De-Pegging Event ?? Escape from Tether, withdrawn $ 7 billion from the stable coin

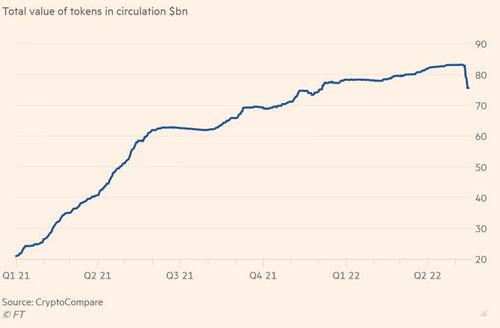

..the market capitalization of Tether (USDT), the largest stablecoin, has plummeted by more than $ 7 billion. As the FT reports , Tether's market value fell 9% from May 12 to $ 76 billion as tokens were canceled to meet ransom demands, CryptoCompare data shows.

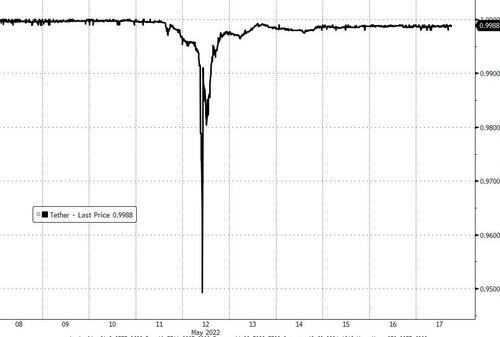

The drop came after the USDT traded around 95 cents last Thursday, well below the $ 1 level it seeks to hold on following the failure of a smaller rival. Tether is trading at $ 0.9988, after stabilizing after the brief depegging, where by depegging we mean the stable Coin's inability to remain pegged, i.e. linked to par, dollar or currency, or basket of currencies, of reference.

Andrew Asmakov of Decrypt reports that during the depegging, Tether, the company behind the stablecoin.

We have redeemed 7B in 48h, without the blink of an eye. How many institutions can do the same?

We can keep going if the market wants, we have all the liquidity to handle big redemptions and pay all 1-to-1.

Yes, Tether is fully backed.– Paolo Ardoino (@paoloardoino) May 17, 2022

stated that in times of market volatility, it still continued to honor all redemptions from verified customers, with approximately $ 2 billion processed on May 12 alone.

Tether Continues to Honor All Redemptions from Verified Customers During Market Volatility, On Track To Process 2bn Today https://t.co/p1AugHb9Gn

– Tether (@Tether_to) May 12, 2022

According to Tether CTO Paolo Ardoino, the company has redeemed $ 7 billion in the past 48 hours, all "without a blink of an eye".

As noted by Glassnode, other major stablecoins, such as Circle's USDC, Binance's BUSD, and MakerDAO's DAI, recorded a 1% to 2% premium during Tether's redemption wave.

Just as USDT supply has shrunk, USDC has risen by $ 2.639 billion over the same time frame – something that, according to Glassnode, could "provide insight into market preferences during times of stress."

"Given the dominant growth of the USDC over the past [two years], this could be an indicator of the shift in market preferences towards USDT and towards USDC as a preferred stablecoin," the report reads.

The other stablecoin that saw a drastic change in supply was DAI, which saw supply drop 24.4% as $ 2.067 billion was burned. DAI is an over-collateralized stablecoin, supported by other digital assets deposited in the Maker protocol.

Notably, as Glassnode notes, despite the high volatility of collateral assets, high demand for DAI and liquidation events, DAI managed to maintain a strong $ 1 anchor, albeit trading at a very slight premium.

We can see how téter also maintained, in the end, an anchor with the market despite the strong fluctuations due to the sudden increase in demand for repayment. The stablecoins with baking in Fiat currencies or in any case with real assets manage to maintain the market despite fluctuations. This has not happened to systems such as Terra Luna based on volatility transfer.

However, these are interesting times.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Article De-Pegging Event ?? Escape from Tether, 7 billion dollars withdrawn from the stable coin comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/evento-de-pegging-fuga-da-tether-ritirati-7-miliardi-di-dollari-dalla-stable-coin/ on Tue, 17 May 2022 18:21:09 +0000.