Energy is not a commodity, but a public infrastructure

All the damage we suffer from privatizations in the energy market

by Davide Gionco

21.04.2022

Water, public infrastructure and energy

In 2011, Italians voted with a large majority (95.8%) in favor of the referendum to maintain public control over water services.

The majority of Italians had understood that water is a fundamental common good, without which we cannot live, whose availability cannot depend on the economic interests of private individuals.

Without water we cannot survive as human beings and we cannot produce the food we eat. Without water, many companies would have to stop their production, we would not have tourism, we would not have public services. Without water, we would not even be able to produce electricity by burning gas, hydrocarbons or coal.

If there was a lack of water in a certain territory of the country, that territory would become depopulated in a very short time, forcing the inhabitants to emigrate to other territories.

The availability of water is a common good, a fundamental infrastructure on which the liveability and economic sustainability of our country depends.

Similarly to the availability of water, a modern country cannot exist without having common access, at affordable prices, to basic food products, a road network, health services, basic education, telecommunications.

Accessibility to energy services, understood as the availability of electricity and the availability of fuel for the production of thermal energy, is clearly a fundamental issue for the subsistence of our country.

Without energy, in fact, we cannot guarantee acceptable levels of comfort in homes, but above all we cannot guarantee the production of goods and services we need to live, from food production, to health services, to school, to security, to construction. , etc.

The far-sightedness of the politicians of the First Republic

The political class that led Italy after World War II, taking it from the ruins of the war to the miraculous boom of the 1960s and 1970s, had very clear ideas about the fundamental role of public infrastructures in the development of the country.

By way of example, we recall the reasons expressed in 1962 ( "Additional note" ) by Ugo La Malfa regarding the creation of ENEL (National Agency for Electricity), through the nationalization of 11 private companies in the sector.

The basic problem to be solved was first of all that the 11 private companies aimed solely at making their own profits, so they tended to create oligopolies or even monopolies, and then maximize the selling prices, since private buyers did not have alternatives. . And this factor was penalizing the competitiveness of companies that were forced to pay too high prices for electricity.

Secondly, those private companies in the electricity sector would never have extended the service to the most backward areas of the country, as it was not profitable for their budgets. But no economic development of the backward areas of the country would ever have been possible without having access to the electricity grid.

The obvious solution, for the far-sighted political class of the time, was the acquisition of those private companies and their nationalization. After that there was a national investment plan, with the construction of high voltage lines, connections with foreign countries and, finally, the decision in 1967 to put ENEL under the direct supervision of the CIPE (Interministerial Planning Committee Economica), in agreement with the Ministry of Industry, Commerce and Crafts.

It was clear to the entire ruling class of the time that electricity was not a commodity like many others, that few private companies could sell to make their profits. These profits, in fact, would have been very little compared to the economic damage caused to the entire country due to lack of growth.

The fact of guaranteeing everyone, throughout the territory and at a "political" price, the same for everyone and not exposed to the (inevitable) speculative maneuvers of private retailers was a fundamental requirement so that tens of thousands of private companies could develop their capacity to produce goods and services of all kinds.

The 1962 decision was probably one of the most decisive in triggering the incredible Italian economic boom of the 1960s.

For completely similar reasons, Enrico Mattei refounded ENI by entering into a series of international agreements, which allowed Italy to procure oil continuously and at controlled prices, without being exposed to the speculative actions of the famous "seven sisters" of oil. (Exxon, Mobil, Texaco, Socal, Gulf, Shell, BP). In all likelihood this action was the main cause of the death in dynamics never clarified by Mattei himself. With the same logic, Mattei's successors at the helm of ENI entered into agreements for the supply of gas with Russia, Algeria and Libya. The goal was always the same: to ensure Italy an adequate supply of energy at affordable prices.

The theoretical basis of this political vision were in all probability the publications of the economist Paolo Sylos Labini, who in his 1956 book "Oligopoly and technical progress" explained how the existence of a few oligopolistic firms on key production factors, such as the distribution of energy could in fact prevent the development of many other companies. The proposed solution is for the State to take control of the energy distribution companies, in order to eliminate the objective of maximum profit and aiming at guaranteeing the basic supply of energy to all.

Not the lowest price, but stable prices and reliable supply

Since the international energy market, especially oil (given that Italy soon decided to free itself from coal) has always been subject to speculation and fluctuations as a result of geopolitical changes, ENEL and ENI had the mandate to operate, as far as possible, to first of all guarantee the certain supply of energy, which is essential in order not to risk the stoppage of production activities. The second objective, as far as possible, was to ensure prices as stable as possible. This objective was important, because excessive fluctuations in energy prices can also create problems for the production sector. In fact, the excessive fluctuation of the cost of energy makes it difficult to determine production costs and, therefore, also industrial planning.

This means that, on a political-economic level, it is better for industries to have an energy price that is on average a little higher, but stable, rather than a strongly fluctuating energy price, even if on average lower.

For this reason, ENI, which dealt with the procurement of primary energy, tended to stipulate 20-30 year supply contracts with foreign parties, at agreed prices.

