Euro or not Euro? Its survival depends on how money and economic policy are managed …

Over two years ago an interesting article was published in Economic Scenarios but, as often happens, passed unnoticed, in which an analysis of the Feri Group , a management and financial consultancy company, was evaluated, which predicted a very bleak future for the Euro. It was not the analysis of a mad sovereignist, but that of a company that manages client assets for 33 billion euros.

The Feri Group envisaged, at the end of 2018, the following scenarios, in a 5-10 year perspective:

Five possible outcomes of a euro crisis are indicated:

a) a massive intervention by the ECB with an expansive monetary measure and a progressive devaluation of the euro, in which the ECB injects large quantities of financial resources on the market leading to the devaluation of the euro and therefore allowing its survival in the short time, but, let's say us, without being able to solve the structural problems.

b) A complete union with fiscal transfers, which however is seen as a very complex solution and for which the editors fear there will be non-linear behavior on the part of those who would receive the transfers;

c) A flexible union, in which some countries are allowed to leave and then re-enter once their problems have been resolved, even through a temporary devaluation. This solution is seen as very unlikely.

d) North Euro and South Euro, in which two separate monetary blocs would be identified, one in central Germany and one in the Mediterranean, and which would be a Realpolitik solution. But it would also be the negation of the European spirit, as well as maintaining major economic problems due to the breaking of contracts and the devaluation of assets, so it is a solution that could result, but not from a voluntary break.

e) Total disintegration of the euro area.

The probabilities assigned, then, by the analysts were the following for the various scenarios:

a) zero percent;

b) 40 percent;

c) 15 percent;

d) 5 percent;

e) 40 percent;

Among other things, the analysts stressed that scenario a) did not in any way mean damage to German citizens who had adequately invested (read, not kept liquid) their money, but that this would not have prevented Germany from opposing strongly to any expansionary monetary policy.

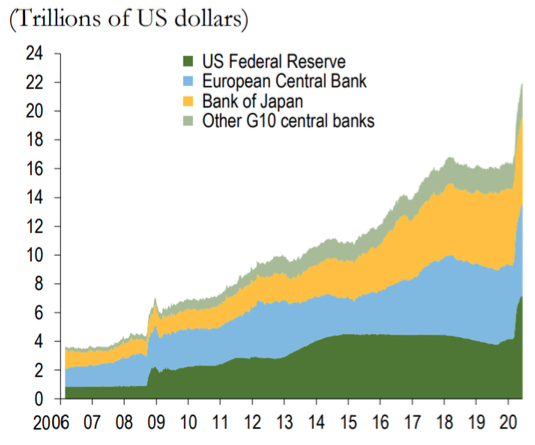

This was 2018. 2020 and 2021 have changed things powerfully. While the end of the expansionary monetary policy might have appeared possible until August 2019, a slight economic slowdown first and the Covid-19 epidemic afterwards have completely changed the prospects. The PEPP will inject € 1850 billion, 17% of the euro area GDP, and it is not the only expansionary program implemented by the ECB.

The Feri Group weighed the bailout of the euro with an expansive monetary maneuver to zero percent. We are sure that now this percentage is still zero, and perhaps it has not become 25% or 30%, or even more. Above all because this expansive maneuver was not slowed down by the German government which, on the contrary, also partially solicited it and took advantage of it in turn.

This is to say that, as attributed to Heraclitus, πάντα ῥεῖ, everything flows, everything changes, and what was impossible yesterday, the survival of the euro in the medium-long term, today is a little less so, or at least it is postponed to future. Clearly this perspective exists as long as there is a softening of monetary and fiscal policies capable of smoothing out the economic and development differences between the various parts of the Union: if this softening were to cease, we would still return to the prospect of a more than voluntary Euro exit. , obliged. Keynes said that “ when facts change, my opinions change ”, indicating that we must be rational and recognize if the environment around us has changed. But Keynes also said that “ Even the gods are powerless against stupidity. It would take the Lord. But he should come down himself, not send the Son; this is not the time for children ”. Here. this sentence is also current …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Euro article or not the Euro? Its survival depends on how money and economic policy are managed… it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/sopravvivera-l-euro/ on Wed, 10 Feb 2021 07:00:40 +0000.