Does the ECB not buy Italian government bonds? We’ll get over it, but he’s wrong

The European Central Bank (ECB) has announced the end of the reinvestment policy of its main asset purchase program (APP) from July 2023. This means that the ECB will no longer buy new bonds to replace maturing ones under the of the APP, launched in 2015 to support the euro area economy and inflation. The ECB said this decision reflects the improved economic outlook and the sustained adjustment of the inflation path towards its target of below, but close to, 2%.

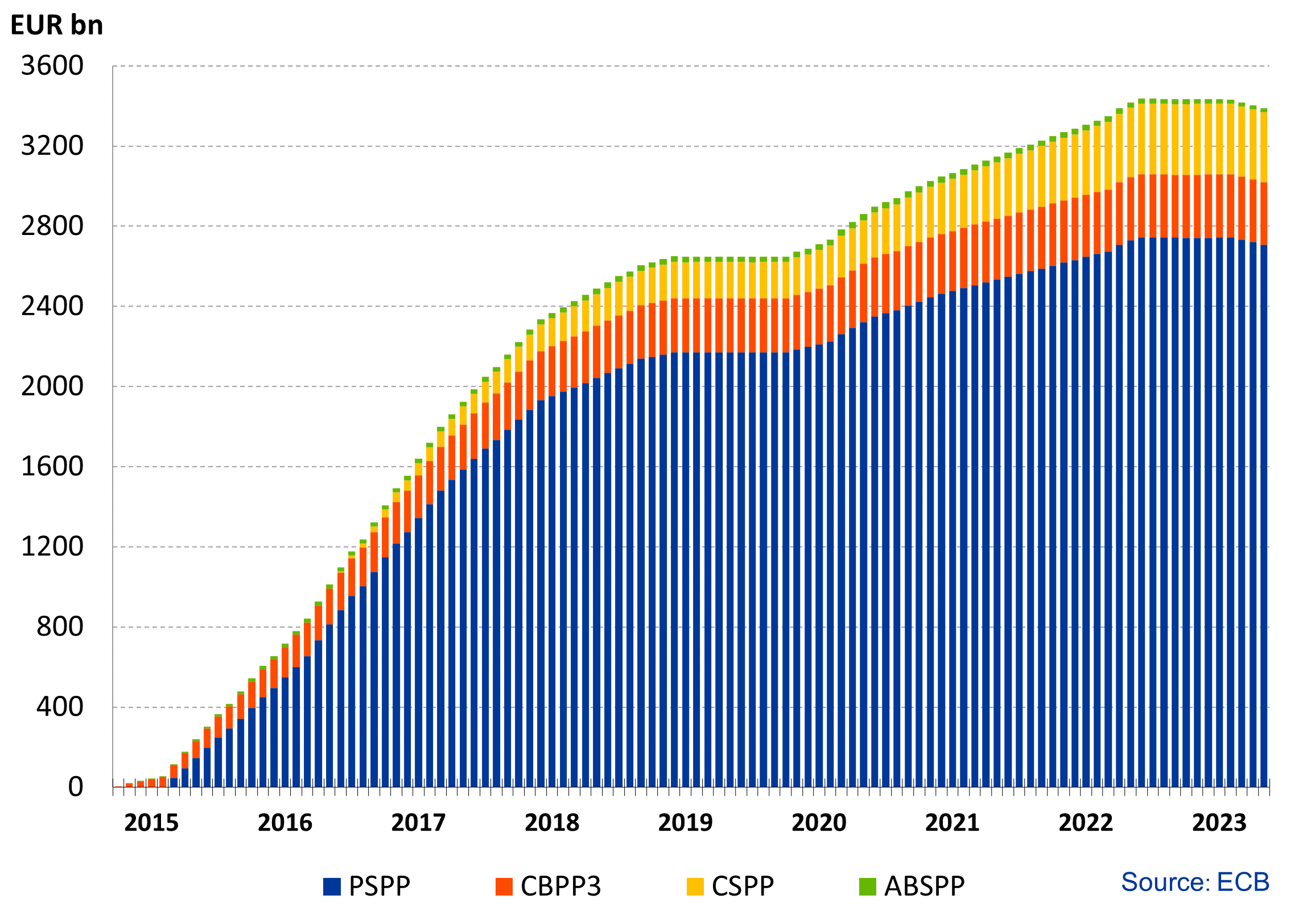

The ECB also underlined that it will continue to provide ample monetary stimulus through the other tools at its disposal, such as the Pandemic Emergency Purchase Program (PEPP) and Targeted Longer-Term Refinancing Operations (TLTRO). meanwhile what was an almost essential tool of his first monetary policy "Whatever it takes" to support the Euro and the economy at any cost, is truly retiring. After all, its decline was already evident, as can be seen from the following graph

We recall that the possession of these securities is practically free of charge also for the Italian state because what is not repurchased in securities is turned over as profit to the Treasury, and therefore to the State.

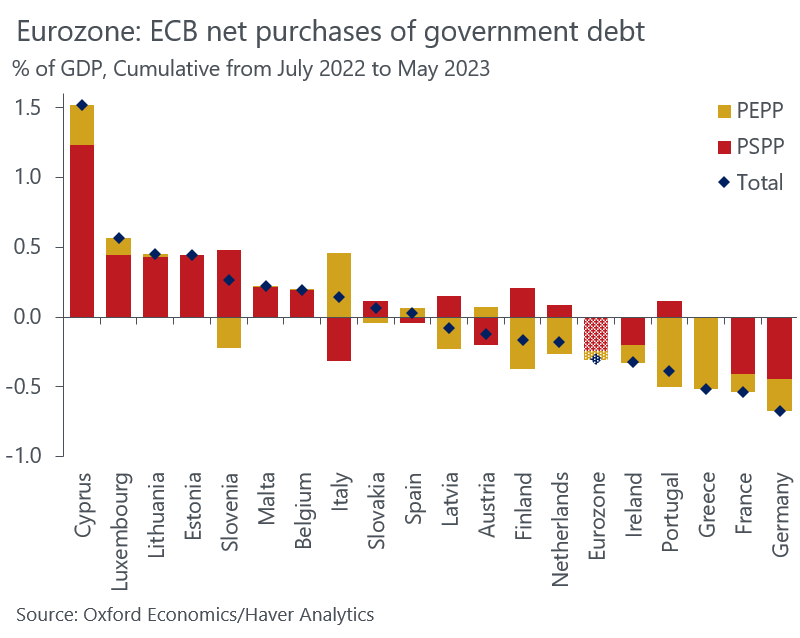

The ECB, on the other hand, decided to stop this aid as well. but he was already selling the shares purchased with the APP, or rather with the PSPP program part of the APP. On the other hand, the purchases of securities continue with interest from the PEPP program, the pandemic one.

Curious is that the purchases of securities of Luxembourg continue, a country that certainly does not need debt support.

What do we do if we fail to sell bonds to the ECB?

What do we do if we don't sell the bonds to the ECB? In this phase we rely on the market, i.e. on small Italian savers who, at least, will bring back the interest paid as consumption. With this logic, the Treasury placed the BTP Italia. The total amount issued was equal to 18,191.090 million euro against 654,675 contracts concluded, with an average denomination of 27,786 euro. This is the highest result ever in terms of value subscribed, but also in terms of number of contracts registered, in a single placement of government bonds for small savers ( retail ). Full liquidity for our coffers.

However, the ECB is wrong in not guaranteeing stability in the cost of government bonds regardless, or nearly so, of the issuer. Stabilizing government bond yields is the mission of any central bank. If the ECB does not do so, it behaves like a soldier who does not fully fulfill his duty. This only works against it and raises doubts about its usefulness: what is the use of a central bank that does not do its duty?

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The ECB does not buy Italian government bonds? We'll get over it, but it comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-bce-non-acquista-titoli-di-stato-italiani-ce-ne-faremo-una-ragione-ma-sbaglia/ on Thu, 15 Jun 2023 13:32:13 +0000.