored the ruble as the payment currency for natural gas and has increased its gold reserves. The countries of the BRICS group (Brazil, Russia, India, China and South Africa) have created a development bank and a common reserve fund to support their economies and facilitate their trade.

The consequences of de-dollarization are difficult to predict with certainty, but they could be significant for both the United States and the rest of the world . For the United States, de-dollarization could lead to a loss of prestige and influence internationally, less demand for Treasury securities and greater exposure to inflationary risk. However, de-dollarization could also offer the United States the opportunity to reform its financial system, diversify its economy, and cooperate with other countries to create a more equitable and stable monetary order. For the rest of the world, de-dollarization could lead to greater autonomy and flexibility in economic policies, less dependence on dollar fluctuations, and greater regional integration.

However, de-dollarization could also create new imbalances and conflicts between different monetary areas, greater uncertainty and volatility in financial markets, and reduced efficiency and liquidity in global trade. As global transactions are conducted in multiple currencies, one must be aware of the risk inherent in each individual currency. Furthermore, at this point the foreign exchange reserves of an individual country are influenced by the commercial counterparties and their currencies.

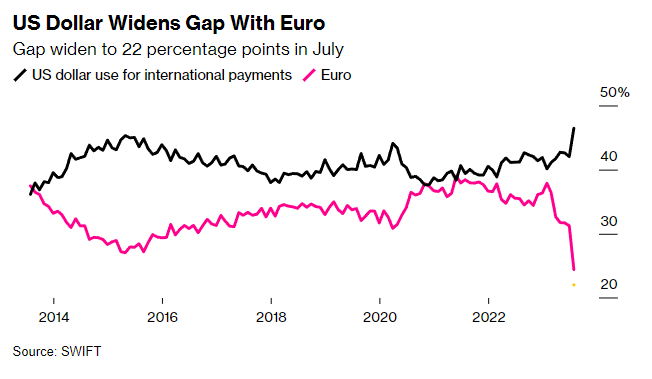

To tell the truth, however, the dollar has recently seen a recovery as an international payment instrument, especially if we consider the comparison with the Euro, which is truly the dying currency in the international context now.

In conclusion, de-dollarization is a complex and dynamic phenomenon that reflects ongoing changes in the world economy and politics. If it were to continue, it could have significant effects on the functioning of the international monetary system and on relations between the United States and other countries. However, it is not certain that the dollar will completely lose its dominant role at a global level, given that it still enjoys some structural advantages, such as the size and solidity of the US financial market, the trust and credibility of the Federal Reserve and the diffusion and the use of the dollar as a means of exchange and savings. Therefore, the future is likely to be characterized by greater diversification and competition between currencies, but also by greater cooperation and coordination between monetary authorities.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article De-Dollarization: what is this global trend comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/de-dollarizzazione-cosa-e-questa-tendenza-mondiale/ on Sat, 21 Oct 2023 07:41:06 +0000.