This type of contract, however, was also convenient for foreign suppliers, who could be sure of amortizing their investments, such as those needed to build a 4000 km gas pipeline from northern Siberia to Italy.

The genes of the European Union and liberalizations

With the exceptions of 1974 (energy crisis caused by the Yom Kippur war) and 1979-80 (energy crisis caused by the revolution in Iran and then by the Iran-Iraq war), in which fluctuations in energy prices were inevitably discharged on users, the price-controlled public energy mechanism has been shown to work well for several decades.

After that, in 1992, Italy signed the Maastricht Treaty establishing the European Union and the subsequent treaties that gradually gave more and more powers to the European institutions.

The first requests, already in the 90s, carried out with conviction by people by the name of Romano Prodi and Mario Draghi, were to privatize the large national energy companies.

All this without major economic analyzes, but on the basis of the neoliberal axiom that “private is more efficient and costs less”.

From that moment on, ENI and ENEL thought less and less about guaranteeing energy at a controlled price to citizens and businesses in Italy and more and more about making profits for their shareholders, like all other multinationals in the world.

We are not saying that, when ENI and ENEL were public, there was no waste and inefficiencies. But we are saying that, as history has shown, the "statutory" objectives of guaranteeing the supply of energy to all Italians and at controlled prices were ensured, without reducing households to the streets and without closing factories due to an excessive increase in energy costs.

The increase in the degree of privatization in the energy sector led first to the multiplication of the number of retailers, leading in Italy not to the reduction of prices, but above all to a reduction of transparency in the sector, with the multiplication of scams and contracts. halter sold by telephone to unsuspecting consumers and managers of small businesses, who could not have been specialists in energy contracts.

The level of privatization reached its peak last summer 2021, with the actualization of the financialization of the European natural gas market.

Since then, the retail price of gas is no longer determined by the prices of long-term supply contracts signed by ENI (or similar companies in other countries) with Russia, Algeria & c., But by daily trading on the stock exchange. TTF (Title Transfer Facility) in Amsterdam, where hundreds of private entities trade virtual quantities of gas, with current or deferred settlement (futures).

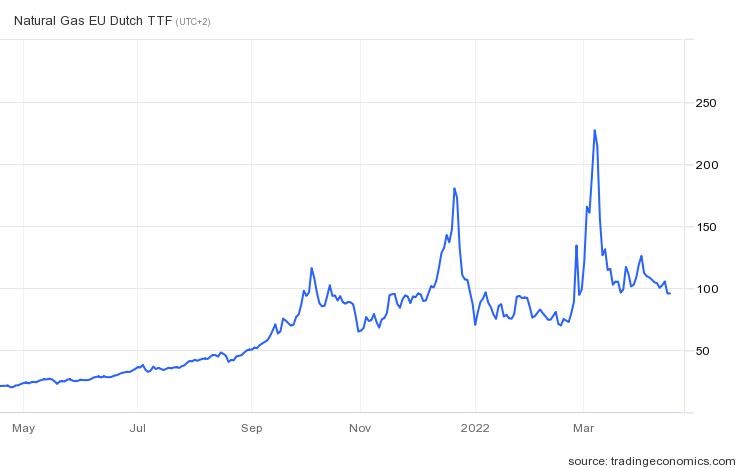

The result of these "reforms" was not the decrease in the price of gas in Europe, but it was an average increase in the price combined with very strong fluctuations in the price.

The insane price increases after a year of "liberalization" should alone be enough to reverse, as it is evident that the dynamics of speculative finance are adapting very badly to a market of structural rigidity such as that of natural gas.

But they will not, because probably the objective of the financial lobbies that dominate the Brussels offices was precisely the increase in financial revenues in the energy sector. Financial rents are guaranteed both by high prices and by frequent price fluctuations.

For these individuals, energy is a commodity like many others, while for citizens and businesses it is almost like the air we breathe, which we cannot do without.

Oil-link and gas-to-gas contracts

To explain the reasons for the dysfunctionality of European liberalization in the energy market, in particular for natural gas, we must first of all understand the types of natural gas purchase contracts.

Since over 40% of the electricity produced in Italy is generated by the combustion of natural gas, the price of natural gas directly affects the price of thermal energy (heating, industrial production), and indirectly, causing an increase in the price of electric energy.

Almost all of the natural gas imported into Italy is purchased wholesale from 3 operators: ENI, Enel and Edison. These operators have entered into long-term contracts (duration 20-30) for large quantities of gas. They are defined as “oil-links” since generally the purchase price of gas is modulated according to the oil price trend ( oil in English).

The most important feature of these contracts is not only the relative price stability, but the fact that orders for large quantities of gas are made taking into account Italy's consumption forecasts (households, businesses and electricity generation) and taking into account the gas storage possibilities in Italy. Foreign suppliers, due to the fact of using gas pipelines of a certain diameter, have a limited peak gas delivery capacity, therefore they foresee the early delivery of the gas during the periods of low demand (spring, summer, autumn) in order to to cope with peak winter demand. Another feature of these contracts is the "take or pay" or that the gas ordered must be paid for, even if delivery is not requested, due to the fact that the supplier cannot guarantee that it will be able to deliver it. quantity later, due to pipeline capacity limitations.

