EUROPE IN DEFLATION. Very distant ECB objectives. Italy -0.9%, but budget limits will soon return

Today Eurostat informs us that the Union is truly in deflation. Not in low inflation, not in zero inflation, in deflation. Let's facilitate a table:

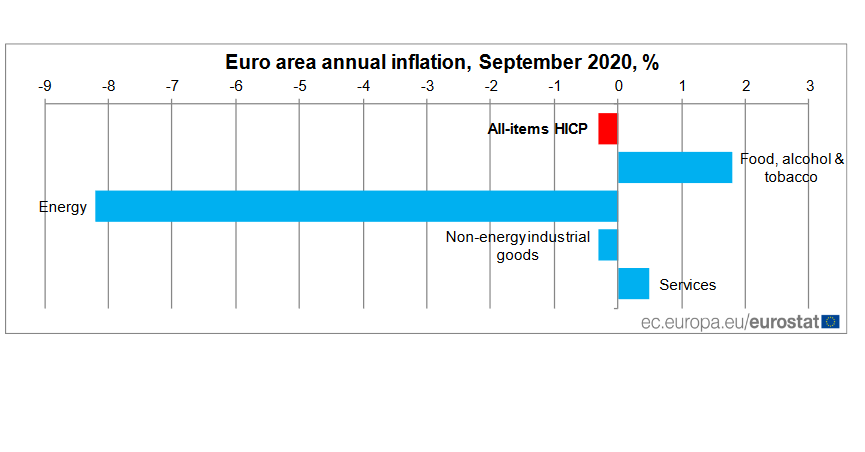

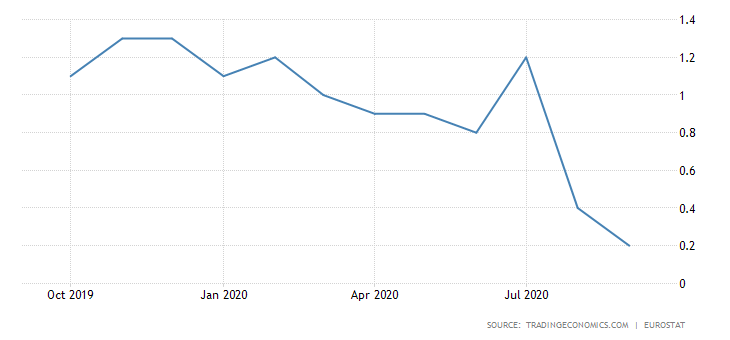

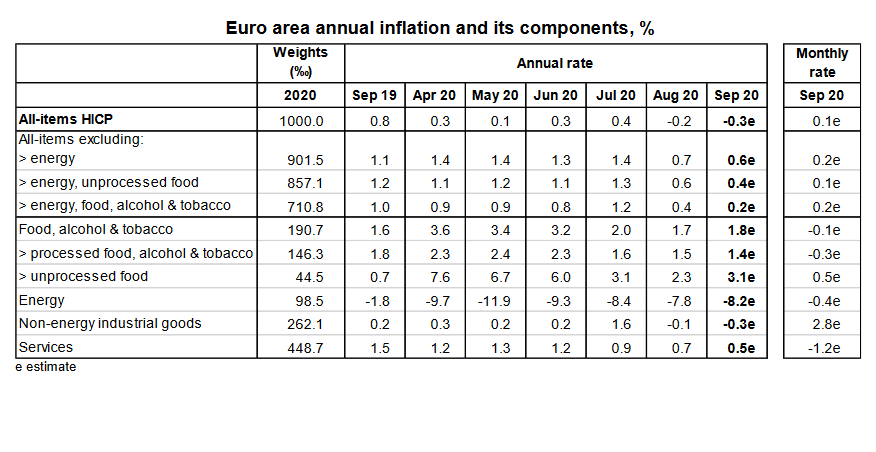

Inflation in the Euro area is equal to -0.3% so we are dryly in true deflation. The fall in energy prices and non-energy industrial products drove this fall. Conversely, a slight increase in food, alcohol and tobacco products and services. In this case, paradoxically but not too much, the drop in the supply of transport has led to an increase in transport prices. Strictly speaking, "Core" inflation, net of fresh agricultural and energy sources, plummets to 0.2%:

Here is a sector breakdown. the HICP is the estimated consumer price inflation.

