Electric Rivian’s “paper colossus” angers Michael Burry. Rightly….

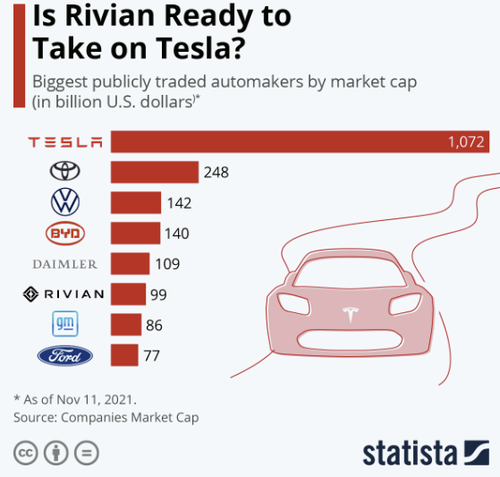

Rivian is a car manufacturer that is worth now, after its very recent listing, is worth more than established car manufacturers, it is worth more than Ford and General Motors, which some plants and a bit of history and experience have.

To be precise, it now capitalizes on 109 billion dollars

With its IPO in New York, electric car maker Rivian raised $ 11.9 billion, nearly € 10.3 billion. Rivian is seen as a possible rival to Tesla. It is the largest IPO on Wall Street this year.

Rivian, in which Amazon gets a 20% stake, sold 153 million shares at a price of $ 78 each. That is, more shares than previously expected and also a higher price per share than previously indicated. According to Rivian, there has been a great deal of investor interest in the pieces, and indeed there has been a nice price hike.

All exceptional for a car manufacturer that, to date, has only produced a few prototypes. To be precise, it has produced 56 trucks on an order it claims to have equal to 50,000, with a slow start in the midst of the logistics and semiconductor supply crisis. Not an easy situation, yet the illusion has led this company to be worth more than Ford and General Motors, and, apparently, everyone pretends nothing has happened!

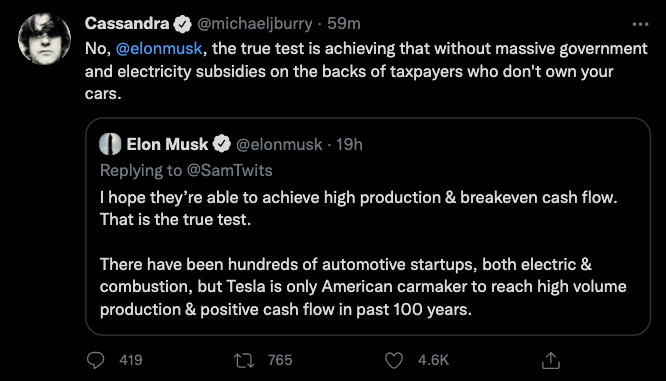

Someone actually noticed this, Dr. Michael Burry, the well-known equity expert, savvy investor, and also known for being featured in the movie "The Big Bet", "The Big Short".

Premise: Michael Burry, who writes under the pseudonym of cassandra, as usual has deleted your tweets after a very short time, but Zerohedge had time to catch them.

The words are serious: Burry sees a bubble far worse than 1929 and 1987. We have:

- More speculation than in the 1920s.

- More overvalued than in the 90s.

- More geopolitical and economic conflicts than in the 1970s.

And whose fault is it as this infamous spectacle continues:

" Players grabbing the barrel of Kyle Rittenhouse's gun (ie taking absurd risks) while the SEC and Federal Reserve nod approvingly ."

The infamous real estate bubble analyst is not done, targeting the wealthy Wall Street boom, while Main Street, the real economy, suffers under the inflation "tax":

“ American real wages, adjusted for inflation, have fallen by 2.2% since January 1st. It seems like the ONLY thing that is truly significant in this manic and manic year. Inflation is a massively regressive tax. Never forget that . " Burry says and he is right: without wage dynamics, without growth in wealth, inflation cuts real wages and therefore reduces purchasing power. How can we think that the stock market can grow without adequate income prospects? It creates a real bubble, and that's it.

But Burry also has some for Elon Musk:

Elon Musk's accomplishments would not have been achievable without taxpayer money in the form of subsidies to Tesla and the electricity it uses. A truth that is difficult to deny.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Electric Rivian's The Paper Colossus article angers Michael Burry. Rightly…. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-colosso-di-carta-dellelettrico-rivian-fa-arrabbiare-michael-burry-giustamente/ on Fri, 12 Nov 2021 17:28:08 +0000.