Deflation in China, a concern for the government. Meanwhile the stock market bounces

The Chinese economy is confirming its deflationary trend, which, certainly, is not something positive in the long term, especially if the deflationary dynamic is internal.

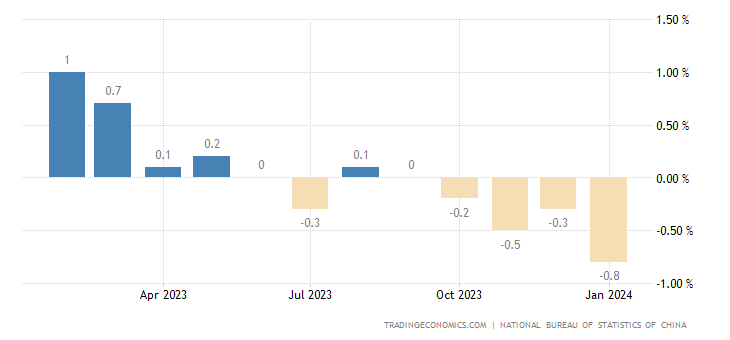

Consumer prices in China fell by 0.8% y/y in January 2024, marking the fourth consecutive month of decline, the longest streak since October 2009, i.e. since the great financial crisis.

The data was worse than market forecasts of a 0.5% decline, indicating the steepest decline in more than 14 years, with food prices falling at a record pace (-5.9% from to -3.7% in December) while prices fell for all components.

Meanwhile, non-food inflation declined (0.4% vs 0.5%), as the decline in transport prices accelerated (-2.4% vs -2.2%), while costs continued to rise for clothing (1.6% vs 1.4%), housing (0.3% vs 0.3%), health (1.3% vs 1.4%) and education (1.3% vs 1.8%).

Core consumer prices, which exclude food and energy prices, rose 0.4% y/y in January, the smallest increase since last June, following a 0.6% increase in the previous three months .

On a monthly basis, the CPI rose 0.3%, marking the second consecutive month of increases and reaching its highest level since last August. In 2023, consumer prices increased by 0.2%.

Here is the relevant graph

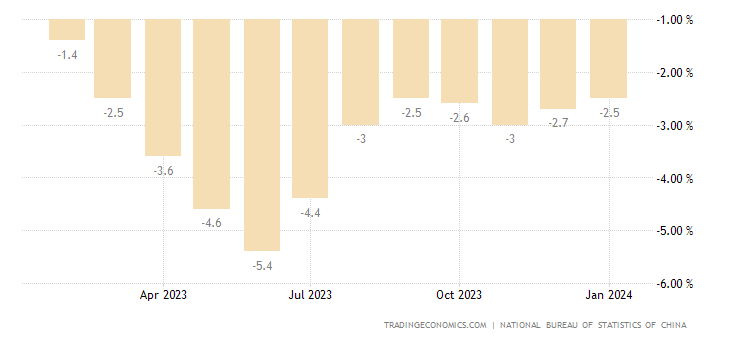

This situation reflects a fall in producer prices.

Chinese producer prices fell 2.5% y/y in January 2024, following a 2.7% decline in the previous month and compared to market estimates of a 2.6% decline .

While marking the smallest decline in four months, the latest result was the 16th consecutive month of contraction in producer prices, reflecting the persistent deflationary forces in the economy. The costs of the means of production continued to fall (-3.0% compared to -3.3% in December), due to a further drop in the prices of products from mines and quarries (-6.0% compared to at -7.0%), raw materials (-2.3% compared to -2.8%) and processing (-3.1% compared to -3.2%).

At the same time, there was a decline in the prices of consumer goods (-1.1% vs. -1.2%), with a decrease in the prices of food (-1.0% vs. -1.4%) and durable goods (-2.3% vs -2.2%), while the cost of everyday goods remained flat (vs -0.1%) and that of clothing increased by 0.1%, at the same rhythm of December.

On a monthly basis, producer prices fell 0.2% in January, following a previous decline of 0.3%. In 2023, producer prices fell 3.0%, following a 4.1% increase in 2022. Here is the related graph:

Consumer prices have also fallen due to some temporary measures, such as the sale of pork from public reserves in the pre-holiday period, but nevertheless this continued deflation is a sign that something is wrong, also because energy prices have remained stable in recent months.

Evidently there is an excess of supply compared to demand, and if inflation is bad, especially if it is stagflation, internal inflation is very bad, because on the one hand it compresses operating margins until companies close down, that is, layoffs and to the increase in unemployment, on the other, deflationary expectations increase, in a negative cycle, the postponement of purchases (why buy something today that will cost less tomorrow) and therefore cause consumption to fall.

The Chinese government will have to make a strong effort to reverse this trend.

The Shanghai/Shenzen stock exchange doesn't seem to worry too much, or has already captured the data, and the SHS 300 index has been growing for a few days now

In this case, the authorities' interventions to limit short selling and the activity of a "YTeam China" to strengthen purchases seem to have worked.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Deflation in China, a concern for the government. Meanwhile the stock market rebounds comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/deflazione-in-cina-una-preoccupazione-per-il-governo-intanto-la-borsa-rimbalza/ on Thu, 08 Feb 2024 12:37:33 +0000.