The only factor that sustained inflation are fresh food products, which, due to the difficulties in transport and in the harvesting process during the closest Covid period, are otherwise in heavy deflation.

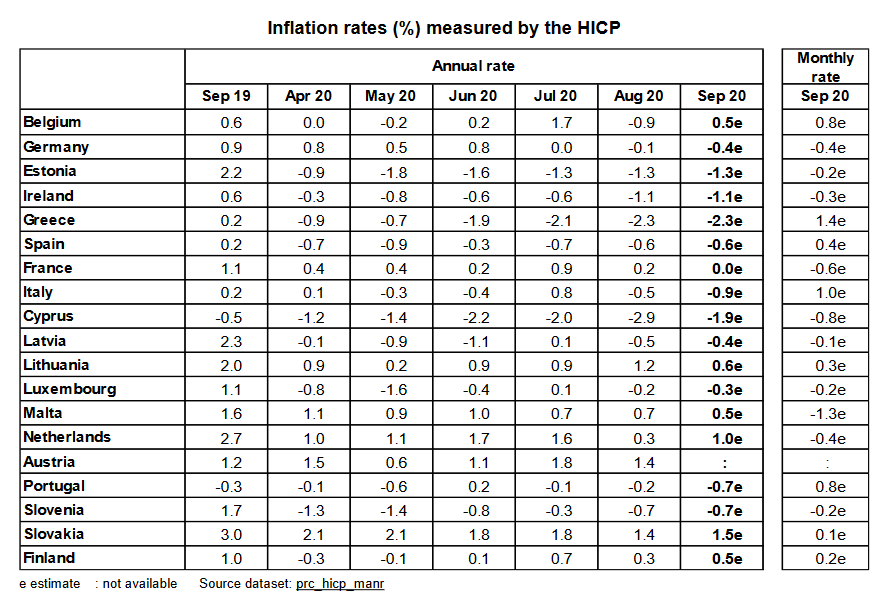

Italy sees a profound deflation on an annual basis with a -0.9%, despite the fact that in September there was a rebound with an estimated + 1%. Germany is in deep deflation, but the fact that the VAT has been reduced temporarily, compressing prices, also comes to weigh here.

So the economy is faltering and it shows clearly. In this case, the Markit services index falls below 50 at the European level, with a value of 48, which is a precursor of a certain contraction in the sector. Without a restart of the services sector, it is very difficult for the entire economy of the euro area to be driven ONLY by manufacturing and by a small slice of advanced services.

What will the ECB do? At this point, the ECB is likely to revise both its inflation and growth estimates downwards in December when it updates its forecasts. In the event that a positive confidence shock (vaccine, treatment, etc.) does not occur, the ECB should be tempted to take new measures to limit short-term deflationary risks. Specifically, it could revise its inflation target or increase the size of its asset purchase program. This scenario is even more likely if the euro bounces around 1.20 against the dollar, a dangerous threshold for EU exports and which many see as a turning point in monetary policy. Now the euro / dollar ratio moves to the limit between 1.17 and 1.18, one step away from the threshold. If US inflation, now at 1.3%, were to remain above that of the EU, but below 2%, maintaining the signal for an expansionary monetary policy, the revaluation of the Euro would be inevitable. At this point there would be no other solution than a review of the further expansion of monetary policy. Lagarde, as always, will have to adapt to reality.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article EUROPE IN DEFLATION. Very distant ECB objectives. Italy -0.9%, but budget limits will return soon comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/europa-in-deflazione-obiettivi-bce-lontanissimi-italia-09-ma-torneranno-presto-i-limiti-di-bilancio/ on Mon, 05 Oct 2020 16:20:26 +0000.