The basic concept of these contracts is planning , which makes it possible to optimize the use of the plants both on the supplier country side and on the consumer country side, as well as to keep prices under control.

Planning is what is needed to ensure the necessary energy supply for a country of 60 million inhabitants, families and industries.

This type of contract has been the norm since the 1970s, with the first supplies of gas from abroad, until last year 2021. After that the European Union "liberalized" the natural gas market, allowing many small subjects to stipulate “mini-contracts” for the purchase of gas, with the purchase price disconnected from the price of oil and therefore called “gas-to-gas”.

The gas purchase price is then established by the supplier on the basis of the orders it receives.

The selling price of gas on the European market is decided by daily trading at the aforementioned TTF stock exchange in Amsterdam, using the marginal price mechanism.

Basically, in the rules for matching supply and demand, gas sales prices are gradually increased until all the gas demand is met, after which the price of the "final quota" of gas sold to satisfy the demand of the last buyers of gas is used as the selling price of all gas.

Let's take an example to better explain: if 50% of the gas is purchased from sellers at 25 € / MWh and then another 45% at the price of 50 € / MWh and finally the remaining 5% is purchased at the price of 75 € / MWh , all the gas offered for sale is priced at 75 € / MWh, allowing large profits to those who bought it at 50 € / MWh and even more for those who bought it at 25 € / MWh.

Among the gas sellers there are not only the producers (Gazprom & c.), But there are also all the investors who previously bought gas at a lower price who now resell it at a higher price.

Just as among the buyers of gas there are not only those who then distribute it to families and businesses, but there are also those who buy it today, and then resell it for tomorrow at a higher price.

And, as is always the case in the financial markets, there are those who make money on short sales and futures by betting on future changes in gas prices.

Given the possibility of making large financial profits, the demand for gas from the few real gas producers has been "drugged" by the stipulation of many short-term contracts, defined as "spot" contracts, lasting a few weeks or even just one day.

The purpose of these contracts is not to guarantee the actual delivery of gas to end users, but only to make financial profits.

Therefore, without the slightest planning, the gas producers received “spot” gas purchase contracts that did not take into account the physical delivery capacity of the product.

As a result, they have set very high selling prices, both to make higher profits and to discourage this type of totally dysfunctional contracts for their market.

Also because in these short-term “gas-to-gas” contracts there is no obligation to collect the goods, if it is not paid for.

The result was that these "marginal" prices relating to contracts to order "theoretical" gas, gas that in many cases was never paid or delivered, determined the marginal price of natural gas on the Amsterdam stock exchange and, therefore , the selling price of gas at levels never seen on the European market.

Naturally, the uncertainties about future gas supplies, due to the conflict in Ukraine and the European sanctions on Russia, have further exacerbated these dynamics that were already underway since last summer.

For those interested in further investigating the issue, we recommend reading this article .

The damage caused to the Italian economy

These dysfunctions resulting from the change in gas quotation methods in Europe have already caused and are causing immense damage to the Italian economy.

We are talking about a "theft", still in progress, worth a few tens of billions of euros at the expense of our families and businesses.

Some particularly energy-intensive companies (steel mills, foundries, glassworks, ceramics, concrete, wood and paper) have already reduced or even stopped production, as with these energy prices they are unable to produce at prices that their customers can bear. .

This is already costing us an increase in unemployment.

The rise in the price of natural gas and electricity (produced by burning gas) has already led to a considerable increase in consumer prices, as well as to a reduction in the profit margins of many companies.

As the conditions for an increase in wages do not exist, this will lead to an increase in poverty in Italy (beyond the current ease of 5 million absolute poor).

But the worst damage will come from a lack of planning.

Given the current high gas purchase prices and the loss of market share by large historical distributors, such as ENI, at this moment no one has an interest in buying gas at high prices to store it for next winter.

The real risk is that next winter we will find ourselves with insufficient gas supplies, because there will not be enough to meet the peak demand for next winter.

At that point Mario Draghi, to cover up the crime, will tell us that "we have decided" to apply sanctions to Russia for the war in Ukraine, so we will have to "make sacrifices" and renounce a significant part (20-25%) of the gas supplies, to "punish Putin".

This while in reality the real cause of the gas shortage next winter will be the speculative and unplanned dynamics of the European gas market.

The inevitable result will be a further increase in gas prices in Italy, this time due to the lack of availability in the face of demand. All this combined with gas rationing, for which many companies will have to forcibly reduce their production and lay off staff.

The same will happen with electricity, given that with the scarce availability of gas it will also be necessary to ration electricity (let's be prepared for periodic interruptions), in addition to the fact that we will pay for it at prices never seen before.

We are writing all this now, that we still have time to change the pricing rules and to reintroduce planning criteria in gas supplies.

May someone intervene, before the disaster in our country, to preserve the public infrastructure that is energy.

The energy authorities or the judiciary.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Energy is not a commodity, but a public infrastructure comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/lenergia-non-e-una-merce-ma-una-infrastruttura-pubblica/ on Thu, 21 Apr 2022 08:41:30 +0000.