“Doctor Copper” indicates short-term recession, but medium-long confidence

The copper market is in a state of extreme contango, a state of the futures curve in which futures contracts trade at a high premium to the spot price and signal weak immediate demand.

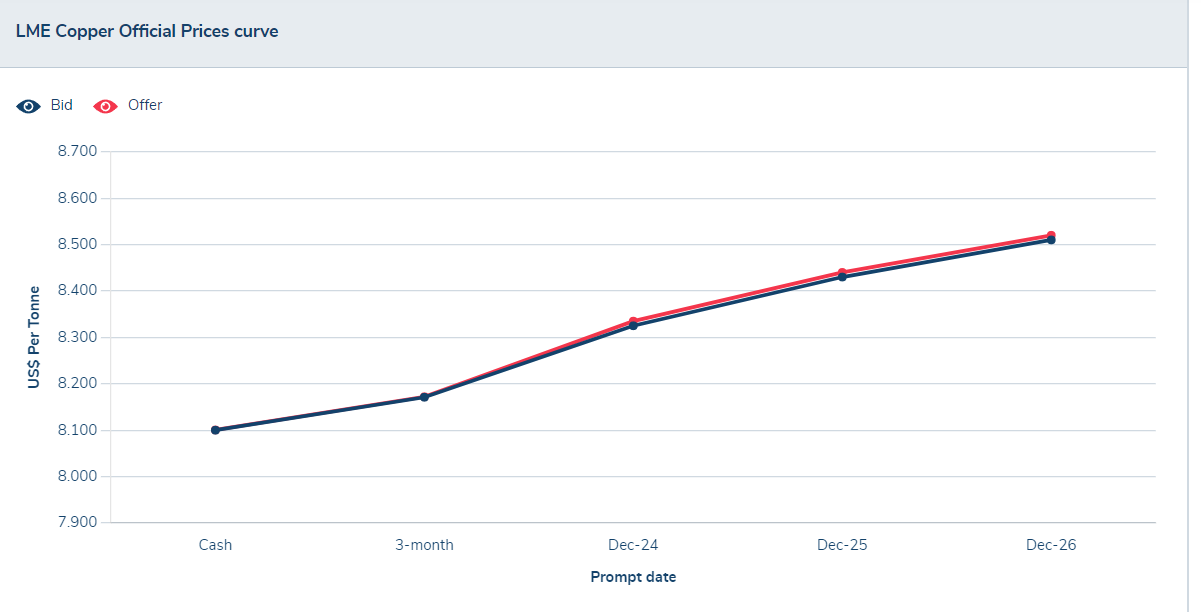

Three-month cash contango on the London Metals Exchange (LME) jumped in late September to the highest since at least 1994, according to data compiled by Bloomberg, as inventories pile up and demand appears to falter. This is what the futures market looks like

Analysts say the rise in inventories signals weakening demand amid a slowing global manufacturing sector and weakness in China's real estate market, and potentially anticipates recessions in developed economies. We know that copper is called "Doctor Copper", because it is considered capable of indicating the future trend of the world economy, given its multiple uses.

Due to the push for the energy transition, industry executives and analysts still expect high demand for copper in the medium to long term. However, short-term demand and prices may continue to be weak due to the uncertain outlook for the global economy and the copper market in China, the world's largest consumer of raw materials.

The faltering rebound of China's economy after reopening and continued weakness in China's real estate sector have weighed on copper prices this year. In the absence of a significant recovery and with weaker economies elsewhere, prices of the red metal could fall further in the coming months.

Last month, copper inventories in LME-registered warehouses reached their highest level since May 2022, Ewa Manthey, commodities strategist at ING, wrote in a recent note. Copper inventories held on the LME have more than doubled in just two months, which “shows clear signs of weakening demand,” Manthey said.

In the first three weeks of September, copper inventories rose more than 50%, following a similar increase in August. A bad sign for the world economy.

Futures spreads are loosening, indicating ample supply, according to ING's Manthey.

“With rising LME inventories and easing near spreads, copper prices could be even weaker,” according to the strategist.

The disappointing recovery and still-struggling Chinese real estate sector have combined with the Fed's signal that interest rates will be higher for longer, further weighing on prices amid already weak copper demand, Manthey noted.

“For copper, risks remain on the downside towards the end of the year due to the uncertain outlook for China's real estate sector. We believe that a commodity-intensive stimulus is needed to support demand growth in the short to medium term,” he added.

Globally, the slowdown in the manufacturing sector and the annual decline in world trade, which has not been seen since the pandemic, could weigh on copper demand even in the short term.

Global trade fell in July by 3.2% year-on-year – the steepest annual decline in three years since August 2020, according to the World Trade Monitor published by the Dutch Bureau for Economic Policy Analysis, CPB.

The negative side of these data is that, in the near future, a strong slowdown is expected which, however, seems to be less present in the future. The award is also the fruit of confidence in the future, in the face of a dark present.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The IL article “Doctor Copper” indicates a short-term recession, but medium-long term confidence comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-dottor-rame-indica-recessione-a-breve-ma-fiducia-a-medio-lungo/ on Tue, 03 Oct 2023 10:00:56 +0000.